No.3624

Golf Gear Market in Japan: Key Research Findings 2024

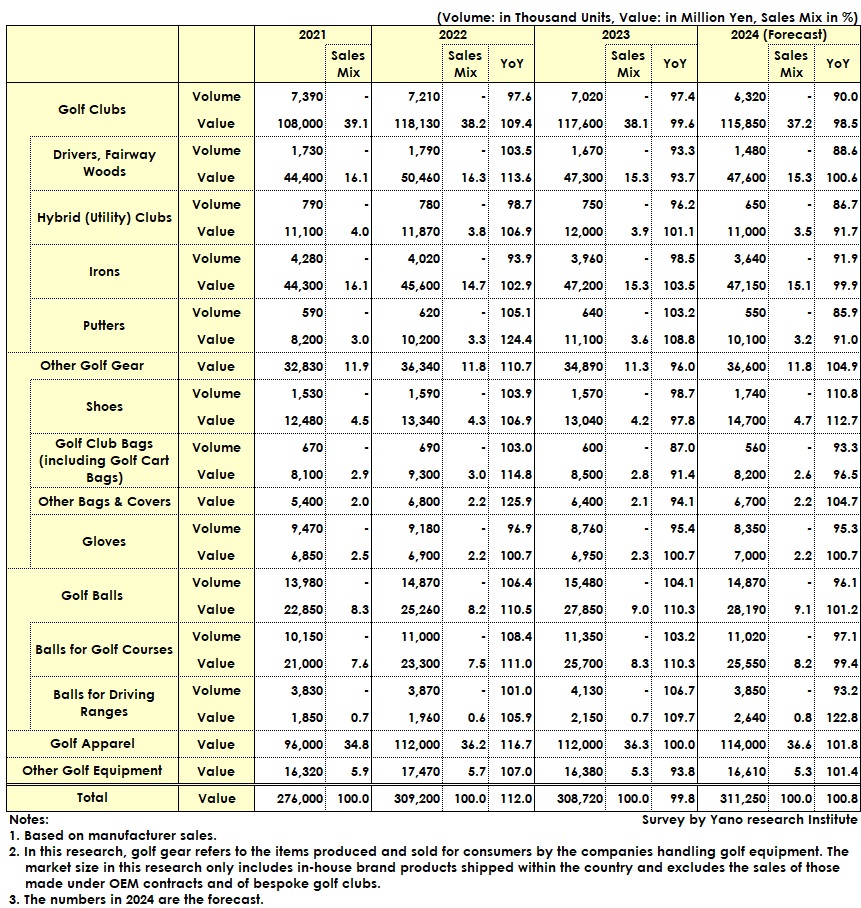

Domestic Golf Gear Market in 2023 is Down to 99.8% of the 2022 Market Size, But Still Higher than Pre-Covid Era at 116.4% of the 2019 Market Size

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic golf gear market and found out the trends by product category, trends of leading companies, and market outlook.

Market Overview

The domestic golf gear market size in terms of sales at manufacturers declined slightly from the previous year to 308,720 million yen in 2023, 99.8% of the 2022 results.

Due to the outbreak of the pandemic, the golf gear market dropped to 231,420 million yen in 2020, 87.2% of the previous year. However, after golf attracted attention as a sport that people can play outdoors amid the pandemic crisis, the market grew to 276,000 million yen in 2021 (119.3% of the previous-year’s size) and to 309,200 million yen in 2022 (112.0% of the previous-year’s size), exceeding 300 billion yen.

Although the market downturned to 99.8% of the previous-year size in 2023, it maintained the favorable condition in terms of sales value, which was still much larger by 16.4% than the market size of 265,330 million yen in 2019. Some categories continued to mark double-digit growth. The year 2023 was the milestone year for the golf gear market because it was the first year to decline since golf boomed during the pandemic. However, it can be said that the aftereffects of the boom still linger to affect in various ways.

Noteworthy Topics

Changes in Sales Forecast by Golf Gear Manufacturers After Peak of “Pandemic Bubble”

The sales of golf gear manufacturers in this research are based on the accumulation of the sales of each manufacturer surveyed. In the Golf Gear Market Size by Category table, most categories are forecast to decline in sales volume, while sales value is forecast to increase slightly or remain flat. This indicates that each manufacturer is planning for a decrease in sales volume and a slight increase or a leveling off in sales value.

In other words, they plan to maintain the sales value by increasing the unit price, while letting the sales volume decrease from the previous year. In the pre-Covid era (before 2019), many golf gear manufacturers used to submit forecasts of double-digit growth in both sales value and volume. When asked about the reasons for the growth, the answers used to be based on a somewhat diehard spirit, such as “No matter what the market environment is, we are budgeted to achieve the submitted number” or “Since the submitted number is the target that we must achieve, we would like to do so by any means.” Quite a few answers were “The submitted number is hardly achievable, but my boss does not allow me to submit the number below the sales budget, so all I can do is to submit the budgeted number.”

This shows the change in the market environment after the pandemic, because before the pandemic, it was unthinkable to submit the number below the sales budget.

After the pandemic is over, one of the most common things you hear from people in the golf equipment industry, including retailers, is how to get away from the extreme reliance on so-called "ready-made" golf clubs. “Ready-made” golf clubs are the finished products that are commonly sold and used. In the golf club market, it has long been standard practice to produce golf clubs based on expected demand and deliver them to retailers.

However, this business model of providing off-the-shelf golf clubs has come to show limitations, as the production lead time for golf clubs has not improved from the past, the fitting of golf clubs at retail has become general, and, in conjunction with this, the sales ratio of custom-made golf clubs has increased, which has increased the number of custom club heads, shafts, and even grips.

Future Outlook

The domestic golf gear market size by manufacturer sales is forecast to reach 311,250 million yen in 2024, 100.8% of the previous year's size. While many categories are forecast to decline in sales volume, they are forecast to increase slightly or remain unchanged in sales value. The weak yen is affecting the rising cost of raw materials for golf equipment, and the increasing cost of developing new products with better features than existing products. Considering the above conditions, the forecast of continued market expansion caused by rising unit prices of products is understandable.

It is the forecast based on the business model with a good balance between supply and demand, which does not generate excess inventory, that has been established by the people in the golf gear industry who have experienced the “pandemic bubble” followed by a reactionary decline in sales and increase in excess inventory.

Research Outline

2.Research Object: Domestic enterprises dealing in golf gear, i.e., manufacturers, trading firms, wholesalers, retailers, golf course operators, golf driving range operators, golf school operators, business organizations related to golf

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and the survey on sales and shipment of golf gear

About Golf Gear/Golf Equipment

Golf gear or golf equipment encompasses the various items such as golf clubs, balls, bags, etc. that are used for playing the sport of golf. In this research, golf gear refers to the above items produced and sold for consumers by the companies handling golf equipment. The market size in this research only includes in-house brand products shipped within the country and excludes the sales of those made under OEM contracts and of bespoke golf clubs.

About the Golf Gear/Golf Equipment Market

The golf gear/equipment market in this research is calculated based on the sales of target products at manufacturers.

* It is the net sales subtracting returned goods sales and markdown receipts (deducted amount) from the total sales (direct store sales + wholesale sales), excluding the overseas sales. Basically, secondhand products (including lost balls) are not included.

<Products and Services in the Market>

Golf clubs (Drivers/Fairway woods, hybrid clubs, irons, putters), golf balls (for golf courses or for driving ranges), golf shoes, golf club bags (including golf cart bags), other bags and covers, golf gloves, golf clothing/apparel (including cap, visors, belts, and underwear), other golf equipment (tees/markers, practicing devices, competition prizes, portable golf rangefinders, and others)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.