No.3547

Trends Analysis of IT Applications in Insurance Companies in Japan: Key Research Findings 2024

Life & Non-life Insurance Companies Harness IT Particularly in Improving Efficiency

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the use cases of information technology at major life and non-life insurance companies, and interviewed insurance company officials to analyze the trends regarding their use of IT. This press release denotes some of the finding on the use of IT in insurance companies by business process.

Summary of Research Findings

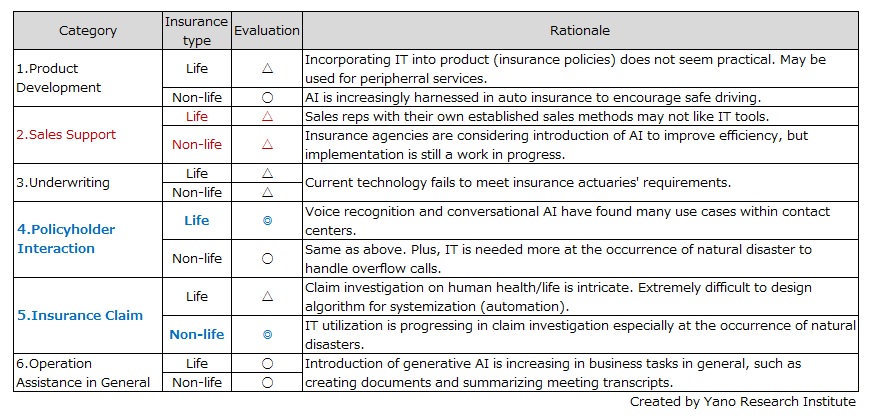

For this study, we obtained public information such as news releases regarding the use cases of information technologies, tabulated the number of cases by category that we defined, and encapsulated the trends per category. The six categories are 1) Product Development, 2) Sales Support, 3) Underwriting, 4) Policyholder Interaction, 5) Insurance Claim, and 6) Assistance in General. We have deliberately used the same classification for both life insurance companies and non-life insurance companies. Additionally, based on the aggregated data, we interviewed insurance company officials. Based on these survey methodologies, we evaluated the level of IT utilization in a three-point scale (◎,〇, and △) by category.

According to the findings of the survey, first thing to note was that life insurance companies are embarking on the use of IT particularly in 4) Policyholder Interaction. Life insurance companies have to deal with a huge number of tasks every day, including administrative procedures, such as policy review and change of registered name for policyholders, as well as making inquiries necessary to handle client matters. The companies opt for AI to handle inquiries that can be answered automatically, while having operators handle more complex situations.

Meanwhile, at non-life insurance companies, they leverage AI in 5) Insurance Claim, particularly for investigation of insurance claims. Non-life insurance companies have been accumulating data on damages associated with natural disasters from the past. Use of the vast amount of data and AI image recognition technology is highly functional in damage estimation. Moreover, in light of increased severity and frequency of natural disasters in recent years, damage investigation amidst disasters has become necessary. The circumstances has seemingly increased the use of IT in non-life insurance.

Noteworthy Topics

Despite Acceptance as Tools to Assist Inhouse Tasks, Generative AI Seen as Unfit for Customer Services

Since around 2023, there is a growing excitement around AI at both individuals and companies, and major insurance companies are no exception.

Regardless of product type (life or non-life insurance), the companies are making progress in adopting generative AI as a tool to support internal business processes. However, at current, it is used for generic tasks (such as document creation, information retrieval, and idea generation) rather than for workflow and processes unique to insurance industry. Feasibility of using generative AI in customer service, such as providing information in response to an inquiry on insurance policy, is still being questioned, because of the troubles incurring the occurrence of AI hallucination (AI generating response that contains incorrect information).

During the interviews, insurance company officials indicated their expectations for the use of generative AI for customer service, hoping to train AI models on a large amount of data on manuals and insurance policies. However, they also stated that they find that outputs of generative AI are not hundred percent accurate. As a financial service, insurance companies have accountability for not misleading customers with inappropriate or false information. In this regard, generative AI is still immature to be used in their customer services.

Meanwhile, we believe it is also important that employees of insurance companies improve AI literacy. They need to be fully aware that generative AI makes mistakes.

Research Outline

2.Research Object: Major life and non-life insurance companies

3.Research Methogology: Literature research and face-to-face interviews by our expert researchers (including online interviews)

About This Survey

To start this study, we obtained public information such as news releases (those released between January 2019 and February 2024) of major insurance companies, regarding the use cases of information technologies. Then, to analyze the differences and commonalities across insurance companies (life and non-life insurance companies), we classified their business processes into six categories based on our own definition. Finally, we tabulated the number of IT use cases per category and found out the trends by category.

To delve deeper on aggregated data, as well as to explore statuses of IT utilization at life and non-life insurance companies that have not surfaced in public information, we also conducted interviews to insurance company officials.

While we fully understand that life insurance companies and non-life insurance companies are different in nature, we deliberately used generalized words to classify their business processes into six categories: 1) Product Development, 2) Sales Support, 3) Underwriting, 4) Policyholder Interaction, 5) Insurance Claim, and 6) Operation Assistance in General.

Please note that IT use cases here do not include so-called ‘digitization’ initiatives, such as switching from paper application form to online application.

<Products and Services in the Market>

Trends of IT utilization in life and non-life insurance companies

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.