No.3576

Cosmetics Contract Manufacturing Market in Japan: Key Research Findings 2024

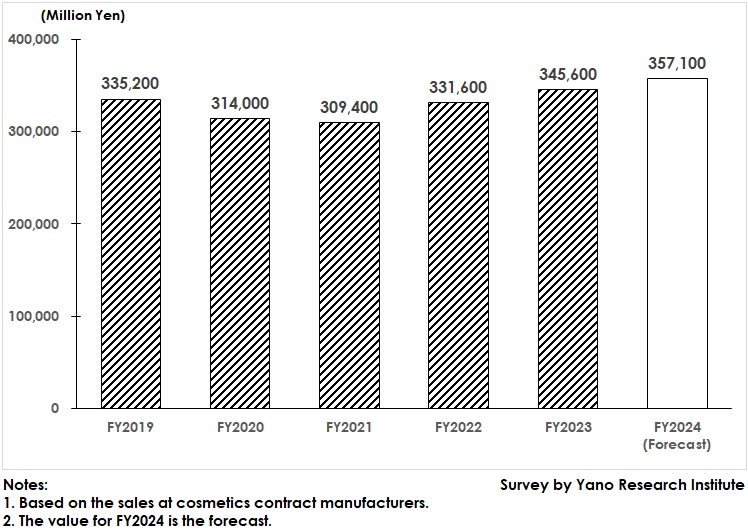

Cosmetics Contract Manufacturing Market for FY2023 Rose to 345,600 Million Yen, 104.2% on YoY

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic cosmetics contract manufacturing market and found out the status, trend of market players, and future perspectives.

Market Overview

The FY2023 domestic cosmetics contract manufacturing market size by the sales at businesses grew to 345,600 million yen, 104.2% on YoY. FY2023 saw degradation of novel coronaviruses to class 5 under the Infections Disease Control Law, which raised expectations for returning demand for cosmetics on account of declining opportunities for wearing face masks. However, cosmetics product sales at stores were not as good as expected in some ways, which led the cosmetics orders received at contract manufacturers to have been overall moderate.

Meanwhile, skyrocketing costs for raw materials, container and packaging materials, energy, manpower for logistics, and fuel and light expenses activated cosmetics contract manufacturers to negotiate price revisions with their clients (cosmetics brands and companies entered from other industries). The pass-through in prices was added to the sales at cosmetics contract manufacturers, which resulted the cosmetics contract manufacturing market to outperform the previous-year size.

Noteworthy Topics

Influence of Upsurge in Imports of South Korean Cosmetics on Production of Japanese Cosmetics Merchandises

Imported cosmetics products from South Korea is surging in Japan.

According to the foreign trade statistics by the Ministry of Finance, imports of cosmetics merchandises from South Korea to Japan have risen rapidly since 2016, and the value has reached 77,521 million yen by 2022, 124.9% of the size of the previous year, exceeding that from France to Japan. Beating France once again in import value for cosmetics merchandises to Japan in 2023, South Korea has become the top cosmetics importer for Japan for two years in a row.

As South Korean cosmetics are mainly bought by their target young customers through ecommerce sites, their main purchasing channel is online in Japan. Although the rate to purchase South Korean cosmetics merchandises at general stores is still low, they are available not only in variety stores or discount shops but also at drugstores and convenience stores that have fixed a special corner and have shown an increase in dealing volume.

South Korean cosmetics products may continue to attract young generation and show a major presence in the Japanese market by linking with other culture. It can threaten Japanese cosmetics merchandises in handling volume at sales floors, which eventually can affect cosmetics contract manufacturing market.

Future Outlook

FY2024 cosmetics contract manufacturing market is projected to increase to 357,100 million yen, 103.3% of the size of the preceding fiscal year. As cosmetics contract manufacturers have been fueled by the orders both from new and repeated clients in the period between the end of 2023 and to the early 2024, it is expected to trigger full-swing recovery in demand. In particular, fabless manufacturers such as those companies entered the market from other industries have grown the sales of haircare and skincare brands at mid-to-high price ranges. By keeping the momentum, the market is likely to expand for the future.

Research Outline

2.Research Object: Contract manufacturers of cosmetics, companies in the business of cosmetics containers and raw materials, cosmetics manufacturers, and other related enterprises and organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, mailed questionnaire, and literature research

The Cosmetics Contract Manufacturing Market

The cosmetics contract manufacturing market in this research refers to the market where contract manufacturers produce items for skincare, makeup, haircare, and other cosmetics products upon being ordered by clients that are cosmetics brands and those new market entrants from other industries. The concerned market mainly consists of contract manufacturing (by contract manufacturers), cosmetics containers (container manufacturers and dealers), and cosmetics raw materials (raw material manufacturers and traders).

<Products and Services in the Market>

Cosmetics items (for skincare, makeup, haircare, others), containers for cosmetics merchandises, raw materials for cosmetics products.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.