No.3588

Children-Related Business Market in Japan: Key Research Findings 2024

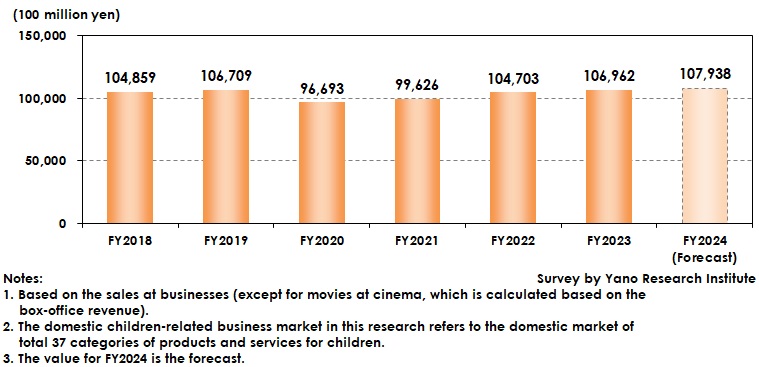

Children-related Business Market (Total 37 Segments) in FY2023 Grew to 10,696,200 Million Yen, Up 2.2% from Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic children-related business market and found out the market trends of children’s products and services by category, the trends of market players, and future perspective.

Market Overview

Size of the children-related business market for FY2023 is estimated at 10,696,200 million yen, up 2.2% from the previous fiscal year, based on the sales at businesses (except for movies at cinema, which is calculated based on the box-office revenue).

Although the market plummeted by around 10% in FY2020 due to the Covid-19 crisis, FY2022 saw recovery in many fields, as negative factors such as behavior restrictions were eliminated. The market remained resilience in FY2023, despite slowdown in growth at many fields in “Educational services and products" stemming from higher commodity prices having caused weaker consumer minds or stronger will to cutting down on spending.

When observing the market size by each of six categories (amusement & leisure, educational services and products, foods, children’s apparel, commodities and services for children, childcare services) that comprise the market, FY2023 saw five categories except for educational services and products outperforming the preceding fiscal year.

Noteworthy Topics

Overview of Three Major Categories in Children-Related Business Market

Of six categories in which 37 segments are classified into, three categories represent a major part of the children-related business market, which are “childcare services”, “educational services & products”, and “amusement & leisure”.

First, for childcare services, “nursery school” segment that makes up most of the services remains stable, because of continuous public funding aiming at measures against falling birthrate and enhancement of parenting support, though growth rate is slowing down after FY2020 owing to decrease in infant users and slowdown in new opens caused by faster decline in number of children. “Afterschool care” segment maintains the rising tendency due to increasing numbers of child users and private facilities after FY2021, though the segment having shrank amid the pandemic in FY2020 on account of temporary closure of primary schools and introduction of work at home system. The increase is also caused by revised prices at some of private childcare businesses, backed by rising operation expenses including manpower costs.

In educational service and products, its largest segment “cram school” seems to be struggling with sluggish demand for learning services to get ready for examinations and unwillingness to attend a cram school, despite an upturn after FY2021. In addition, recent commodity price rise has led to narrowing down the subjects to take or hesitation in going to a cram school. “Learning classes for children” has also diminished once again after steady recovery from significant shrinkage in FY2020. The scale down of “learning classes for children” in FY2023 owes to higher commodity prices having caused the concerns on household budget squeeze, which has prompted to control spending and review the classes. On the other hand, "sports classes/sporting clubs for children" has been on the rise, despite negative factors of commodity price hikes causing class reviews at many households, as the importance of improving children’s physical endurance and of exercising opportunities have been reacknowledged, stabilizing the demand for learning sports and exercising amongst various learning classes.

Lastly, in amusement and leisure category, four segments, i.e., “children’s & family movies shown in cinema”, “amusement parks/theme parks”, “game arcades/gaming facilities”, and “indoor playgrounds” that plunged in FY2020 continues the healthy recovery in FY2023, driving the entire category.

*Source: “Summary on Status of Childcare Centers” by the Children and Families Agency

Future Outlook

In addition to shrinkage in demanders caused by faster decline in the number of children, intentions to save and to tighten the spending due to commodity price hikes are negatively affecting the children-related business market. Still, supported by promising categories such as childcare services with growing demand by a larger number of double-income households and amusement & leisure category with expectations for further betterment from the end of the pandemic, the FY2024 children-related business market size is projected to reach 10,793,800 million yen, up 0.9% on YoY

Research Outline

2.Research Object: Companies providing products and services for children

3.Research Methogology: Face-to-face interviews by specialized researchers, surveys via telephone and email, and literature research

Children-Related Business Market

The domestic children-related business market in this research refers to the domestic market of total 37 segments of products and services for children, based on the sales at businesses (except for the movie sales at cinemas, which is calculated based on the box-office revenue). Ages of children that the products and services target are assumed to be between 0 and 15, though the range differs by segment.

<Products and Services in the Market>

1. Amusement & leisure (toys, gaming consoles, children’s books, children’s & family DVDs/Blue-ray discs, kids’ bikes, children’s & family movies shown at cinema, amusement parks/theme parks, game arcades/gaming facilities, indoor playgrounds) 2. Educational services and products (cram schools, private kindergartens, early childhood development classes [education & sports programs], English conversation classes for preschoolers/students, learning classes for children, sports classes/sporting clubs for children, correspondence courses for preschoolers/students, learning books/textbooks, kids’ stationery, kids’ desks and chairs, school bags) 3. Foods (baby formula, baby foods, sweets for kids) 4. Children’s apparel (clothes, accessories, school uniforms, shoes) 5. Commodities and services for children (paper diapers, strollers, baby cot & comforters, child seats, studio photography for kids, mobile phones for children, safety/security goods & services for children) 6. Childcare services (nursery schools, after-school care)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.