No.3592

Housing Equipment Market in Japan: Key Research Findings 2024

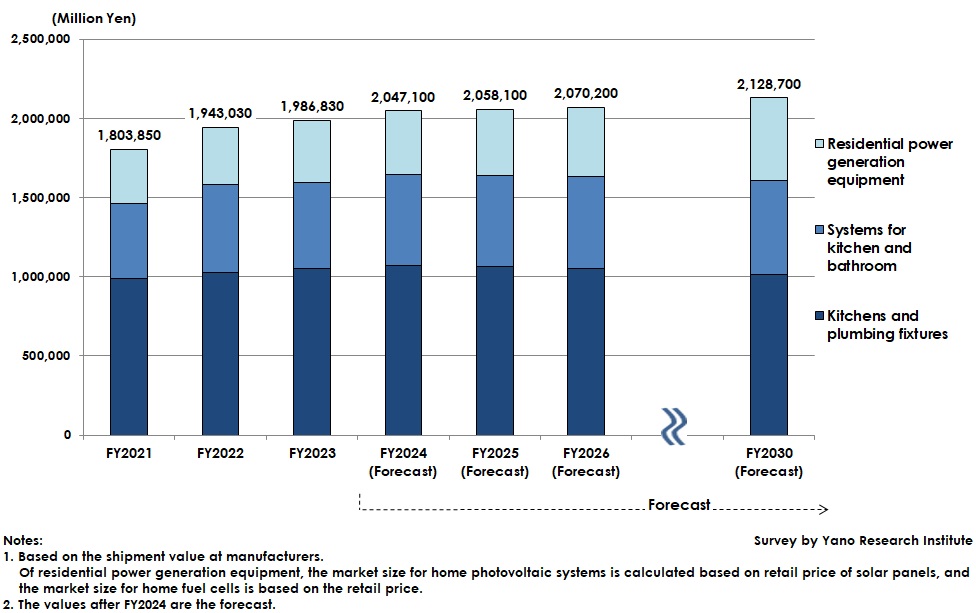

Housing Equipment Market Size (Kitchens and Plumbing Fixtures, Systems for Kitchen and Bathroom, and Residential Power Generation Equipment) for FY2023 Rose by 2.3% on YoY to 1,986,800 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic housing equipment market and found out current market status, trends of market players, and future perspectives.

Market Overview

The major housing equipment market size (the total of kitchens and plumbing fixtures, systems for kitchen and bathroom, and residential power generation equipment) for FY2023 was estimated at 1,986,800 million yen, up 2.3% from the previous fiscal year.

The decreasing trend of new construction starts could be the hindrance against growth of three categories in the housing equipment market in the mid-to-long term view. Nevertheless, the market of kitchens and plumbing fixtures for FY2023 rose from the previous fiscal year by 2.2% because of price revisions by manufacturers due to soaring raw material prices. The market of residential power generation equipment was brisk at 8.1% increase on YoY, owing to growing demand for at-home consumption of renewable energy sources such as solar power, which led to favorable sales of household energy storage systems and residential photovoltaic systems. On the other hand, the market of systems for kitchen and bathroom declined by 1.5% on YoY, struggling from shrinkage in at-home spending demand that surged during the pandemic and from swelled stocks at distribution centers.

Noteworthy Topics

High-Efficient Hot Water Heaters Can be Growth Driver for Housing Equipment Market

The Sixth Energy Strategic Plan approved by the Cabinet in 2021 has targeted new dwellings constructed after FY2030 to secure energy-saving performance to the level of ‘Net Zero Energy House (*1)’ and to achieve 60% of photovoltaic system deployment rate. The Revised Energy Conservation Act (the Act on Rationalizing Energy use and Shifting to Non-fossil Energy) on Buildings, after having been revised and in effect several times in stages, will mandate all the buildings including detached houses to meet the energy efficiency standards by April 2025.

Because hot-water supply occupies 30% of household energy consumption according to the Agency for Natural Resources and Energy, it has been the issue to spread high-efficient hot water supply systems. Of such systems, EcoCute (*2) and hybrid water heaters (*3) are regarded as a promising candidate of surplus photovoltaic power application.

In recent years, curtailment of output has been seen frequently to balance energy supply and demand, especially during fair weathers when solar power is generated more than enough. To prevent from curtailment of output, which can be said as just dumping the electricity produced, urging the self-spending of excess power at households equipped with a photovoltaic power system is said to be effective. The moves to reduce discarding of renewable energy by installing EcoCute or a hybrid water heater to enable users to use surplus power during the daytime to boil water have been invigorated. The markets of EcoCute and hybrid water heaters are likely to expand in accordance with the renewable energy promotions.

*1) A net zero energy house (ZEH) is a dwelling that contributes to realization of carbon neutrality by introducing renewable energy such as photovoltaics thereby to make the annual energy income and outgo to zero, while achieving enormous energy efficiency through improved thermal insulation performance, and other methods.

*2) EcoCute is the heat-pump water heater that efficiently use CO2 in the air. CO2 is compressed to a supercritical state of high temperature, at which state water can be boiled by using the heat.

*3) Hybrid water heater uses both EcoCute and ‘latent-heat recovery water heater”. A latent-heat recovery water heater recovers the heated air generated during water heating via gas. Hybrid water heaters basically use the heat pump to heat water but use the latent-heat recovery water heater when demand for hot water supply is high.

Future Outlook

The major housing equipment market size for FY2024 is projected to grow by 3.0% from the preceding fiscal year to 2,047,100 million yen.

With price revision effects are continuing, the market of kitchens and plumbing fixtures for FY2024 expects an increase by 2.0% on YoY to 1,073,500 million yen.

The market of systems for kitchen and bathroom is likely to reach 571,900 million yen, up 5.5% on YoY. As stocks at distributors that swelled in FY2023 are about to be resolved, the shipment pace is regarded to be on the way of recovery.

Despite slower growth observed since the previous fiscal year, the market of residential power generation equipment is predicted to rise by 2.3% on YoY to 401,700 million yen, on account of continued growth of household energy storage systems and residential photovoltaic systems.

Research Outline

2.Research Object: Housing equipment manufacturers and industrial organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone and emails, and literature research

The Housing Equipment Market

The housing equipment market in this research refers to home-use equipment installed at residence, categorized into three types: 1) Kitchens and plumbing fixtures, 2) Systems for kitchen and bathroom, and 3) Residential power generation equipment. Details of each category are as follows:

(1) Kitchens and plumbing fixtures: kitchen (systematic kitchen, sectional kitchen), systematic baths, electronic toilet seats, household sanitary equipment, and washstands (not including taps)

(2) Systems for kitchen and bathroom: Dish washer, hot water supply system, stoves (gas stove, and induction heating [IH] system), bathroom heater and dryer system

(3) Residential power generation equipment: Household energy storage systems, home solar systems, and home fuel cells

Market sizes for each housing equipment are basically calculated by the shipment value at manufacturers. Nevertheless, of (3) residential power generation equipment, the market size for home photovoltaic systems is calculated based on retail price of solar panels, and the market size for home fuel cells is based on the retail price.

<Products and Services in the Market>

Housing equipment (kitchens and plumbing fixtures, systems for kitchen and bathroom, and residential power generation equipment)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.