No.3605

Reward Points Services Market in Japan: Key Research Findings 2024

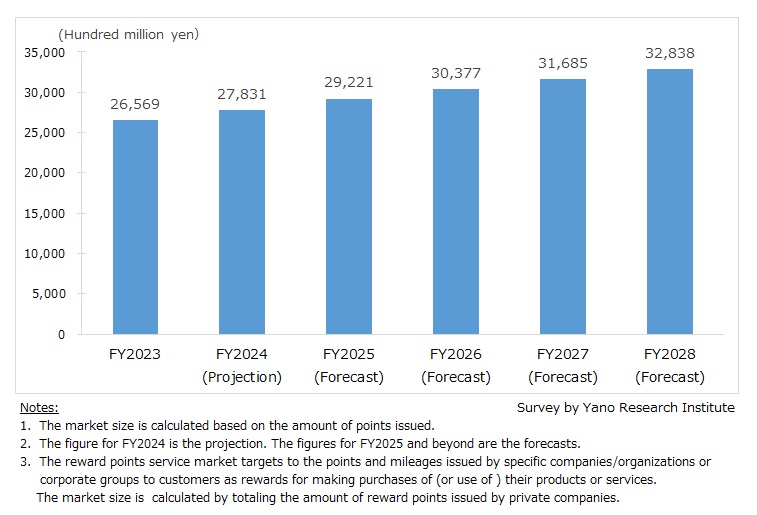

FY2023 Domestic Reward Points Services Market Size Estimated at 2.7 Trillion Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic reward points services market, and found out the current status, the trends of market players, and future perspectives.

Market Overview

The domestic reward points services market grew to 2,656,900 million yen for FY2023 (based on the total amount of reward points issued). It is expected to expand further by 4.7% to 2,783,100 million yen in FY2024.

Although consumption was sluggish from FY2020 due to Covid-19 crisis, most industries are already seeing recovery to pre-pandemic FY2019 level, and the value of reward points issued has been on a rise.

Shared reward point services have been expanding the number of merchants participating in their programs, particularly those where consumers shop on a daily basis. Increase of digital transaction including code payments and credit cards, stemming from the penetration of cashless payment systems, has expanded the total value of reward points issued.

In addition, more consumers began to “hunt” for points as the idea of “poi-katsu”, activities to accumulate reward points efficiently and maximally, became popular. This has also contributed to the increase of points issued.

Noteworthy Topics

Expansion of “Point Economic Zone” Centered Around Reward Points

Majority of the shared reward point program providers establish “point economic zone” by themselves or with group companies, delivering various products and services like telecommunication network, code payments, credit cards, securities, insurance, banking, and ecommerce within the point economic zone. By providing multiple services in the point economic zone that can be consumed on daily basis, the companies strive for building a long-term relationship with customers, with intent to maximize customer lifetime value. Points play a central role in the point economic zone both as a reward for making purchases and as an incentive for using their services.

Moreover, some programs raise point redemption rate for code payments and/or e-commerce in accordance with the level of use. The strategy of incentivizing customers has been successful in increasing loyalty in some customers to the specific point economic zone.

By connecting all kinds of memberships and IDs, businesses in that economic zone have a better chance of developing one-to-one marketing for customers with particular attributes or purchase records. Going forward, point economy-oriented businesses are likely to continue enhancing their services to increase customer lifetime value, while they actively issue reward points through marketing campaigns.

Future Outlook

Driven by the penetration of cashless payments, the expansion of point “economic zones”, the increase of member stores of shared points, and the increase of companies offering points as a part of their loyalty programs, the domestic market of reward points services is forecasted to grow steadily to 3,283,800 million yen by FY2028.

The amount of points to be issued will increase in accordance with the growth of transaction volume of credit cards and code payments, which is underpinned by the penetration of cashless payments. The total amount of shared points to be issued is forecasted to increase as we are seeing point economic-zone-oriented businesses developing marketing campaigns to acquire new customers, in addition to issuing reward points for purchases.

Meanwhile, the expansion of the point economic zone works positively on its member stores. The more customers accumulate and redeem points, the more sales are promoted. For this reason, it is essential for shared point service providers to establish a business cycle where their points are abundantly issued in their point economic zones and redeemed at member stores.

It should also be noted that the number of businesses introducing brand loyalty point programs are expanding. While conventional point services had been used mostly in distribution/retail industries for customer acquisition and retention purposes, it is increasingly adopted by businesses in other industries. Businesses newly introducing point programs will place more importance on acquiring customer data through membership program in addition to attracting and retaining customers with reward points.

Research Outline

2.Research Object: Shared reward point service providers, mileage service providers, operators of point service program websites, point exchange service providers, and reward points solution providers

3.Research Methogology: Face-to-face interviews (including online interviews) by our expert researchers, survey via email and telephone, and literature research

What is the Reward Points Services Market?

In this research, the reward points services market targets to the points and mileages issued by specific companies/organizations or corporate groups to customers as rewards for making purchases of their products or services. The market size of reward points services is calculated by totaling the value of reward points issued by private companies.

The total value of reward points issued includes (1) proprietary points and mileages specific to that merchant (house points), (2) points as incentives for using specific payment option (credit cards, electronic money, code payment), and (3) shared reward points earned by customers across member stores and services (points from a third-party shared platform, such as Rakuten points, d POINTS, Ponta, and V-Points).

<Products and Services in the Market>

Loyalty program points (house points), shared reward points, mileages, loyalty program point websites, reward points exchange services, reward points related solutions

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.