No.3836

Fertilizer Market in Japan: Key Research Findings 2025

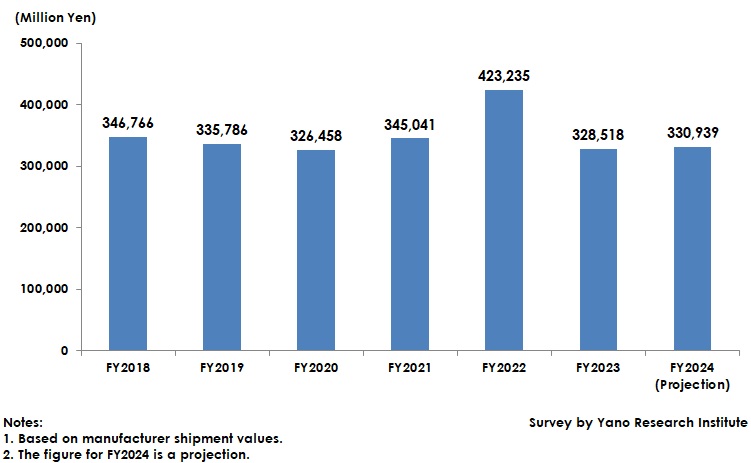

Fertilizer Market Projected to Reach 330,939 Million Yen in FY2024, A 0.7% Increase from Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the domestic fertilizer market and found out market size, trends of market players, and future outlook.

Market Overview

Japan is facing unstable procurement of fertilizer ingredients due to skyrocketing international prices for fertilizer ingredients caused by global issues, including China’s export control over rock phosphates, a fertilizer ingredient, as well as traditional issues, such as increased global food demand stemming from population growth and economic development.

Manufacturers raised prices for chemical fertilizers one after another due to soaring production costs since FY2021, including energy and fertilizer ingredients, such as rock phosphates, potassium chloride, and urea. This resulted in a surge in demand just before prices rose and considerable expansion in market size in FY2022. FY2023 saw a significant reactionary fall in demand, which shrank the market size to 328,518 million yen, 77.6% of the size of the previous fiscal year.

Noteworthy Topics

Initiatives to Prevent the Outflow of Plastic from Plastic-Coated Fertilizers

Coated fertilizers are water-soluble fertilizers coated with sulfur or synthetic resins. These coatings control the amount and duration of fertilizer elution. These fertilizers have been developed as high-performance products because the coating enables precise control over fertilizer release, a feature unavailable with traditional fertilizers. The components of these fertilizers dissolve into the soil according to crop growth. This reduces the amount of fertilizer needed and the frequency of fertilization. Since this results in labor savings, these fertilizers have primarily spread among rice producers.

Plastic-coated fertilizers excel at precisely controlling fertilization timing thanks to the plastic coating. However, there are environmental concerns about the coatings flowing out of the arable land and into the ocean after use. Organizations related to fertilizers, including the National Federation of Agricultural Cooperative Associations (JA Zennoh) and the Japan Fertilizer & Ammonia Producers Association, are studying new technologies and materials, such as zero-plastic biodegradable resins, as part of their “Initiative to Prevent the Outflow of Plastic Coatings from Slow-Release Fertilizers”, with the goal of achieving a system of agriculture that does not depend on plastic-coated fertilizers by 2030.

*Source: https://www.maff.go.jp/j/seisan/sien/sizai/s_hiryo/hihuku_hiryo_taisaku.html (in Japanese).

Meanwhile, slow-release fertilizers that do not use plastic are environmentally friendly because their biodegradable resins basically dissolve into the soil, while controlling the release of fertilizer components. Nevertheless, they currently have difficulty achieving precise control over fertilizer release timing, coating strength, and price. Manufacturers are developing products that use light or microorganisms to help biodegradable coating resins break down and dissolve into the soil. However, they have not yet discovered technologies that allow for immediate dissolution.

Current measures to prevent the outflow of coatings include thoroughly publicizing methods for containing fertilizers in paddy fields and promoting industry-wide communication to develop highly biodegradable fertilizer ingredients.

Future Outlook

The fertilizer market grew slightly to 330,939 million yen in FY2024, a 0.7% increase from the previous fiscal year. Due to the skyrocketing price of rice in 2024, more land is likely to be dedicated to cultivating staple rice.

Crop producers tend to reduce the amount of fertilizer used, due to soaring fertilizer prices in recent years. While demand for general-purpose fertilizers that produce simple effects is decreasing, demand is increasing for environmentally friendly products that do not use plastic, such as slow-release or organic fertilizers, as well as labor-saving products that reduce fertilization frequency, such as organic chemical and liquid fertilizers.

Because the market is susceptible to currency exchange rates, global situations, and the constant yearly increase in logistics expenses, it is crucial for manufacturers to stabilize the fertilizer business. They can achieve this by establishing optimal supply chains, leveraging economies of scale through joint logistics, partnering with JA Zennoh and other manufacturers, and increasing sales of high-value products, such as ecofriendly and labor-saving fertilizers.

Research Outline

2.Research Object: Manufacturers and developers related to fertilizers, soil breeding/improvement agents, and feeds, National Federation of Agricultural Cooperative Associations (JA Zennoh), and other fertilizer-related organizations.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and surveys via telephone

The Fertilizer Market

The fertilizer market in this research refers to the market for compound chemical fertilizers, mixed fertilizers, organic fertilizers, single nutrient fertilizers, liquid fertilizers, coated fertilizers, paste fertilizers, and other fertilizers. Market size is calculated based on the manufacturer shipment values.

<Products and Services in the Market>

1) Soil breeding and soil improvement agents (soil breeding for rice, for horticulture, for home gardening, soil improvement agents for greenery activities, micro-organic soil improvement agents) 2) Fertilizers (compound fertilizers [high analysis compound fertilizers, NK compound fertilizers, NPK compound fertilizers, organic compound fertilizers], compound chemical fertilizers, mixed fertilizers, organic fertilizers, single nutrient fertilizers, liquid fertilizers, coating fertilizers, paste fertilizers, and others), 3) Feed (formula feed, eco-feed)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.