No.3540

Global Cellulose Nanofiber (CNF) Market: Key Research Findings 2024

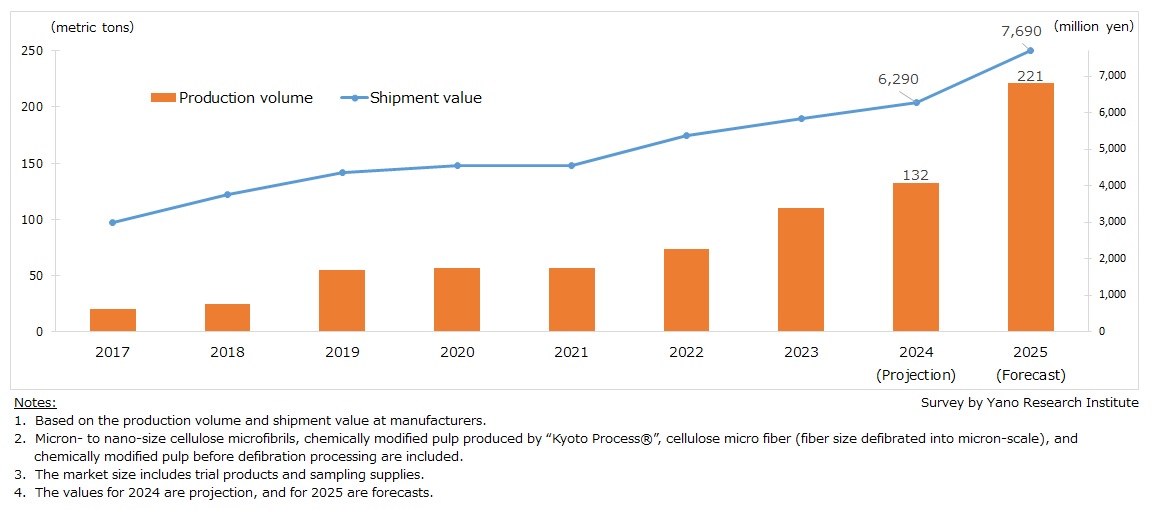

Global CNF Production Volume in 2024 to be 132 Metric Tons with Shipment Value 6,290 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global CNF (cellulose nanofiber) market for 2024, and found out the market trends, trends of market players, and future outlook.

Market Overview

Global CNF production volume in 2024, including prototypes and sample products, was expected to reach 132 metric tons (120.0% of the preceding year) with shipment value at 6,290 million yen (107.7% of the previous year). Currently, the total production capacity of CNF production facilities at domestic CNF manufacturers is 1,220 metric tons per year, with the utilization rate of CNF production facilities (on an output basis) being approximately 10% of the global production volume (projection).

Development of sampling supplies gained momentum around 2016-2017 period, advancing in two applications: Functional additives for cosmetics and coating agents, which adds properties like dispersion stability, emulsion stability, and thixotropy to base material; and composite material (resin strengthener), which adds strength to automotive parts (in the interior and the exterior), case of home appliances, and construction materials. Sampling supplies as functional additives has been enjoying stable demand. On the other hand, the demand volume for sampling supplies as composite resin has not grown as initially expected. We believe this owes to the huge price gap between the CNF sampling supplies and materials traditionally used for automotive parts.

Noteworthy Topics

Improved Quality of CNF-reinforced Resin Increases Expectation for Resin Application in Automotive Parts

Resins for automotive parts must be high performance and high quality - they are required to be highly resistant to heat, impact, and abrasion. Meanwhile, the quality of mechanically recycled resin is lower than that of virgin resin because foreign substances cannot be completely removed in mechanical recycling, and because they cannot avoid deterioration during the thermal history they undergo. For these reasons, the application of recycled resin in automotive parts had been limited. Production of resin through chemical recycling (the process where plastics are broken down to monomer level before being recycled) would solve most of these quality issues, however, recycling facilities and waste plastic procurement systems for chemical recycling is still in the phase where infrastructure is under development.

Under the circumstances, mechanically recycled resins reinforced with CNF and cellulose fiber (CeF: Cellulose Fiber) are attracting attention. CNF has high flexural strength and flexural modulus. The flexural modulus of CNF-reinforced PP (polypropylene) containing 10% CNF is 3.9 GPa, which is almost twice as strong as that of unreinforced PP. Even when compared to that of PP containing 10% glass fiber (GF), the modulus is almost 40% higher. In addition, the bulk density of the filler (CNF reinforced PP) is 1.5 g/cm3, which is less than 60% of GF’s 2.55 g/cm3. CNF-reinforced resin is lighter than GFRP (glass fiber reinforced plastic) and capable of foam molding. Use of composite resins not only enhances the performance of auto parts, but also reduces vehicle weight. The use of composite resin implies the horizontal recycling of used auto parts and the utilization of plant-based fillers, reducing CO2 emission in the entire LCA.

It should also be noted that, although CNF-reinforced resin was considered as a material lacking impact resistance required for automotive parts, CNF-reinforced resin makers are currently developing resins modified with elastomeric components or reinforced by morphology control (the technology to control the external and internal structure of particles). In view of this trend, the demand for CNF-reinforced resin as automotive parts to expected to rise hereafter.

Future Outlook

Amidst the situation where production capacity of domestic CNF manufacturers exceeds 1,000 metric tons per year, to avoid production to fall far short of the original plan, manufacturers need to increase market presence of CNFs as eco-friendly structural material (CNF-reinforced resin) by compounding with recycled resin, polylactic acid, and materials from biological sources like natural rubber latex.

Measures to combat climate change and cut plastic waste generation in Japan, such as the promotion of Carbon Neutral by 2050 (“CN2050”) and the Plastic Resource Recycling Promotion Act, and international moves such as the EU proposal for end-of-life vehicles (ELV), present a once-in-a-lifetime opportunity to expand the demand for CNFs.

In view of considering the 10 years from 2014 to date as the 'first founding period' during which makers developed CNFs in full scale and increased its market recognition, the next 10 years should be positioned as the 'second founding period' where they need to stabilize production costs and performance by securing stable demand volume for CNFs in industrial sectors. To achieve this, CNF must solidify reputation as a low-carbon, low-cost material.

Research Outline

2.Research Object: Cellulose nanofiber manufacturers (paper manufacturers, chemical manufacturers, etc.,) and R&D institutions

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

<What is Cellulose Nanofiber?>

Cellulose nanofibers (hereinafter CNFs) are cellulose fibers included in plants that are defibrated into nanoscales.

The methods to extract CNFs from cellulose fibers include 1) chemical disintegration method, in which hydrogen bond of molecular chains are loosened via catalyst or acid before putting them into a grinder, 2) mechanical disintegration method using high-pressure homogenizers for delaminating cell walls of the fibers and liberate the nanoscale fibrils, and 3) aqueous counter collision method, where nanofibers are obtained through cellulose-dispersed liquid collided with kinetic energy of water at high speed.

<What is the Cellulose Nanofiber Market?>

In this research, the cellulose nanofiber market includes micron- to nano-size cellulose microfibrils, chemically modified pulp produced by “Kyoto Process®”, cellulose micro fiber (fiber size defibrated into micron-scale), and chemically modified pulp before defibration processing. Please note that the market size includes trial products and sampling supplies.

<Products and Services in the Market>

Cellulose nanofiber (CNF), various products using CNFs as an additive or as reinforcing agent

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.