No.3660

Apparel Market in Japan: Key Research Findings 2024

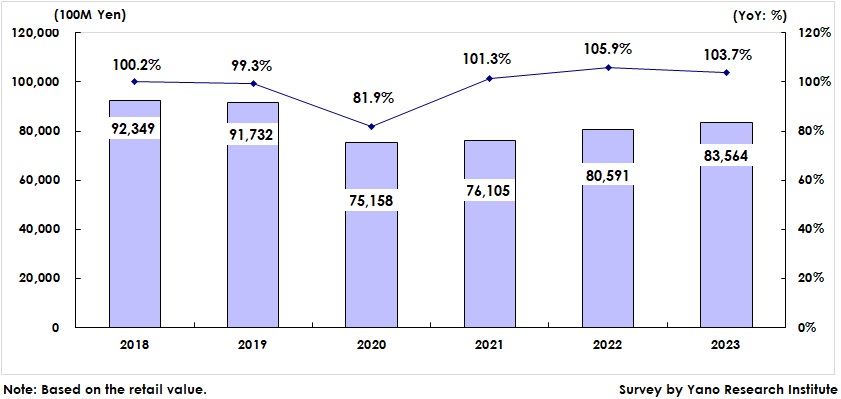

Domestic Apparel Retail Market Size in 2023 Rose to 8,356.4 Billion Yen, 103.7% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic apparel market and found out the market trends by item and by sales channel, and the status of the apparel industry including apparel manufacturers and retailers.

Market Overview

The size of the domestic apparel retail market (total value of men’s, women’s, baby and children’s apparel items) reached 8,356.4 billion yen in 2023, 103.7% of the previous year's value, and the third consecutive year of outperformance.

In terms of sales by channel, department stores and specialty stores continued their remarkable performance from the previous year. In connection with the resumption of events, people flocked to brick-and-mortar stores to meet the increasing demand for new clothes or for replacement of old outfits to celebrate school enrollment, coming of age ceremonies, etc. Online shopping, that had shown an upsurge in demand during the pandemic, seemed to be facing a downturn in demand, as its growth rate slowed. Increased shopping in physical stores seemed to be one of the reasons.

Noteworthy Topics

Overall Apparel Industry Trend 2023

The trends for major apparel companies in 2023 show a bipolarization between offensive companies that seek to proactively recover from disrupted sales amid the pandemic, and those defensive companies that seek to drive structural reform rather than recover from disruption.

The former companies are proactively developing and launching new brands and new ways of doing business. New brands tend to offer higher price ranges than existing brands. This reflects the companies' aim to excavate sophisticated fashion trends.

On the other hand, the latter companies are pursuing structural reform by improving management efficiency and shedding unprofitable brands.

As they are being squeezed out by apparel tenants with price appeal to customers, companies undergoing structural reform have less intention of opening new stores in shopping malls. Offensive companies, on the contrary, are stepping up store openings for the new brands with higher prices than before and for the tenants in the new type of operation.

Future Outlook

The size of the domestic apparel retail market (total value of men’s, women’s, baby and children’s apparel items) is projected to be on the recovering trend toward the pre-Covid level until around 2025.

The apparel market is in moderate long-term decline due to a waning population and an aging society with fewer children. However, rising raw material prices as well as logistics costs and labor costs are boosting the unit selling price, which is likely to somewhat limit the extent of the decline for the time being. Further market uptrend may be possible if wages keep on rising, halting the decline in per capita apparel spending and increasing apparel spending per household.

Research Outline

2.Research Object: Manufacturers of products in any of the following apparel categories: men’s, women’s, baby’s, and children’s), retailers (department stores, mass merchandisers, specialty stores, etc.,) business organizations, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, mailed questionnaire, and literature research

The Apparel Retail Market

This research has calculated the size of the apparel retail market based on the retail value of apparel products handled by comprehensive apparel companies, men’s apparel companies, women’s apparel companies, baby & children’s apparel companies, etc. Note that secondary market sales such as secondhand shops are not included.

<Products and Services in the Market>

Men’s apparel (suits, jackets/blazers, coats, slacks, trousers/pants, shirts), women’s apparel (suits, formal wear, dresses, jackets/blazers, coats, trousers/pants, shirts/blouses), others (knit products [sweaters, T-shirts, polo shirts, etc.,], denim items, babies’/children’s items, underwear, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.