No.3527

Wireless Internet of Things (IoT) Market in Japan: Key Research Findings 2024

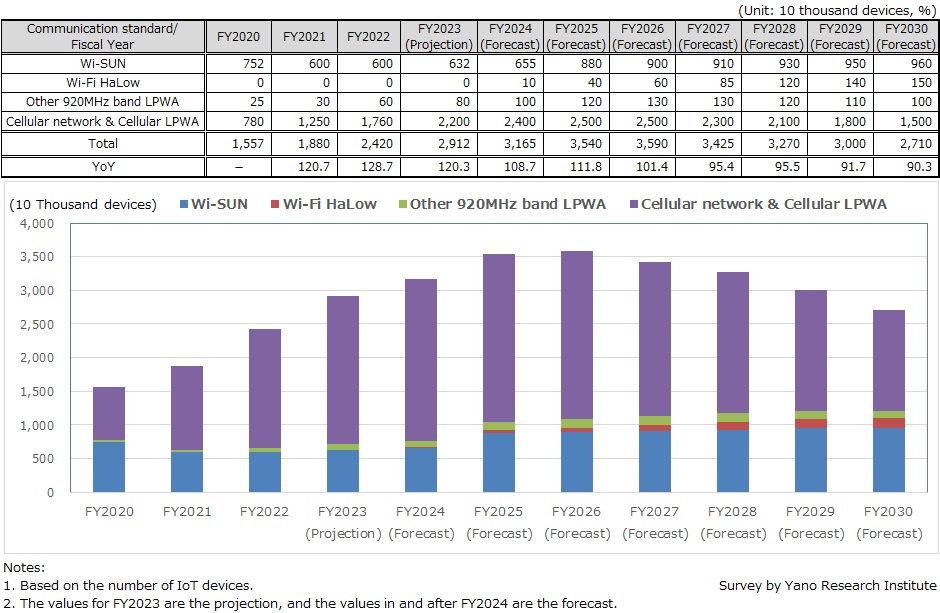

Wireless IoT Market Size in Japan Projected to Reach 27,100,000 Units in IoT Devices by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed wireless Internet of Things (IoT) devices geared to B2B and has found out the market size for wireless IoT by communication standard*, trend of applications by field, and future perspectives. Here discloses the wireless IoT market size by communication standard and the spreading trends by field.

*920MHz band LPWA (Wi-SUN), 920MHz band LPWA (Wi-Fi HaLOW), Other 920MHz band LPWA (SIGFOX, LoRa, ZETA, ELTRES, Sidewalk, etc.), Cellular network (3G, 4G/LTE) & Cellular LPWA (NB-IoT, LTE-M)

Market Overview

In IoT applications, there still are some areas such as factories, offices, and buildings where wired communications are still needed because of trustworthiness and security. However, in recent years, wireless communications have improved their trustworthiness, convenience, and flexibility. Alongside the cost reduction and more diversity in these communications and devices, wireless IoT systems and solutions are increasing. Hereafter, outdoor image solutions (image IoT solutions) are likely to increase.

Possible applications for image IoT solutions include crime prevention & security, disaster prevention & disaster monitoring, infrastructure monitoring, field & biological monitoring, energy facility monitoring, and telemedicine. Because image IoT solutions require the network that responds to fast and large-capacity communications, those that are promising among wireless communication standards seem to be cellular network (4G/LTE, 5G) and cellular Low Power Wide Area or LPWA (NB-IoT, LTE-M).

The FY2023 wireless IoT market size based on the number of IoT devices for the concerned communication standards, i.e., Wi-SUN, Wi-Fi HaLow, Other 920MHz band LPWA, and cellular network & cellular LPWA, is expected to expand by 20.3% on YoY to 29,120 thousand devices. When observing this in detail by the standard, cellular network & cellular LPWA occupies 75.5% at 22,000 thousand devices, followed by Wi-SUN, mainly for electric power smart meters, occupying 21.7% at 6,320 thousand devices, and Other 920MHz band LPWA accounting for 2.7% at 800 thousand devices.

Noteworthy Topics

High-Bandwidth Wi-Fi Market

Basically, Wi-Fi standards have come to use higher bandwidth, from 2.4GHz to 5GHz, enabling higher communication speed. From Wi-Fi 6E standard, the coverage includes 6GHz frequency.

High-bandwidth Wi-Fi that enables high-speed, large-capacity data transmission targets applications in manufacturing industry, construction industry, logistics warehouses, etc.

In manufacturing, data collection from production facilities and equipment, location information management for tools, network camera image data collection, operational control & automated driving of automated guided vehicles (AGVs), data collection from various sensors including pressure sensors, flow sensors, temperature sensors, as well as watt-hour meters, data collection from Programmable Logic Controller (PLC), data collection from industrial robots are the target work.

For construction industry, the target work may be worker position data, location information of heavy machinery & construction machinery & components, location information of working robots, hazardous location alert, monitoring camera data collection, collecting vital data of workers, construction site environmental data collection, monitoring at the time of remote control of heavy machinery/construction machinery, etc.

At logistics warehouses, the target work may be location information on inventory items, operational control of forklifts or other logistics vehicles and machines, network camera data collection, operational control & automated driving of AGVs, worker vital data collection, temperature & humidity information, material location information, temperature management at transportation, etc.

Future Outlook

After FY2020 when behavior restrictions from COVID-19 have affected, the wireless IoT market has been overall favorable and is projected to rise by 8.7% to 31,650 thousand devices in FY2024.

The market has once slowed down amid the pandemic but lift of behavior restrictions has turned the pending or postponed business to run once again, bringing the market to steadily recover and some PoC cases to proceed to implementations. By communication standard, the growth rate of Wi-SUN deployed to electric smart meters has somewhat decelerated, but cellular LPWA that occupies the core of IoT market has been thriving and has contributed as a driving force of the whole market.

Hereafter, automotive-related applications such as connected cars, energy related applications including smart meter solutions, and IoT solutions on location information applied to logistics warehouses, manufacturing industry, construction industry, and watch services at long-term care and other facilities are likely to drive the market.

Nevertheless, the cellular network standards (3G, 4G/LTE, NB-IoT, LTE-M), the concerned research target, are projected to shrink after FY2025 as shift to 5G from 3G and 4G is expected in the cellular network. This can be the main cause of shrinkage of the entire concerned market for this research, after peaking in FY2025 to FY2026.

Research Outline

2.Research Object: Mobile Network Operators (MNOs), Other telecommunication businesses, business groups, IT vendors, user companies, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, and literature research

IoT Market by Communication Standard

The research was done to the following communication standards targeting wireless IoT for B2B:

- 920MHz band LPWA (Wi-Fi HaLOW)

- 920MHz band LPWA (Wi-SUN)

- Other 920MHz band LPWA (SIGFOX, LoRa, ZETA, ELTRES, Sidewalk, etc.)

- Cellular network (3G, 4G/LTE), Cellular LPWA (NB-IoT, LTE-M)

*The market size is calculated based on the number of IoT devices

*IoT devices for B2B refer to those devices embedded with communication features such as smart meters, various sensors, surveillance cameras, tablets, various equipment, machinery, drones, etc.

<Products and Services in the Market>

IoT terminal, IoT device, communication module

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.