No.3791

Food Industry and Consumer Trends in 4 Southeast Asian Countries (Vietnam, Thailand, Indonesia, and Philippines): Key Research Findings 2025

Food Industry in Vietnam, Thailand, Indonesia and Philippines Gathering Attention Amidst Rise of Middle-income Households - Urbanization and Lifestyle Changes Drive Expansion of Modern Trade

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the food market in four Southeast Asian countries (Vietnam, Thailand, Indonesia and Philippines), and for each country, found out the economic condition, the state of food manufacturing industry, the trends by product category, the trends of Japanese enterprises in the markets, and the trends of food retailing. This press release denotes some of the findings from the consumer questionnaire carried out in Vietnam.

Summary of Research Findings

Wet markets selling fresh foods and family-owned shops offering processed foods and daily necessities are the predominant shopping locations in Southeast Asian countries. While there are some country-specific differences, these forms of "traditional trade" have generally served as the main retail channels across the region.

On the other hand, driven by the urbanization and lifestyle changes in each country, modern retailers ("modern trade") like supermarket and convenience stores are gaining momentum. The decrease in traditional trade and the shift toward modern trade is progressing particularly in metropolitan areas including state capitals. In addition, in terms of business form, minimarts (small-scale supermarkets) and convenience stores are on the rise. Leading enterprises in modern trade are actively rolling out minimarts and convenience stores not only in urban areas but also in suburban neighborhoods.

Noteworthy Topics

■70% of Consumers Buy Processed Foods at Supermarkets

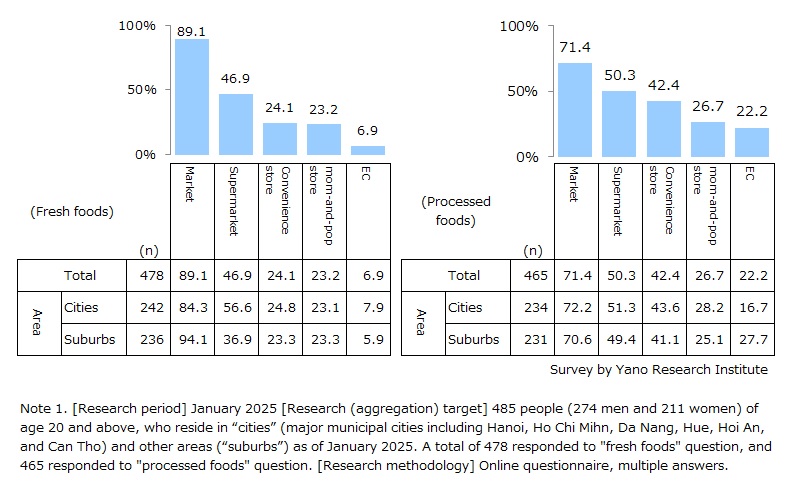

In January 2025, a consumer questionnaire was conducted to 485 consumers (274 men and 211 women) of age 20 and above in Vietnam. When asked where they purchase food (multiple responses allowed), 90% of respondents said they still buy perishable foods at traditional "markets". In contrast, when it comes to processed foods, 71.4% reported shopping at supermarkets, and 50.3% at convenience stores, both higher than the 42.4% who shop at mom-and-pop stores (free-standing, small family-run stores). This pattern was observed in both urban and suburban areas, suggesting that it is a nationwide trend. (Chart 1)

■Top Selling Japanese Processed Foods by Category: "Condiments", "Confectionaries", and "Flour/Noodles"

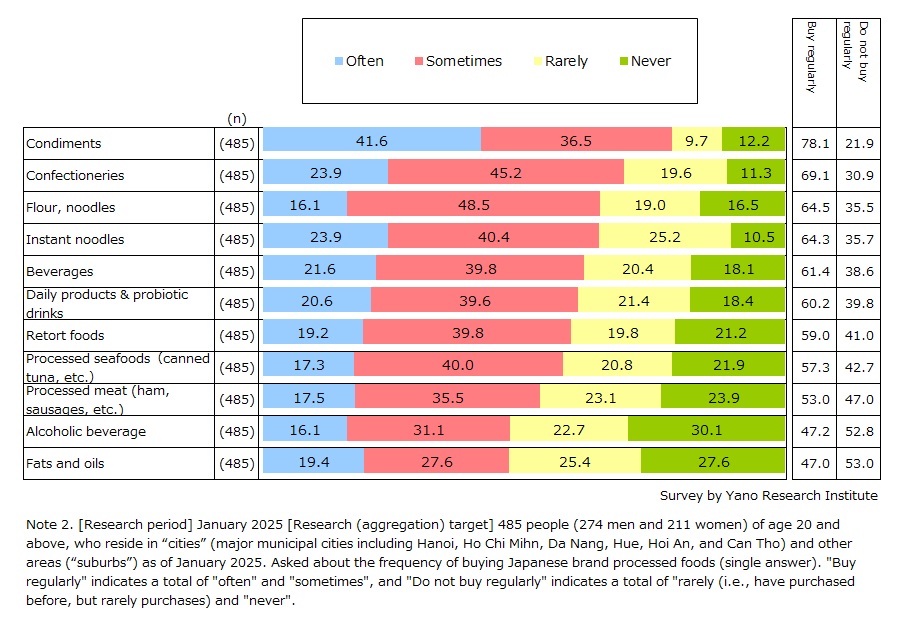

When asked about the frequency of purchasing Japanese processed foods (single answer per category), "condiments" ranked highest, with 78.1% of respondents selecting either "often" or "sometimes". This likely reflects the strong market presence of Japanese umami seasoning manufacturer in Southeast Asia. The second most frequently purchased category was “confectionary” (69.1%), followed by "flour/noodles" (64.5%) and "instant noodles" (64.3%). Overall, highly processed food categories tend to rank higher than others (Chart 2).

Research Outline

2.Research Object: Leading food manufacturers and food retailers in Vietnam, Thailand, Indonesia and Philippines (local office, Japan office)

3.Research Methogology: Survey by our expert researchers and local partners, online consumer questionnaire (in Vietnam), and literature research (government trends and economic environment based on public statistics)

In the market report, we surveyed the current state of food market in the four Southeast Asian countries, Vietnam, Thailand, Indonesia and Philippines, based on the economic condition, the current state of food manufacturing industry, the trends of major food product categories, the trends of Japanese companies in these markets, and the trends of food retailing industry.

In conjunction with the research, we also carried out a consumer survey in Vietnam, where Japanese food manufacturers are increasingly making entries in recent years. The questionnaire was targeted to 485 people (274 men and 211 women) of age 20 and above, who reside in "cities" (major municipal cities including Hanoi, Ho Chi Mihn, Da Nang, Hue, Hoi An, and Can Tho) and other areas ("suburbs"). This press release announces some of the findings from the consumer questionnaire regarding the point of purchase for fresh foods and processed foods, and the purchase status of Japanese processed foods by product category.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.