No.3678

IT Investment by Domestic Enterprises in Japan: Key Research Findings 2024

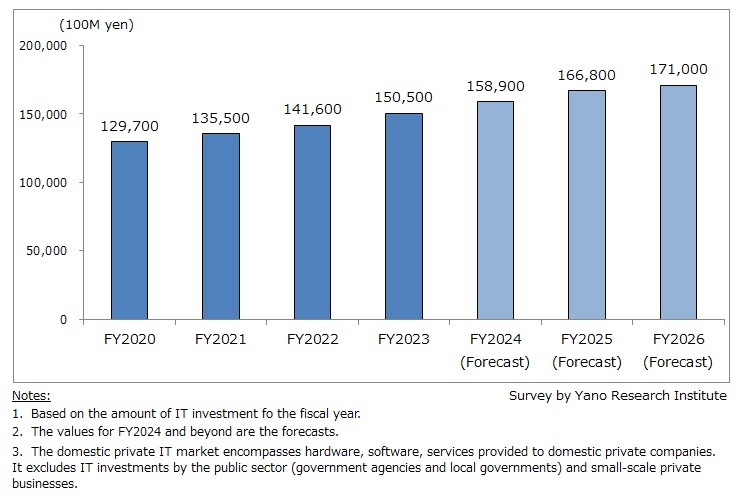

IT Investment by Domestic Private Enterprises Reached 15,050 Billion Yen in FY2023, Up 6.3% from Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the current status and future trends of IT investment by domestic private enterprises in FY2024.

Market Overview

The domestic private IT market in FY2023 (including hardware, software, and services; excluding public sector and small-scale private businesses) grew to 15,050 billion yen, up by 6.3% from the previous fiscal year.

The growth can be attributed to a wide range of market drivers, including the replacement of mission-critical systems, cloud migration, compliance with legal requirements (such as the Electronic Bookkeeping Act and Qualified Invoice System), and the promotion of digital transformation.

A notable trend is the significant spending by large companies on advisory fees for business consultants, aimed at enhancing their competitiveness through the replacement of mission-critical systems and cloud migration. This has also contributed to market expansion.

Noteworthy Topics

Impact of “DX Report” Proved to be Limited

For this annual survey, we conduct corporate questionnaire to domestic private companies every year to explore their IT investment statuses. For the 2024 Survey, 453 companies responded.

The so-called “2025 Digital Cliff,” highlighted in the 2018 DX Report by METI, is fast approaching. The report warned that Japan could face annual economic losses of up to 12 trillion yen after 2025 if businesses continue to rely on outdated IT systems. This stark projection has reportedly raised awareness among companies about the urgent need for digital transformation (DX).

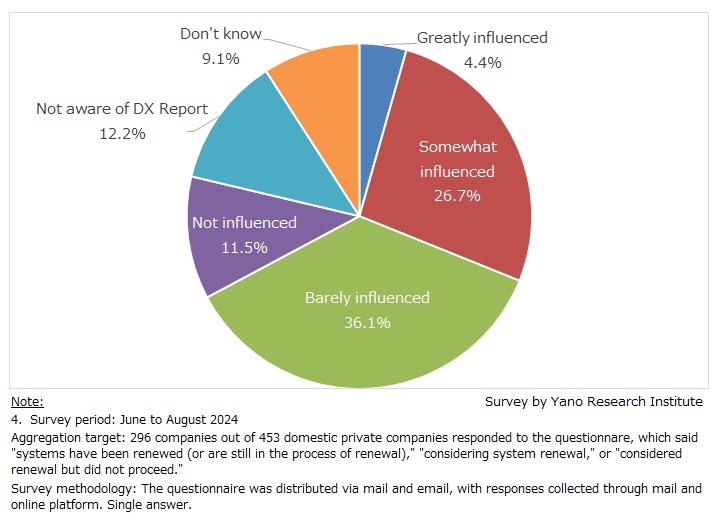

In our corporate questionnaire, we first asked about the status of system renewal. Out of 453 companies, 296 responded with one of the following: "systems have been renewed (or are still in the process of renewal)," "considering system renewal," or "considered renewal but did not proceed." We then asked these 296 companies whether the DX Report had influenced them to act toward renewing their legacy systems.

The results showed that approximately 30% of respondents felt influenced by the report, with 4.4% stating they were "greatly influenced" and 26.7% saying they were "somewhat influenced." On the other hand, 47.6% of respondents reported little to no impact from the report. Specifically, 36.1% said they were "barely influenced" by the report in their consideration of digital transformation, while 11.5% stated they were "not influenced."

The report is credited with significantly contributing to the widespread adoption of the term "DX" in Japan and increasing awareness of the need for digital transformation within enterprises. However, based on our questionnaire findings, its impact as a catalyst for system renewals appears to have been minimal.

*“DX Report – Overcoming the IT System “Cliff of 2025” and Full-scale Development of DX”, by the Ministry of Economy, Trade, and Industry (METI), September 2018

Future Outlook

The domestic private IT market is projected to reach 15,890 billion yen in FY2024, up 5.6% from the preceding fiscal year, and to 16,680 billion yen by FY2025 (up 5.0% YoY) and 17,100 billion yen by FY2027 (up 2.5% YoY).

Private companies remain actively engaged in replacing mission-critical systems and servers, as well as in cloud migration, throughout FY2024. Notably, large enterprises are increasingly adopting a "DX as Offense" approach, viewing digital transformation as a strategic initiative to drive innovation and develop new business opportunities. Investment in data utilization, including data standardization and the introduction of AI, is also on the rise.

In addition, external factors such as the weak yen and a shortage of IT personnel are contributing to increased IT investment. Companies are also revisiting their business continuity plans (BCP) in response to the frequent natural disasters experienced in recent years.

Looking ahead to FY2025 and FY2026, spending on hardware is expected to rise, primarily driven by the surge in demand for PC replacements as support for Windows 10 ends in October 2025. With growing interest in emerging technologies like AI and analytics, IT investments for new business development are also expected to expand. As a result, the domestic private IT market is forecasted to grow steadily.

Research Outline

2.Research Object: Domestic private companies

3.Research Methogology: Questionnaire to private companies and literature research

What is the Domestic Private IT Market?

In this research, the domestic private IT market encompasses hardware, software, services (such as maintenance, managed services, and outsourcing), and online services (including ASP and cloud services) provided to domestic private companies. The total market size is calculated based on the investment amounts made by these companies. It is important to note that this market analysis excludes IT investments by the public sector (government agencies and local governments) and small-scale private businesses.

To assess the current status and future trends of IT investment among private companies, a questionnaire was conducted as follows: [Survey period] June to August 2024; [Target audience] 453 domestic private companies; [Survey methodology] The questionnaire was distributed via mail and email, with responses collected through mail and online platform.

<Products and Services in the Market>

IT investment by domestic private enterprises (on hardware, on software [including development from scratch and introduction of customized/non-customized software package], managed service/outsourcing services for maintenance and operations, online services like ASP/cloud, access charges, consulting, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.