No.2821

Sharing Economy Service Market in Japan: Key Research Findings 2021

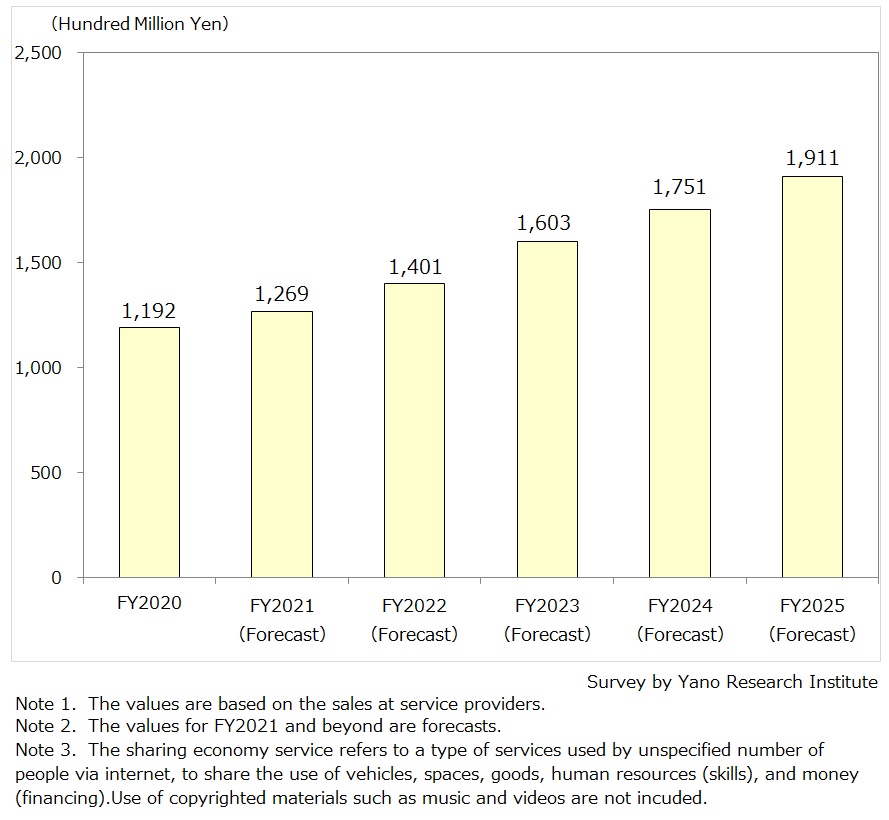

Sharing Economy Service Market for FY2021 Expected to Attain 126,900 Million Yen, Up 6.5% from Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the sharing economy service market in Japan, and found out the trends by major/noteworthy field, the trends at market players, and future outlook.

Market Overview

Overall trend of the sharing economy service market is difficult to summarize particularly in the covid-19 crisis, as the market includes various business fields, which had ups and downs.

Despite the pandemic, size of the domestic sharing economy market for FY2020 grew by 5.3% from the preceding fiscal year, generating 119,200 million yen (based on the sales at service providers). While the covid situation continues, it is estimated to rise by 6.5% for FY2021 to attain 126,900 million yen.

Noteworthy Topics

The Emergence of External Services Assisting Sharing Economy Services

Compared to other services in general, operation of sharing services is troublesome. For example, in the goods sharing service, unlike spot sales, they need to retrieve and provide maintenance on their products. Frequent maintenance on shared items is required, as items used by multiple customers in a short period of time wear out faster than items possessed by a single person.

For skillshare service between individuals, contacts are mostly done anonymously. Service providers are required to establish secure service platform, patrol to avoid troubles, and provide quick support to reported problems.

While the sharing services require burdensome operations, many businesses in the market are startups. In view of the increase of users along with the growth of the sharing economy service market, providers supported only by in-house resources may not be able to keep up with demand. In fact, the market had witnessed some services that had to limit new user registration during the pandemic, because their operation could not cope with the sharp increase in users.

In recent years, assisting services for the sharing economy services are emerging. For instance, E-Guardian provides back office operations such as user authentication on behalf of the providers; Mitsui Sumitomo Insurance offers insurance service for sharing service providers; and AJIS provides round maintenance service for sharing services. As the market expands hereafter, the number of sharing economy service providers using these services is expected to rise.

Future Outlook

FY2021 saw COVID-19 situation continuing from the previous fiscal year. Although its impact differs by business domain for which the services are provided, sales of sharing services that can be used at home or provided online are expected to grow even if the crisis does not end, since people still refrain from going out and spend longer hours at home.

Considering the situation where most of the sharing services are provided via online service platform, the services can be used from anywhere. Convenience is a major strength of the sharing service business under the COVID-19 crisis, as is the case with other e-commerce services.

Research Outline

2.Research Object: Sharing economy service providers and related businesses

3.Research Methogology: Face-to-face interviews by the specialized researchers (including online interviews) and literature research

Sharing Economy Service Market

In this survey, the sharing economy service refers to services that offer sharing of “vehicles (car share, ride share)”, “vehicles (bike share)”, “space (private lodging service/minpaku)”, “space (parking space, etc.)”, “goods”, “human resources (skillshare)”, and “money (crowdfunding, social lending)”. Use of copyrighted materials such as music and videos are not included.

Size of the sharing economy service market is calculated based on the sales at service providers, including matching charges, sales commissions, monthly membership fees, and other service revenues. It does not refer to actual billings of sharing economy businesses.

<Products and Services in the Market>

Sharing of “vehicles (car share, bike share)”, “space (private lodging service [minpaku], parking lot share)”, “goods”, “human resources (skillshare)”, “money (crowdfunding, social lending)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.