No.3589

Linen Supply Market in Japan: Key Research Findings 2024

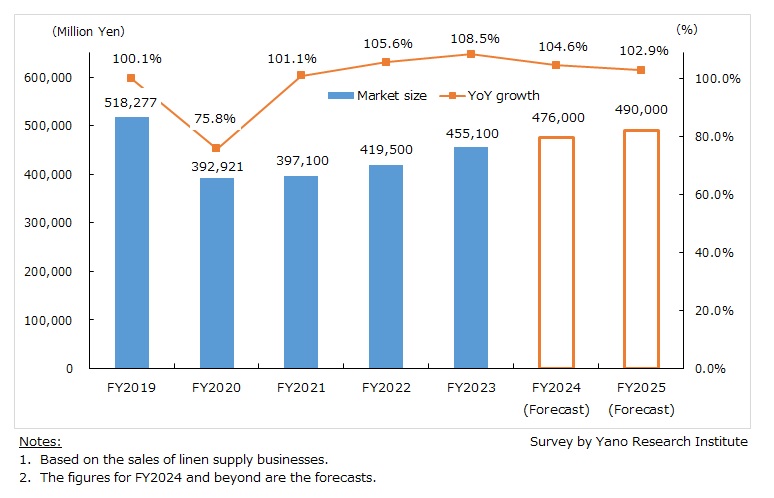

Linen Supply Market Grew to 455,100 Million Yen for FY2023, 108.5% of Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic linen supply market and found out the market trends by segment, the trends of market players, and future perspectives.

Market Overview

Linen supply refers to the services that provide linen products on lease, and its application ranges widely from hotels to hospitals, service outlets (restaurants, amusement facilities, etc.,) and others (offices, factories, etc.). The linen supply market in FY2023 grew to 108.5% of the previous fiscal year to 455,100 million yen (based on the sales of linen supply companies), indicating an upturn for three consecutive years.

As the pandemic subsides globally, Japanese government eased activity restrictions in FY2022 and downgraded COVID-19 to Class 5 infectious disease in May 2023. The change boosted inbound tourism, which led to a dramatic recovery of tourism industry. Consequently, linen supply industry saw demand increase, particularly for hotel beddings and linens. The growth of the linen supply market largely attributable to the demand recovery for linen products at lodging accommodations like hotels and Japanese inns.

Noteworthy Topics

Trends of Linen Supply Industry Amidst Economic Recovery

Easing of activity restrictions to prevent the spread of COVID-19 began in FY2022, and people’s flow increased accordingly. Consumer spending increased in many regions, and inbound tourism bounced back.

As the economic bounces back, the demand for linen supply is rising for hotels. Although the level of recovery varies by area, guests are returning to hotels and tourist facilities across the country. People that were held back from travelling during COVID period are back, not only inbound tourists but also domestic tourists, including those taking short excursions (such as visiting neighboring prefectures). While some hotels and Japanese inns run at a lower occupancy intentionally to ensure high service quality, it is important for linen supply industry to make sure they do not miss out on opportunities brought about by the surge in inbound tourists.

Similarly, a sign of recovery is also observed for the demand for linen supply in foodservice (various types of restaurants), and transportation (bullet trains, express trains, passenger ships, and passenger airplanes). Nevertheless, against the backdrop of labor shortages, price hikes, and the weak yen, the demand is not recovering as much as in lodging industry.

Future Outlook

The linen supply market in FY2024 is projected to rise to 476,000 million yen, 104.6% of the previous fiscal year. The hotel linen market is expected to remain robust for FY2024, exceeding pre-pandemic FY2019 levels. This is largely due to the increase of inbound tourists and the rise of contract price at linen suppliers, which is stemming from the soaring room rates at hotels and other lodging accommodations.

For other segments, the market trends will divide into those that grow marginally and those that diminish. Cloth diapers, hand towels, and cleaning supplies are expected to wane in particular for the lack of demand drivers.

Even so, with strong sales in hotel applications that can offset the decline in other applications, the overall linen supply market is expected to sustain growth. That being said, the growth will slow down hereafter. It is forecasted to attain 490,000 million yen for FY2025, up by 2.9% of the previous fiscal year.

Research Outline

2.Research Object: Domestic leading linen suppliers, the wholesalers and manufacturers of linen products and equipment for linen supplies, etc.

3.Research Methogology: Face-to-face interviews (including online interviews) by our specialized researchers, survey via email and telephone, mailed questionnaire, and literature search

Linen Supply Market

In this research, the linen supply market indicates the market of companies that provide cleaned and processed linens to business outlets (offices, stores, factories, etc.,) on rental basis. The market size is calculated based on the sales at linen suppliers.

Main applications and types of the linen supply are: 1) lodging accommodations (bedding and other linens for hotels, Japanese inns, and other accommodation facilities), 2) healthcare (bedclothes and other linens for hospitals, standalone clinics, and nursery homes), 3) foodservice (linens and uniforms for various types of restaurants), 4) spa/gyms (towels and uniforms used at saunas, Japanese style public bathes, aesthetic salons, fitness gyms, etc.), 5) industrial (uniforms for factories, offices, etc.), 6) transportation (mainly seat covers used for shinkansen bullet trains and limited express; sheets, pillowcases, and curtains used for sleeper cars, passenger ships, and passenger planes also included), 7) cloth diapers (for children and adults), 8) hand towel rentals (for restaurants, sports facilities including golf ranges and golf courses, and amusement facilities including karaoke, pachinko parlors, and bowling alleys, etc.,) and 9) cleaning supplies (mops and dusters for households, mats and fabric rolls of cloth towel dispensers for business outlets, etc.).

<Products and Services in the Market>

Hotel linen, hospital linen, linens and uniforms for foodservice, towels and uniforms for hot spa/gyms, industrial uniforms, linens for transportation (train, ship, planes), cloth diapers, hand towel rentals, cleaning supplies

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.