No.3642

Food Service Market in Japan: Key Research Findings 2024

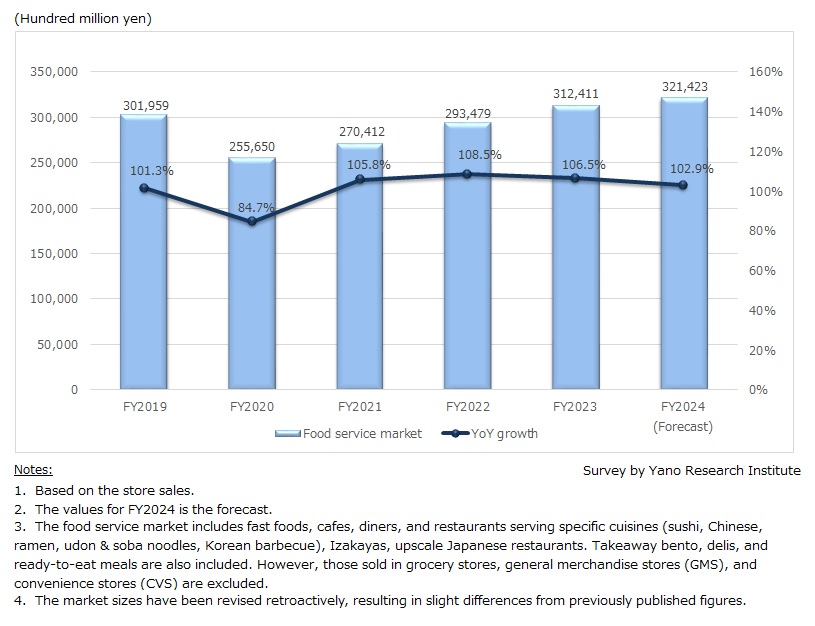

Food Service Market for FY2023 Expanded to 31,241,100 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the domestic food service industry, and found out the market size, the trends of market players, and future outlook.

Market Overview

The domestic food service market for FY2023 (including takeaway bentos, delis, and ready-to-eat food) grew by 6.5% from the preceding fiscal year to 31,241,100 million yen (based on the store sales). As pandemic restrictions eased, socioeconomic activity began to recover in 2023. The demand recovery throughout the year pushed the market size to exceed pre-pandemic levels.

By business category, fast food restaurants, which performed well even during the pandemic, continued to thrive, thanks to strong demand for takeout and delivery services. Family restaurants have improved operational efficiency by closing underperforming locations, implementing self-ordering and payment systems (via in-store tablets or smartphones), and introducing robotic servers as part of their digital transformation efforts. Other business categories, such as sushi restaurants, udon & soba shops, Chinese restaurants, ramen shops, and cafes, have also seen a rebound. However, the total number of izakaya (Japanese-style pubs), pubs, and beer restaurants declined during the pandemic, and while there has been an increase in demand for banquets and events, sales have not yet to return to pre-pandemic levels.

Noteworthy Topics

Companies Raise Prices as Cost Reductions Prove Insufficient to Offset Rising Expenses

Over the past few years, companies have faced significant challenges in managing the rising costs of raw materials, employee wages, and distribution. Despite efforts such as changing ingredients and optimizing logistics, it became increasingly difficult for companies to maintain existing prices. As a result, many of them were forced to adjust their pricing.

Several restaurant chains began raising prices in the second half of 2021. Unable to absorb these increased costs, some have implemented regular price hikes, adjusting prices once or twice a year. To mitigate customer turnover from these price increases, businesses are working to strike a balance between maintaining quality and managing price expectations to gain consumer acceptance.

Other strategies include implementing regional pricing, where product prices vary by location based on differences in rent and labor costs, and introducing late-night surcharges to cover the higher wages paid for late-night shifts compared to daytime hours.

Future Outlook

The restaurant market in FY2024 is expected to see an increase in customers traffic compared to FY2023, as socioeconomic activities continue to recover from the pandemic’s impact. In addition, the average spending per customer is expected to increase due to price adjustments. Given the circumstances, we project the overall domestic food service market (including takeaway bentos, delis, and ready-to-eat food) to grow by 2.9%, reaching 32,142,300 million yen in FY2024.

Research Outline

2.Research Object: Food services (major food chains, leading companies)

3.Research Methogology: Face-to-face interviews (including online interviews) by our expert researchers, surveys via email, and literature research

Food Services

This research focuses on the food service market that includes fast food establishments, cafes, diners (often referred to as family restaurants), and restaurants serving specific cuisines, such as sushi, Chinese food, ramen, udon & soba noodles, Korean barbecue, as well as business types like Izakayas (Japanese pubs), upscale restaurants, takeaway bento (lunch boxes), delis, and ready-to-eat meals.

The research target is limited to businesses specializing in restaurants and takeaway food, and does not include canteens in schools, hospitals, offices, or food services related to accommodations like hotels or inns.

Among businesses operating at night, this research includes those that serve meals to certain degree, such as Izakayas, gastropubs, beer restaurants, and fine dining restaurants. However, it excludes businesses that primarily serve alcoholic drinks, such as snack bars, nightclubs, and cabarets, as well as businesses located in red-light districts. Additionally, takeaway bento meals, deli dishes, and ready-to-eat food sold by specialty stores, which are often located in department stores and supermarkets, are included, while those sold in grocery stores, general merchandise stores (GMS), and convenience stores (CVS) are excluded.

<Products and Services in the Market>

Fast food chains serving Japanese food or western-style food, diners (so-called family restaurants), restaurants that respectively serve sushi, conveyor-belt sushi, home-delivery sushi, Izakaya pubs, gastropubs, beer restaurants, luxury restaurants, Chinese cuisine & ramen noodle restaurants, udon & soba shops, Korean barbecue restaurants, other business forms such as those takeaway bentos (assorted-plate meals)/deli dishes and ready-to-eat food specialty stores

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.