No.3554

Medical Imaging Systems Market in Japan: Key Research Findings 2023

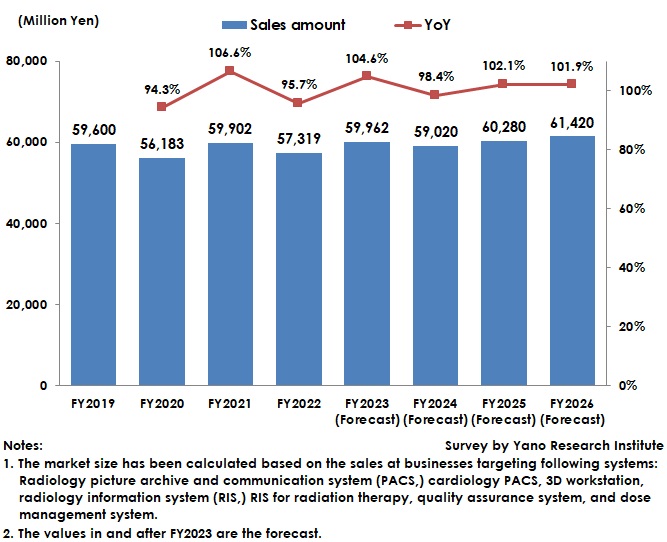

Domestic Medical Imaging Systems Market Size for FY2022 Declined by 4.3% on YoY to 573,19 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic medical imaging systems market and has found out the market trends by segment, trends of market players, and future perspectives.

Market Overview

This research, among medical imaging systems used mostly at hospitals, has surveyed and calculated the market size specifically on radiology picture archive and communication system (PACS), cardiology PACS, 3D workstation, radiology information system (RIS), RIS for radiation therapy, quality assurance system, and dose management system.

The market of radiology PACS, the core of medical imaging systems, has shifted from new deployment to replacement and continues to experience a moderate negative growth. As for the peripheral systems such as RIS, RIS for radiation therapy, image search system, etc. have also already widespread and have made up of replacement market, the entire PACS-related market is generally on a flat trend.

The medical imaging system market size (based on the sales at businesses) for FY2022 is estimated at 57,319 million yen, a decline by 4.3% on year-on-year. One of the major factors of market shrinkage seems to be a reactionary fall from upsurged demand in FY2021 that recorded 6.6% of growth on year-on-year as the market recovered from delays in system implementation and upgrade amid COVID-19 crisis. Added to that, the dose management system market has been on an enormous downtrend, though it expanded in FY2020 as dose management having become mandatory in FY2019.

Noteworthy Topics

Radiology PACS Market Trends

Radiology PACS has rapidly increased the introduction rate after FY2009 as the medical fee revisions triggered to increase filmless operation and PACS deployment. Majority of its current market has been formed by replacement demand.

In such an environment, the market as a whole has leveled off with small influence from the pandemic. When considering the PACS adoption rate and the numeric transition of facilities, the market size transition expects the demand at middle-to-large size facilities to be from flat to a slight decline, while demand at small facilities (including clinics) to be on the rise due to some cases of deployment of systems being planned, making the entire market projections to be on levelling off to a slight rise. In fact, those companies that have developed a wide range of customers including clinics basically show steadfast sales performance, while those businesses providing products mainly for large-scale hospitals show peak out in their sales performance.

Future Outlook

As the impact of the pandemic has been eliminated since FY2023, and as the majority of the market is formed by replacement demand, the medical imaging system market is projected to hover around 60,000 million yen.

In such an environment, many of medical imaging system vendors have started providing AI-powered diagnostic imaging services. In addition, initiatives are taken to address diverse solutions, such as digital camera images management, business related to pathological images, and personal health record (PHR) services that allow patients to refer medical information including medical images stored at the hospital, etc. Such trends are projected to accelerate hereafter.

Research Outline

2.Research Object: Domestic manufacturers of medical imaging systems and devices, and distributors of imported products of such systems

3.Research Methogology: Face-to-face interviews (online interviews included) by expert researchers and survey via telephone

The Medical Imaging Systems Market

This research has calculated the market size of medical imaging systems by targeting following systems: Radiology picture archive and communication system (PACS), cardiology PACS, 3D workstation, radiology information system (RIS), RIS for radiation therapy, quality assurance system, and dose management system.

<Products and Services in the Market>

Radiology picture archive and communication system (PACS,) cardiology PACS, 3D workstation, radiology information system (RIS,) RIS for radiation therapy, quality assurance system, and dose management system, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.