No.3796

Global Market of Electric Four-Wheel Vehicles: Key Research Findings 2025

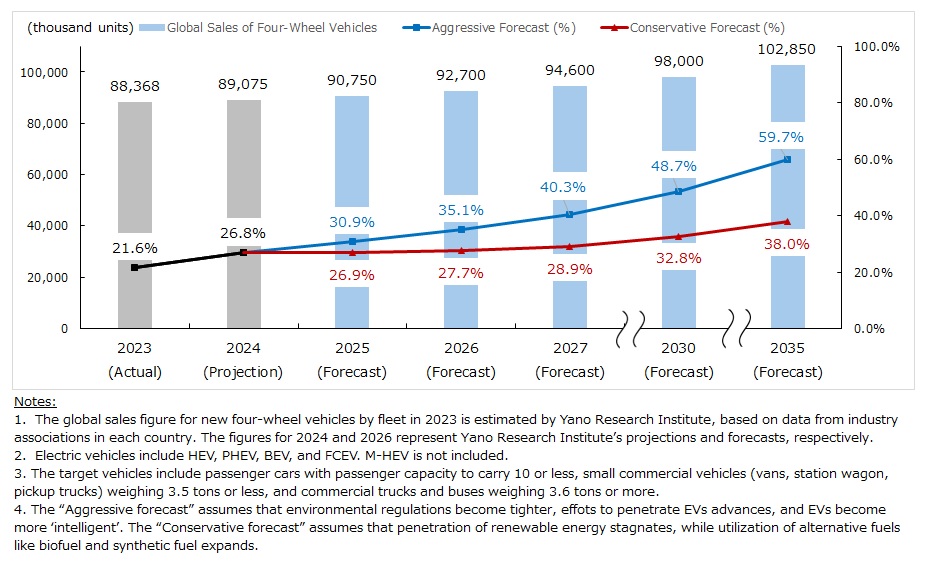

Global Electric Four-Wheel Vehicle Sales in 2035 Projected to Reach 102,850 Thousand Units, with Electrification Ratio of Up to 59.7%

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the market of global electric four-wheel vehicles, and found out the market trends in major countries and major manufacturers. This press release discloses the global forecast for four-wheel vehicle sales and the forecast on the ratio of electric four-wheel vehicles (passenger cars and commercial cars) until 2035.

Market Overview

The global forecast of four-wheel vehicle sales for 2023 is estimated to have reached 88,368 thousand, showing a high growth thanks to the stabilization of parts supply such as semiconductors and normalization of supply chain. Nonetheless, due to a demand pullback, the sales for 2024 grew is projected to have only grown by 0.8% to 89,075 thousand.

Out of the total new car sales for 2024, electric four-wheel vehicles are projected to have occupied 26.8% at 23,864 thousand (which is up by 25.1% YoY in fleet sales), indicating that one out of four new cars sold were electric vehicles. By the type of powertrain, BEVs represent 11,463 thousand (up by 14.4% YoY), PHEVs 6,145 thousand (up by 58.7% YoY), and HEVs 6,246 thousand (up by 20.5% YoY).

In Europe, where BEVs were promoted most strongly, deceleration in the shift to EVs was evident. Due to the end/shrinkage of national purchase subsidies in their main markets, Germany and France, sales of BEVs and PHEVs in 2024 declined to 2,136 thousand and 959 thousand (down by 1.7% and 3.9% YoY), respectively. However, as seen in 29.4% growth in sales of HEVs, attaining 1,542 thousand, the trend of electrification is not diminishing.

Sales of HEV were stronger than BEVs also in the US market. There is a contrast between the sales of HEVs and BEVs, where HEVs is projected at 1,606 thousand, up 36.7% from the previous year, while BEVs projected at 1,244 thousand, up 6.8% from the previous year. This trend was led by the demand decline for BEVs (stemming from the concern that it will lose residual value) coupled with the sales strategies of Toyota and Hyundai that focus on HEVs.

In the Chinese market, driven by the purchase subsidies for NEVs (New Energy Vehicles), high growth for BEV sales is expected at 6314 thousand, up 27.6% year-on-year. However, the sales growth of PHEVs is expected to exceed that of BEVs, with 97.0% year-on-year growth to 4,584 thousand. 2024 saw significant advancements in PHEV technology, as witnessed in the release of PHEVs by BYD and Geely Automobile that are with driving range of up to 2,000km on a single charge. Even though BEV cell performance has improved, for large SUVs in particular, the driving range is still limited. Thus, the PHEV powertrain is preferred over BEV powertrain in this segment.

Noteworthy Topics

Correlation Between Electrification Rate and Vehicle Intelligence

Software Defined Vehicle (SDV) became a buzzword in the automotive industry in 2024. While there is no universally agreed-upon definition across the industry, the term generally refers to vehicles whose core functions are controlled by software and can be updated via over-the-air technology. The concept is rooted in the belief that the value of vehicles is shifting from hardware to software: In other words, from ownership to the experience of services that the vehicle can provide. In this context, the vehicle serves primarily as a mobility service platform. Going forward, generative AI is expected to enable faster and more efficient software updates and integration of new features for SDVs. Consequently, this evolution is anticipated to accelerate the realization of fully autonomous driving technologies.

China is currently leading the way in this field. BYD, one of the country’s major automakers, has been putting forward the strategic view that "electrification is the first half, and intelligence is the second half." Reflecting this strategy, the company announced plans to equip all of its models with autonomous driving capabilities as a standard feature in 2025. This marks the beginning of the “second half” of the EV race in China.

Chinese companies are also taking the lead in standardizing operating systems and middleware. Backed by the government’s “China OS” standardization initiative, China has set a target for domestically developed in-vehicle operating systems to represent a 50% market share by 2025. Efforts to build a robust software platform ecosystem are progressing rapidly.

In contrast, traditional automakers in Japan and Europe often need to adapt legacy platforms originally designed for internal combustion engine (ICE) vehicles into E/E architecture suitable for SDVs. As a result, the pace of SDV development is increasingly diverging between Chinese manufacturers and their Japanese and European peers.

Vehicle intelligence links closely with vehicle electrification. Since the architecture of SDVs and autonomous cars consume huge amounts of electricity when compared to conventional automobiles (due to the needs for fully operating systems like SoC and sensors while driving), they are compatible with EVs like PHEVs and BEVs loaded with medium to large capacity batteries. Furthermore, because the simple powertrain structure aligns well with high precision electric controllers, it enables quicker reflection of computer-based decisions compared to ICE vehicles. From this perspective, vehicle intelligence is best developed in conjunction with EV platforms. In turn, vehicle intelligence is expected to drive penetration of electrified vehicles in the market.

Future Outlook

Here are two forecasts prepared for the global sales for electric vehicles until 2035 as a part of the global four-wheel vehicles market: The “Aggressive forecast” and the “Conservative forecast”.

As the “Aggressive Forecast”, we forecast that the global sales for electric vehicles will reach 47,690 thousand by 2030 and 61,400 thousand by 2035, with electrification ratio at 48.7% and 59.7%, respectively. This is based on an assumption that electric vehicles will become the majority of the new four-wheel car sales, associated with the tightening of environmental regulations and standards (such as emission control and restriction on new sales of ICE vehicles) in conjunction with 2050 Carbon Neutrality goals, further promotion by the government and industry players to make steady advancements in penetrating EVs, and further development of more ‘intelligent’ EVs.

As the “Conservative Forecast”, the global sales for electric vehicles are expected to attain 32,110 thousand by 2030, and 39,090 thousand by 2035, with electrification ratio at 32.8% and 380.%, respectively. This is based on a less optimistic assumption that penetration of electric vehicles decelerates due to lack of government subsidies and soaring costs, and penetration of renewable energy stagnates. It assumes that carbon neutrality will be pursued in a more flexible manner, allowing utilization of alternative fuels like biofuel and synthetic fuel. Difficulties are anticipated in commercial electric vehicle segment in particular, as the segment is challenged with operational cost, transportation inefficiencies, soaring cost pertaining to alternative fuels and EV charging stations.

In view of the Aggressive Forecast (61,400 thousand) for 2035 by powertrain, we project HEV will show the highest growth, reaching 18,050 thousand (289.0% on the same basis). BEV will represent 27400 thousand (239.0% of the sales in 2024) and PHEV will attain 15,500 thousand (252.2% on same basis). From the perspective of practicality, price, and renewable energy, HEV is a powertrain expected to be most prioritized in many regions.

Research Outline

2.Research Object: Manufacturers of mobilities (passenger cars, commercial vehicles, and two-wheel vehicles), parts suppliers, system suppliers, industry groups, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, and literature research

Global Electric Four-Wheel Vehicle Market

Electric four-wheel vehicles (xEVs) in this research include HEVs (Hybrid Electric Vehicles), PHEVs (Plug-in Hybrid Electric Vehicles), BEVs (Battery Electric Vehicles), and FCEVs (Fuel Cell Electric Vehicles). Note that M-HEVs (Mild Hybrid Electric Vehicles), a type of hybrid vehicle that cannot be driven solely on electric power are excluded.

By size, the target vehicles include passenger cars with passenger capacity to carry 10 or less, small commercial vehicles (vans, station wagon, pickup trucks) weighing 3.5 tons or less, and commercial trucks and buses weighing 3.5 tons or more.

The global sales for new four-wheel vehicles by fleet (unit) in 2023 is estimated by Yano Research Institute, based on data from industry associations in each country. The figures for 2024 and 2025 represent Yano Research Institute’s projections and forecasts, respectively.

Note that the target of the main survey is mobilities in general, i.e., including passenger cars, commercial vehicles, and two-wheel vehicles.

There are two forecasts prepared for the electrification rate of four-wheel vehicles: The “Aggressive forecast”, which is based on an optimistic assumption where regulations on environment become tighter (thus encouraging a shift to EVs), industry players make steady advancements in penetrating EVs, and EVs become more ‘intelligent’; and the “Conservative forecast”, which is based on a less optimistic assumption, where penetration of renewable energy stagnates, and utilization of biofuel and synthetic fuel expands.

<Products and Services in the Market>

ICE (Internal Combustion Engine) vehicle, HEV (hybrid Electric Vehicle), PHEV (Plug-in Hybrid Electric Vehicle), BEV (Battery Electric Vehicle), and FCEV (Fuel Cell Electric Vehicle)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.