No.3656

Non-Residential Wood Construction Market in Japan: Key Research Findings 2024

Non-Residential Wood Construction Market Projected to Attain 880,000 Million Yen for FY2024, 100.1% YoY, and Grow to 1,140,000 Million Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic non-residential wood construction market, and has found out the market size, the trends by segment, and future outlook.

Market Overview

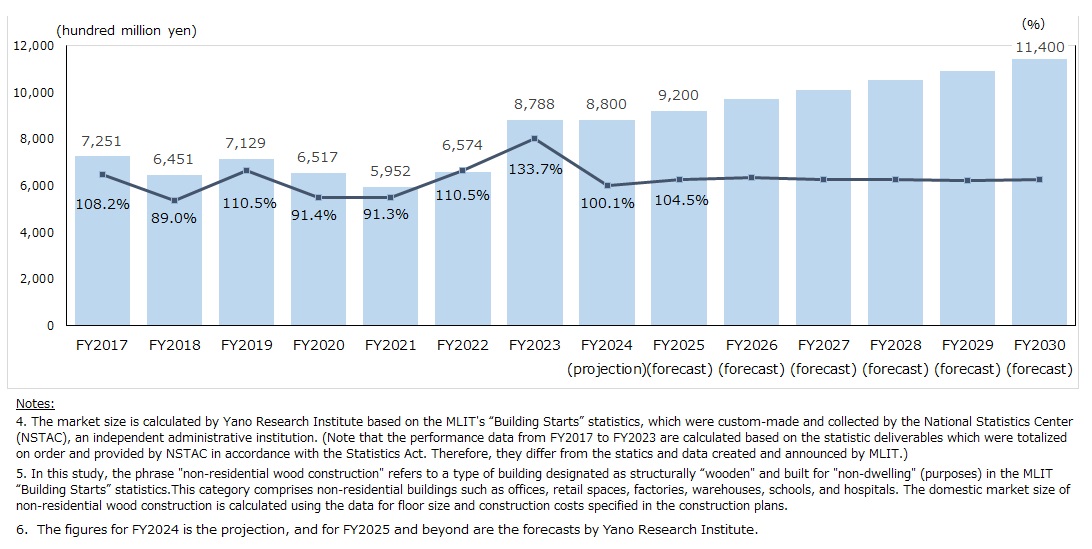

The domestic market for non-residential wood construction (including new buildings, extensions, and renovations) expanded significantly in FY2023, growing 33.7% from the preceding fiscal year to reach 878,800 million yen, based on construction costs. The resumption of construction projects that were canceled (or postponed) due to the pandemic and the "wood shock"* fueled market expansion, while rising construction costs increased market size. Overall, the market was nearly 20% larger than in FY2019.

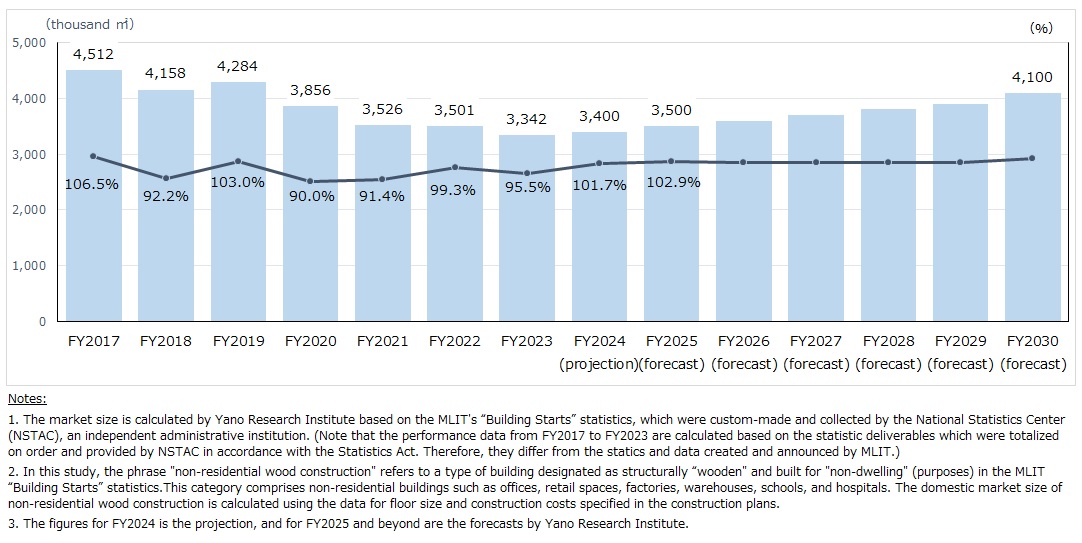

On the other hand, the market size based on floor area decreased to 3,342,000 m² in the same fiscal year, which represents 95.5% of the previous year's figure. Since FY2020, the total floor area has been declining due to reductions in floor sizes and the number of stories per building. The recent rise in construction costs, driven by soaring prices of raw materials and labor, has led building owners to reduce the scale of their projects, favoring smaller, low-rise buildings.

*” Wood shock”: A global spike in lumber prices triggered by a surge in new housing construction, particularly in China and the US, during the pandemic, which led to an unprecedented rise in lumber material prices.

Noteworthy Topics

Non-Residential Wood Construction Aligns Strongly with Sustainability Trends

As society becomes more environmentally aware and focused on achieving the SDGs and carbon neutrality, building owners (including companies, municipalities, and organizations), architects, and builders are expected to play a role in these efforts. In this context, due to wood's ability to store CO2, more and more owners are opting for wood construction over traditional SRC (Steel Reinforced Concrete Structure), which have been predominant in Japanese non-residential buildings.

Additionally, the use of hybrid-timber construction systems, which combines S/RC with wood, is also on the rise. It is worth noting that, according to the MLIT's “Building Starts”, the wooden office building construction steadily increased to 105.0% of the previous year by floor area and to 115.5% by construction costs.

Future Outlook

The non-residential wood construction market for FY2024 is projected to grow by 1.7% from the preceding fiscal year to 3,400,000 m2 by floor area and by 0.1% to 880,000 million yen by construction costs.

Against the backdrop of soaring prices of steel and other raw materials used in non-residential construction, demand for wood construction is on the rise in FY2024. Low-rise non-residential wooden construction is expected to increase steadily in particular, as it is most price competitive against SRC construction.

As more companies are expected to address SDGs and carbon neutrality, the need for using CO2-absorbing timber is expected to expand hereafter. Currently, companies that focus on ESG, which aims for sustainable development, are mainly large companies listed on the stock exchange. However, small and medium-sized enterprises are also expected to be take ecological and societal perspectives in the future. This trend will help expand the market of non-residential wood construction. The market for nonresidential wood construction in FY2030 is expected to reach 4,100,000m2 by floor area (122.7% of the FY2023 level), and 1,140,000 million yen by construction costs (129.7% of the FY2023 level).

Research Outline

2.Research Object: Businesses of non-residential wood construction (general constructors, house makers, architectural firms, construction material makers, pre-cut pallet lumber/framing package makers, wood frame material makers, laminated wood material makers, etc.)

3.Research Methogology: Face-to-face interviews by our specialized researchers (including online interviews) and literature research. *The market size is estimated by Yano Research Institute using the tailor-made tabulation of MLIT's "Building Starts" statistics by National Statistics Center (NSTAC), an independent administrative institution. The performance data from FY2017 to FY2023 are calculated based on the statistic deliverables that were totalized on order and provided by NSTAC in accordance with the Statistics Act. Therefore, they differ from the statistics and data created and announced by MLIT.

What is the Non-Residential Wooden Construction Market in Japan?

In this study, the phrase "non-residential wood construction" refers to a type of building designated as structurally “wooden" and built for "non-dwelling" (purposes) in the MLIT “Building Starts” statistics. This category comprises non-residential buildings such as offices, retail spaces, factories, warehouses, schools, and hospitals. The domestic market size of non-residential wood construction is calculated using the data for floor size and construction costs specified in the construction plans. Target buildings comprise extensions and renovations as well as new constructions.

We excluded data for residential buildings, such as apartment complexes, from MLIT’s data for "medium- to large-scale (medium- to high-rise) wooden buildings."

<Products and Services in the Market>

Non-residential wood construction

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.