No.3325

Global Alternative Proteins Market: Key Research Findings 2023

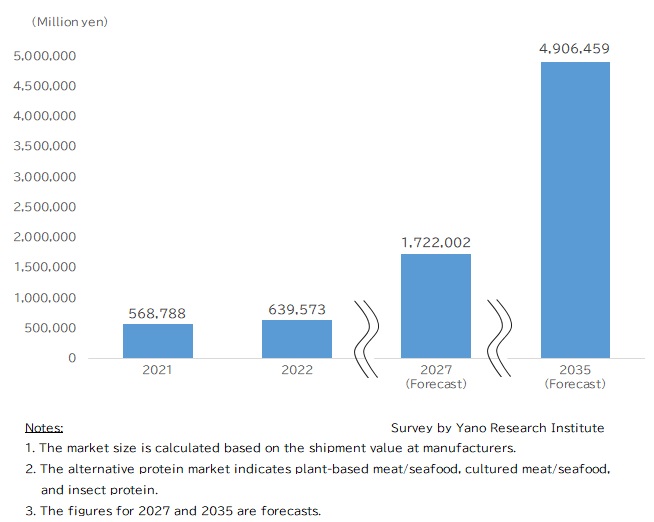

Global Alternative Protein Market Estimated to Capture a Valuation of 639,573 Million Yen in 2022

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on global market of alternative proteins (plant-based meat/seafood, cultured meat/seafood, insect proteins), and found out the current status, the trends of market players, and future perspective.

Market Overview

Size of the global alternative protein market (plant-based meat/seafood, cultured meat/seafood, and insect proteins) is estimated at 639,573 million yen in 2022, based on the shipment value at manufacturers.

Demand for meat is increasing due to global population growth. According to the "World Food Supply and Demand Outlook for 2031" (FY2021) by PRIMAFF (Policy Research Institute, Ministry of Agriculture, Forestry and Fisheries), global meat demand for 2031 is expected to trend upward compared to the demand levels in 2018-2020. Demand for beef is expected to increase from about 62 million tons to 71 million tons (15.2% more than 2018-2020 level), pork from about 106 million tons to 121 million tons (14.1%), and poultry from about 105 million tons to 128 million tons (21.8%). Meanwhile, it is becoming increasingly difficult for conventional meat producers to be a sole supplier for growing meat demand, partly because their business is seen responsible for environmental issues, emitting huge amount of greenhouse gas and massive use of feed and water. Furthermore, ensuring food security has become a global challenge, as instability across the globe has been causing insecurity and price hikes of foods in 2022 and 2023.

Under the circumstances, plant-based meat using raw materials derived from legume and vegetables, lab-grown cultured meat, and insect proteins are garnering attention. Development of alternative seafood (plant-based seafood and cultured seafood) is also underway from the standpoint of sustainable seafood production to balance demand and supply.

Noteworthy Topics

Plant-based Meat & Seafood Market: Japanese Manufacturers Start Production at New Manufacturing Plants in 2023 and 2024

Of all the protein products produced with materials derived from plant, plant-based meat has been expanding, as it is acknowledged as highly sustainable compared to conventional meat production (consuming less water and emitting less greenhouse gas), the demand increases against the backdrop of global food shortage led by population growth, and the rise of consumer consciousness about health and food diversity.

The plant-based meat market in Japan is burgeoning as new manufacturing plants have (and will be) inaugurated in 2023 and 2024. Plant-based seafoods and eggs are gaining stream as they are commercially launched and introduced at food services.

Meanwhile, in the US, food industry made an upturn in 2021 and 2022, recovering to the pre-pandemic level. However, uptick of inflation across the globe in 2022 impacted food industry in the US. Food price hikes caused consumers to hold off purchases. It is assumed that the plant-based meat retail market in the US had been impacted as well.

Future Outlook

In view of the plant-based meat market by region, the US and Europe, the markets that have already grown to fairly good size, expects stable growth. China and other Asian countries anticipate growth fueled by the rise of health consciousness and rapid advancements in plant-based meat production technology in the region. In Japan, consumers are increasingly aware of alternative meat, thanks to retailers in favor of shelving ambient and chilled plant-based products, makers producing more variety of frozen products, and food services releasing plant-based menus. Boosted by the establishment of the Japanese Agricultural Standards (JAS) for plant-based meat products and active branding through social media, the domestic demand for plant-based meat expects to grow hereafter.

Meanwhile, in December 2020, the cultured meat division of an American food company launched the world's first cultured meat product in Singapore. Subsequently, in June 2023 the company received a full approval from the U.S. Department of Agriculture (USDA) to produce and sell their products in the states. Research and development are underway in the US, Singapore, Israel, Europe, and Japan, mostly by startups. High cost of production is a major challenge, and thus market players are developing production techniques for cost reduction and efficiency improvements.

Under the circumstances, the global market size of alternative proteins (plant-based meat/seafood, cultured meat/seafood, and insect protein) is forecasted to reach 1,722,002 million yen by 2027 based on the shipment value at manufacturers. Further, the market is projected to continue expansion thereafter to reach 4,906,459 million yen by 2035.

Research Outline

2.Research Object: Alternative protein companies and related associations

3.Research Methogology: Face-to-face interviews by our expert researchers, survey via telephone and email, and literature research

What is the Alternative Protein Market?

In this research, the alternative protein market refers to the products of plant-based meat, plant-based seafood, cultured meat, cultured seafood, and insect proteins.

Plant-based meat/seafood indicate foods made with proteins derived from plants such as legume and vegetables, that are processed (heated, cooled, pressurized, etc.) to have meat-like/seafood-like taste and texture.

Cultured meat/seafood indicates foods produced with proteins grown in labs from animal cells. (In December 2020, the cultivated meat division of an American food company launched the first cultured meat in Singapore. The company then received approval from the U.S. Department of Agriculture (USDA) in June 2023 to enter interstate commerce. In other countries or regions, market players are still in the R&D phase. At current, there is no cultured seafood commercially available.)

Insect-protein product refers only to food for humans, i.e., animal feeds, fertilizers, and pet foods are not included this market.

<Products and Services in the Market>

Alternative protein products (plant-based meat/seafood, cultured meat/seafood, insect proteins)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.