No.3626

Global Electric Commercial Vehicle Market: Key Research Findings 2024

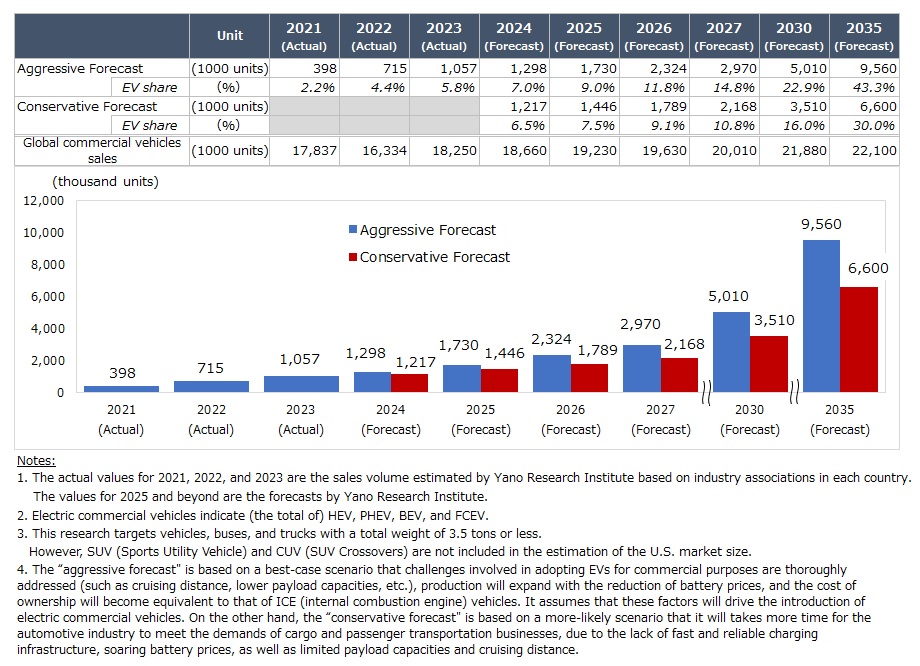

Electric Commercial Vehicles Forecasted to Reach 9,531 Thousand by 2035 Globally, 43.1% of All Commercial Vehicles

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the global market of commercial vehicles, and found out the market status in major countries, the trends of major manufacturers, and the trends of major transportation companies.

This press release discloses the forecasts on global sales and the share of electric commercial vehicles up to 2035.

Market Overview

The global sales of commercial vehicles in 2023 were 18,250 thousand, up by 11.7% from the preceding year.

Trends in China, Europe, and the U.S affects the sales trend of global commercial vehicle, as they account for about 70% of the global sales. The demand for replacing commercial vehicles is rising in China in particular, against the backdrop of the enforcement of so-called “National 6” standard in 2023, which limits vehicle emissions. Strong demand for cargo transport underpins the sales of light-duty commercial vehicles and trucks expects, while the development of a high-speed railway network may hinder the sales of passenger buses from 2024. As a whole, the global commercial vehicle market will be driven by emerging countries, where strong economic growth is anticipated in the medium to long term.

Out of the total commercial vehicle sales in 2023, the number of electric vehicles was 1,055 thousand units, indicating a share of 5.8%. While the China and Europe have been leading the global electric commercial vehicle market, the ending of subsidies promoting EVs decelerated the growth. Nonetheless, electric vehicles can serve as a great option for transportation companies aiming to reduce carbon emissions. If the challenges associated with the wide adoption of EVs can be addressed, sales will rise in the medium to long term, especially for Zero Emission Vehicles. (ZEVs: BEV & FCEV).

The challenges associated with the penetration of EVs as commercial vehicles include high sales price, low payload capacities, and short cruising range. Countermeasures are observed in many countries. For instance, Europe and the U.S have eased (or considering the ease of) payload limitations specifically for ZEVs, and discussions are underway in Japan as well; in 2023, about 5,500 battery-switchable heavy-duty trucks was introduced in China, while demonstration tests is ongoing in Japan, with the initiatives of automakers and energy providers. Moreover, various charging methods including dynamic wireless charging are under development to assure stable charging infrastructure for freight and passenger transportation.

Noteworthy Topics

Decarbonization Strategies of Freight & Passenger Transportation Companies

Enterprises are required to reduce or eliminate carbon emissions from their entire supply chain, including distribution. While disclosure of Scope 3 (greenhouse gas emissions of entire supply chain) is becoming a major trend in Europe, Japan, and in California in the U.S., some companies have set a goal of using only BEVs for their product delivery. A trend of shippers requesting transportation companies to carry their cargo on ZEVs is expected to become stronger. From transportation companies’ perspective, now is the time to offer an additional value, which may contribute to their shippers' decarbonization strategy. Going forward, the offering of “green logistics” using ZEV will be a crucial strategy for transportation companies to open up new business opportunities.

Meanwhile, passenger transportation companies are focusing on MaaS (Mobility as a Service, a concept of integrating various means of transportation, such as buses and trains, into a single transportation service) to increase their users. In China, participants in the ‘green MaaS (campaign)’ can receive carbon credits for their ‘green’ travel behavior, such as walking, cycling, and taking buses (instead of driving private cars). In Japan, there are moves to establish so-called regional economic blocs, by adopting cashless payment systems for public transportation. Combined with the energy data obtained through the introduction of ZEVs, integrated consumer data may be utilized for the development of new products and services, which may eventually increase passengers of transportation services. Such initiatives will increase strategic significance in the future for passenger transportation businesses.

As observed, carbon neutrality, corporate social responsibility, and data utilization are the major drivers for penetration of electric commercial vehicles. Under the circumstances, the sales volume of electric commercial vehicles is projected to rise, BEVs in particular.

Future Outlook

As decarbonization progresses globally, freight and passenger transportation companies will increase presence in the market as enablers of decarbonization, not only in terms of Scope 1 (direct GHG emissions by their own companies) and Scope 2 (indirect emissions from the use of electricity, heat, and steam supplied by other companies), but also in Scope 3 (GHG emissions by supply chain). With wider electric commercial vehicle options, ranging from light-duty commercial vehicles to heavy-duty trucks and buses, China and Europe will drive the global market with BEVs. Given the situation, the sales volume of electric commercial vehicles is forecasted to reach 9.531 million units by 2035, with the share at 43.1%.

Looking at trends by country, China sees growth in sales of electric commercial vehicles, especially NEVs (New Energy Vehicles: PHEVs, BEVs, and FCEVs). However, as the government cut the subsidies, the growth decelerated. Fuel consumption regulations encouraged the replacement of light-duty trucks with NEVs domestically, while tapping overseas market by exporting buses and knockdown kits (for using foreign factories as assembly plants for their EVs).

In Europe, although a shift to EVs has been progressing for light-duty commercial vehicles, the reduction of incentivizing subsidies slowed down the growth rate. On the other hand, major commercial vehicle OEMs (automobile manufacturers) in Europe have increased heavy-duty BEV trucks, while Alternative Fuels Infrastructure (AFI) Regulation propelled the installation of quick chargers and hydrogen stations. As governments are working together with OEMs to electrify heavy-duty trucks and create new system for achieving carbon neutrality in the transportation sector, we believe the sales volume of electric vehicles will increase.

On the other hand, since the cruising range and lower payload capacities remain challenging for BEVs, FC (fuel cell) trucks for high-utilization and long-distance transportation are expected to increase through the latter half of the 2020s. FCEVs and alternative fuel engines are likely to be used for long-distance transportation, while BEVs will be utilized for short-distance and last-mile logistics. The use of electric vehicles for transportation will not be solely driven by BEVs; it will also grow based on the specific needs of different applications.

Research Outline

2.Research Object: Commercial vehicle manufacturers, auto parts suppliers, transportation companies (freight, passengers)

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone/email, and literature research

<About Commercial Vehicles>

In general, the term “commercial vehicle” refers to a vehicle that aims to transport goods and merchandise or passengers. This research targets commercial vehicles with a total weight of 3.5 tons or less, i.e., light-duty vehicles, light-duty buses, and light-duty trucks. However, the estimation of the U.S. market size does not include SUV (Sports Utility Vehicle) and CUV (SUV Crossovers).

In this research, we categorized vehicles by GVW of vehicles: light-duty vehicles (GVW 3.5 tons or less), light-duty trucks (GVW 3.5 to 8 tons), heavy-duty trucks (GVW 8 tons or more), light-duty buses (GVW 3.5 to 8 tons), and heavy-duty buses (GVW 8 tons or more). The numbers for global commercial vehicle sales are based on this vehicle classification.

<About The Share of EVs>

We took best-case scenario and more-likely-scenario for forecasting the share of EVs among commercial vehicles. The “aggressive forecast" is based on a best-case scenario that challenges involved in adopting EVs for commercial purposes are thoroughly addressed (such as cruising distance, lower payload capacities, etc.), production will expand with the reduction of battery prices, and the cost of ownership will become equivalent to that of ICE (internal combustion engine) vehicles. It assumes that these factors will drive the introduction of electric commercial vehicles. On the other hand, the “conservative forecast" is based on a more-likely scenario that it will takes more time for the automotive industry to meet the demands of cargo and passenger transportation businesses, due to the lack of fast and reliable charging infrastructure, soaring battery prices, as well as limited payload capacities and cruising distance.

<Products and Services in the Market>

ICE commercial vehicles, electric commercial vehicles (HEV, PHEV, BEV, and FCEV)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.