No.3695

Corporate Questionnaire to HVAC and Plumbing/Sanitary Contractors in Japan: Key Research Findings 2024

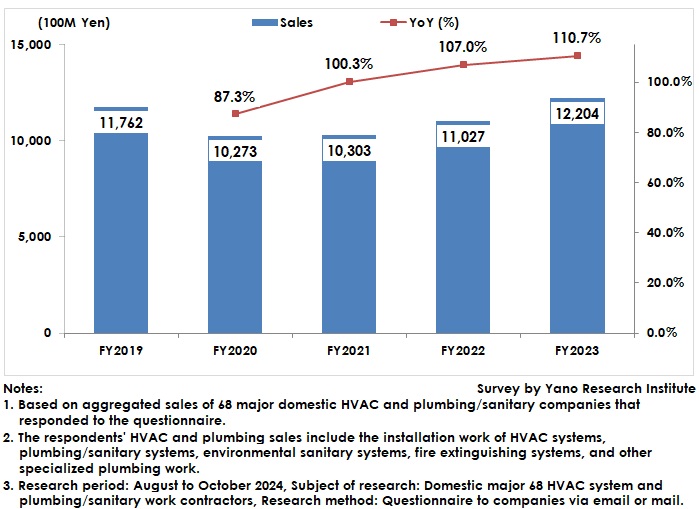

Domestic Major 68 HVAC and Plumbing/Sanitary Installation Contractors Generated 1,220,400 Million Yen in Sales in FY2023, 110.7% of Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a corporate questionnaire among 78 leading domestic heating, ventilation, and air conditioning (HVAC) and plumbing/sanitary systems contractors. This press release announces some of our analyses of the aggregated sales of HVAC and plumbing/sanitary system installations of 68 companies that responded to the questionnaire.

Summary of Research Findings

A questionnaire on the business of heating, ventilating, and air conditioning (HVAC) and plumbing/sanitary system installations was conducted among 78 companies engaged in HVAC and plumbing/sanitary system installations from August to October 2024. This paper presents a part of the analysis results of the total sales of HVAC and plumbing/sanitary system installations from FY2019 to FY2023 in 68 companies that responded to the questionnaire.

Sales in the HVAC and plumbing business (a total of 68 companies responded) reached 1,220.4 billion yen, 110.7% of the previous fiscal year.

Sales for construction work continued to increase as new demand for HVAC systems was generated in industrial HVAC fields such as semiconductors, automobiles and food, in addition to the increased demand for colossal new buildings as part of redevelopment projects in major metropolitan areas.

In FY2023, while order intake for construction work was favorable, severe cost conditions such as soaring material and labor costs persisted. Meanwhile, due to the need to secure contractors, clients began to make concessions on rising material and labor costs in price negotiations with these contractors. In this regard, some of leading construction companies are responding to skyrocketing costs through price negotiations, while at the same time selecting the construction business to accept with limited personnel in the labor shortage environment, thereby focusing on improving earnings.

Noteworthy Topics

Continued Need to Address Labor Shortages and Rising Labor Costs, Including “2024 Problem”

While the order intake in FY2023 was favorable, HVAC and plumbing installation contractors were no exception to being subject to the overtime gap regulation, which has been fully implemented in April 2024 as a part of the work style reform, forcing them to act on the 2024 issue.

Regardless of the business size, companies in the industry are required to reduce overtime and streamline and save human labor. This, together with the intensified recruitment competition caused by the labor shortage in the entire construction industry, is likely to further increase labor costs.

As a countermeasure, companies are working to pass on prices through negotiations with clients, reduce the workload of employees and save labor in work processes through digital transformation and the use of robots. More specifically, the focus is on reducing the workload onsite by means of sharing information and creating a paperless environment through tablets between field and office workers and reducing inspection work through the use of robots. However, these efforts are only being made by some of the major companies. Many companies are still exploring the solutions even after FY2024. It is expected that the problem will be solved not only within the HVAC and plumbing/sanitary work industry, but also by the entire construction industry

Research Outline

2.Research Object: Domestic major 78 HVAC system and plumbing/sanitary work companies

3.Research Methogology: Mailed/email questionnaire, face-to-face interviews (including online) by expert researchers, and literature research

Questionnaire on HVAC and Plumbing/Sanitary System Installation Business

From August to October 2024, a questionnaire on the business of heating, ventilation, and air conditioning (HVAC) and plumbing/sanitary work was conducted among 78 companies engaged in the installation of building systems, especially HVAC and plumbing/sanitary systems.

The survey identified the trend of HVAC and plumbing work by examining the total value of construction work in sales, the trend of orders received and materials procured, and the focus and emphasis of the companies. This press release reports the results of the analysis of the total sales of HVAC and plumbing system installations from FY2019 to FY2023 by aggregating the total value of construction work in sales of 68 companies that responded to the questionnaire.

The respondents' HVAC and plumbing sales include the installation work of HVAC systems, plumbing/sanitary systems, environmental sanitary systems, fire extinguishing systems, and other specialized plumbing work.

<Products and Services in the Market>

Heating, ventilation, and air conditioning (HVAC) and plumbing/sanitary work

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.