No.3536

B2B Payments Service Market in Japan: Key Research Findings 2024

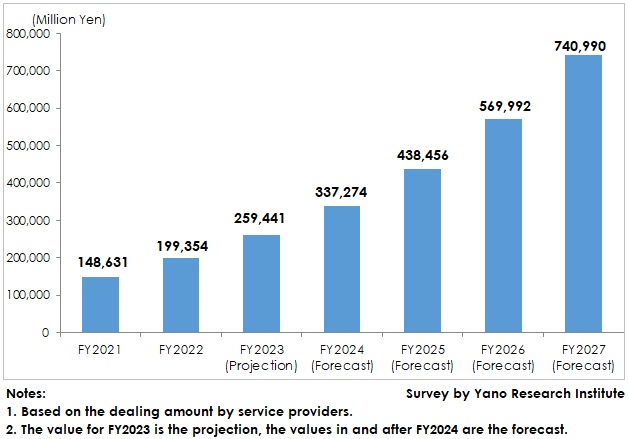

FY2022 B2B Payments Service Market Size Expanded by 34.1% to Over 199,000 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic B2B payments service market and has found out the market status, trend of market players, and future perspectives.

Market Overview

Various payment methods have been used for the transactions between enterprises after having received products and the invoice, such as check, bill, cash, direct debit, and bank transfer. Today, bank transfer is the mainstream of payments between corporations.

B2B payments services are the one-stop service on payment procedures for business transactions, which include credit approval, issuing of invoices, deposit confirmation, dunning for payment, together with debt collection assurance.

B2B payments services were launched by two companies in 2011 and were entered by multiple companies from 2017 to 2020. The market has been rapidly on the expansion in recent years.

The B2B payments service market based on the dealing amount at service providers has reached 199,354 million yen for FY2022, 134.1% of the size of the preceding fiscal year, and expects an expansion to 259,441 million yen by FY2023. The backdrop against this is the intentions to streamline the paperwork chiefly at SMEs due to manpower shortage and to reduce costs. The conventional payments procedures accrue cumbersome paperwork not to mention issuing of invoices and deposit management for each of the transactions, making the work for accounting demanding. By outsourcing all these procedures to B2B payment companies, accounting work becomes less troublesome and more efficiently managed.

Noteworthy Topics

Rising Demand for B2B Payments Services due to Reformed Conventional Systems

Revisions to the electronic books maintenance act in January 2022 and enactment of the invoice system in October 2023 render huge paperwork burden for SMEs, requiring them to face a tremendous change from conventional accounting procedures. To cater to the act and the system, introduction of dedicated systems and operational knowhow are needed. However, it is difficult for SMEs to meet such needs due to limited manpower and funds.

In such a situation, B2B payments services, that do all the invoicing procedures from issuing and saving of electronic invoices, credit approval, to deposit confirmation and dunning for payment, etc. are seen as an attractive solution to the above-mentioned challenges especially by companies that issue numerous numbers of invoices for small amount.

Future Outlook

The B2B payments service market is projected to expand to approximately 740,000 million yen by FY2027.

As promotions of digital transformation and a series of amendment to conventional systems such as the invoice system and the electronic books maintenance act in place, the B2B payments service market is on the rise. In addition, the market expansion seems to be promising furthermore by acquiring demand by major companies moving to work efficiency in addition to increasing demand for financing by SMEs.

Research Outline

2.Research Object: B2B payments service providers

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, and literature research

The B2B Payments Service Market

B2B payments services in this research refer to one-stop service on payment procedures for business transactions on behalf of client companies, which include all payments processing such as credit approval, issuing of invoices, deposit confirmation, dunning for payment, and, importantly, debt collection assurance that is to prevent from payment risks such as payment postponement, nonpayment, and bad debts. The market size has been calculated based on the dealing amount by service providers.

<Products and Services in the Market>

Payments Service for transactions between companies

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.