No.3549

Automotive Plastics Recycling Market in Japan: Key Research Findings 2024

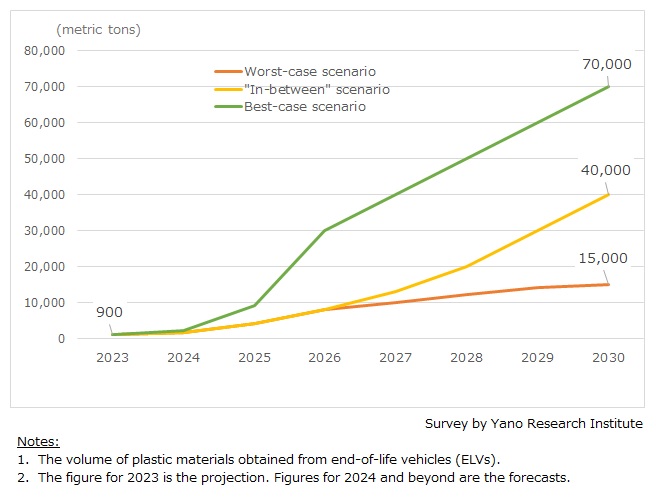

Volume of ELV Plastics Recovered in Japan Estimated at 900 Metric Tons in 2023

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the automotive plastic recycling market, delved into the related policies and legislation in Japan, EU, and the United States, as well as the trends of ELV plastic recycling, the use trends of secondary plastics at automakers, and the trends of market players.

This press release announces the forecasts on the domestic volume of ELV plastics obtained by 2030.

Market Overview

Europe has been embarking on establishing a circular economy ("CE") and achieving carbon neutrality ("CN"). Accordingly, they are reviewing the life cycle of automotive plastics. In 2021, the European Commission made an announcement that it would put forward a revision of ELV Directive and 3R-type Approval Directive. Accordingly, a new rule that repeals and replaces both directives was proposed in July 2023 (referred to as “ELV regulation” hereafter).

The ELV regulation that builds upon and replaces two existing directives has two major impacts on automotive manufacturers. First of all, it became legally binding. If automakers do not comply with the regulation, they will not be able to obtain type approval of vehicles, which means they will be forbidden to sell their vehicles in Europe. Secondly, it added a new restriction: for any vehicles to be on sale 72 months after the regulation enter into force, they must use at least 25% of post-consumer recycled plastics (PCR plastics), which must include 25% of ELV plastics.

Although views on the ELV regulation varies by company, they have unanimously shown support for promoting plastic recycling from the CE and CN perspective.

However, many automakers also indicated concerns that transition within 72 months period will not be enough to develop new vehicles, given the typical timeframe they need from design to launch. They also implied some doubts about the reasoning of the "25% PCR-derived, 25% ELV-derived" target.

We have estimated that the volume of ELV plastics in Japan reached 900 metric tons in 2023.

At present, ELV plastics used as raw material in automobiles are mainly materials of car interior recovered in the dismantling process. While procurement of ELV-derived recycled plastics is a challenge for automakers, some automakers are starting to use plastics in exteriors of ELVs, which has not been used until then. Furthermore, to ensure stable procurement, they are giving consideration to the use of plastics made from automobile shredder residues (ASR).

Noteworthy Topics

Introduction of Resource Recovery Incentives

Conventionally, cost, quality, safety, and stable procurement of raw materials have been a challenge for increasing the domestic production of ELV plastics. The more thoroughly plastics are recovered from ELVs, the more ELV plastic are produced. However, meticulous recovery of resources is onerous and increases labor cost at dismantlers.

Some dismantlers have introduced car crushers in their mill to increase transportation efficiency of ELVs. Nevertheless, only large operators expecting sizeable volume of scraps to process can afford such investments. Recovering plastics from ELV is an expensive investment for small- and medium-sized operators that actually undertake majority of ELV dismantling in Japan.

Implementation of a Resource Recovery Incentives is scheduled in Japan in April 2026. Under the current ELV Recycling Law, when a dismantler recovers resources like plastics and glasses from ELVs, they lose “recycling fee” for the amount of ASR reduced because the “recycling fee” is determined by the weight of ASR. The new incentive system rewards dismantlers with an incentive corresponding to the weight of reduced ASR, which will be funded with the recycling fees paid by vehicle users. It is expected to solve the cost issue at dismantlers and stable procurement of secondary raw materials at automakers.

Future Outlook

We have made projections for the domestic volume of ELV plastics by 2030 on three case scenarios. In every scenario, we assumed that the new resource recovery incentives will increase the volume of ELV plastics.

The worst-case scenario assumes that recovery of plastics will remain at dismantlers until 2030, without shredders adding precision to recovery of plastics in shredding process nor making progress in recovery of plastics from ASR. The projection for the volume of ELV plastics for 2030 is 15,000 metric tons.

Based on “in-between” scenario, which stands on the assumption that ELV plastics recovered at dismantlers AND shredders will be utilized as raw materials at automakers, the volume of ELV plastics will grow to 40,000 metric tons by 2030.

In the best-case scenario, the volume of ELV plastics will reach 70,000 metric tons by 2030. It assumes that the use of secondary raw materials will be at full-scale at automakers, and thus the demands increase for rigid plastic recovered at shredders and plastics made from ASR.

Research Outline

2.Research Object: Automakers, recycled plastic companies, plastic producing companies, trading firms, auto parts makers, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

In this research, ELV plastics indicates the secondary plastic materials obtained from end-of-life vehicles (ELVs).

Currently, recycling of ELV in Japan starts with the removal of CFCs, followed by separation of airbags, reusable parts, and metals by dismantlers. The ELVs are then handed over to shredding operators as dismantled automobiles (scraps).

The scraps are shredded into automobile shredder residues (ASR), from which the shredding operator removes metallic components. ASR generated by shredding facilities are used for “thermal recycling” (burnt as fuel to produce energy) or sent to landfill. To date, a very small fraction of dismantlers and shredding-and-sorting operators can recover plastics from ASR.

<Products and Services in the Market>

ELV plastics, broken bumpers collected at car dealers

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.