No.3125

Global IT Vendors' CASE Car Strategy: Key Research Findings 2022

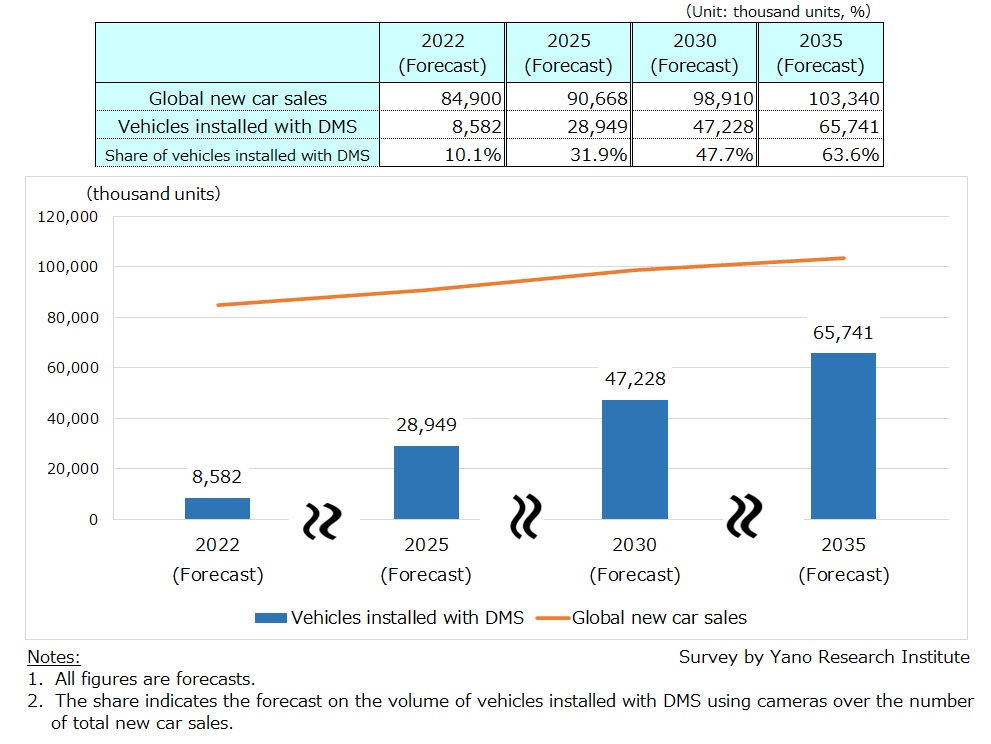

Global Sales Volume of Vehicles Installed with DMS Forecasted to Grow to 65,740 Thousand Units by 2035, Representing 63.6% of Total New Car Sales

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the CASE car strategy of global IT vendors and forecasted the landscape of automotive industry to 2035. This press release announces the forecast of the global sales volume of vehicles installed with DMS (driver monitoring system).

Summary of Research Findings

While CASE (Connected, Autonomous, Shared, Electric) is a new trend in the automotive industry, IT venders and semiconductor manufacturers with technological excellence and huge capital, such as GAMAM (Google, Amazon, Microsoft, Apple, Meta) and BATH (Baidu, Alibaba, Tencent, Huawei), are eager to enter the automotive industry, particularly in the areas of “C (Connected)” and “A (Autonomous)” through the development of cockpit/Human-Machine Interface (HMI) and vehicle interior/driver monitoring systems (DMS). In particular, they have competitive edge in the development of DMS and image analysis apps (software).

In accordance with the EU Regulation that established safety requirements for the vehicles to protect vehicle occupants, it is going to be mandatory for all new vehicles to be registered in EU (passenger cars, buses, bans, and trucks) to install the variant of security devices as of July 2024. Such devices include event data recorder (EDR)*, ISA**, and breathalyzer. Similarly, the Japanese Ministry of Land, Infrastructure, Transport and Tourism has mandated installment of EDR on new vehicles as of July 2022. While EDR, ISA, and breathalyzers have been developed as separate hardware, they will be integrated as DMS applications. Since wide penetration of DMS is expected globally hereafter, the global sales volume of vehicles installed with DMS is forecasted to multiply from 8,580 thousand units in 2022 to 65,740 thousand units by 2035, representing 63.6% of total new car sales by 2035.

It is also assumed that other applications, such as “drowsiness detection based on eyelid movement”, “eye tracker to prevent drivers from taking their eyes off the road”, “evaluation on cognitive distraction of drivers and vehicle occupants”, “iris authentication”, and “vascular pattern recognition” will be added to DMS as applications. Global IT venders with expertise in the smartphone are expected to make entrance to the market of biometric authentication. Iris authentication may be used for in-vehicle payment/security purposes, and vascular pattern recognition may be utilized off the vehicle, for example, to provide personal identification for medical institutions.

*EDR (Event Data Recorder): Event data recorder is a device installed in a vehicle to record vehicle data for a brief period of time before, during and after a crash.

**ISA (Intelligent Speed Assistance): Intelligent speed assistance is a system that can actively warn drivers via automotive displays/monitors when they exceed the speed limit, using road-sign recognition cameras and GPS-linked speed-limit database.

Noteworthy Topics

Tesla

What makes Tesla’s automobile business one-of-a-kind is not only the online sales of luxury BEV (Battery Electric Vehicle), but also in how it established its unprecedented business model by following achievements (note that explanations in parenthesis indicate how it relates to CASE):

1. A successful pioneer in BEV business (“Electric”)

2. Attractive use of the touchscreen-based large displays in the cabin (such as iPad) (“Connected”)

3. “Autopilot” as a standard feature in every vehicle (“Autonomous driving”)

4. “Full Self Driving (FSD)” Beta made available “Over-the-Air (OTA)”, meaning vehicles receive over-the-air software updates (“Autonomous”, “Connected”)

5. Built-out the “Supercharger Network”, the charging stations for BEV, not only to sell BEVs but also to provide infrastructure for energy companies to realize electrified society

6. “Starlink”, a satellite internet constellation operated by SpaceX, the business led by Tesla’s CEO Elon Musk, providing consistent internet coverage for Tesla BEV across the globe (“Connected”)

7. Ongoing development of entertainment for vehicle occupants during BEV charging time (IVI***, “Connected”)

8. In addition to FSD updates, paid/free applications are available over-the-air. It is assumed that Tesla has released over 120 major updates for vehicles in the US in 2021. UX/CX (user experience/customer experience) satisfaction scores among Tesla users that received updates over-the-air are said to be extremely high.

9. All Tesla vehicles are connected cars, and data from the connected cars are used to examine road accidents as well as to analyze user’s tendencies. By expanding the range of analysis, the data is useful in various fields, such as BEV development, car insurance, and energy management. This has contributed to the development of future business models in related industries.

***IVI (In-vehicle infotainment): IVI is an integrated in-vehicle display system that provides both “information” (such as warning of speeding when the driver exceeds the speed limit, by linking with intelligent driving assistance system) and “entertainment” (like music and video).

Research Outline

2.Research Object: OEMs, suppliers, IT vendors, and semiconductor vendors in Japan, Europe, the US, China, and other Asian countries

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone and email, past survey data in our database, and literature research

Since CASE (Connected, Autonomous, Shared, Electric) is a new trend in the automotive industry, OEMs (auto makers) are making attempts to provide various services based on the technological innovations.

Meanwhile, IT venders and semiconductor manufacturers with technological excellence and huge capital, such as GAMAM (Google, Amazon, Microsoft, Apple, Meta) and BATH (Baidu, Alibaba, Tencent, Huawei), are eager to enter the automotive industry, particularly in the areas of “C (Connected)” and “A (Autonomous)” through the development of interface, such as cabin/Human-Machine Interface (HMI) and vehicle interior/driver monitoring systems (DMS). They are also demonstrating interest in expanding into the field of "S (Shared)", backend services like MaaS, and ultimately on to cruise control.

<Products and Services in the Market>

1. “Connected”: 5G apps, connected services (OTA, entertainment), in-vehicle OS/platform, AI/machine learning, Vehicle-to-Everything (V2X), vehicle data analysis (including drive recorders), road infrastructure, positioning system, alliance/investment/acquisition 2. Forecasts on in-vehicle HMI/DMS: connected cars, 5G connected cars, integrated cabins/cars without steering wheels, smart key & virtual key, DMS using cameras, voice recognition, AR/VR, biometric authentication, facial recognition (services surrounding vehicles that are based on personal identification) 3. “Autonomous”: OS/platform for autonomous driving, driverless taxi & shuttle services, remote control, AI/machine learning, High-Precision 3D Map (HD-MAP), driverless autonomous electric vehicle services, road infrastructure, positioning system, alliance/investment/acquisition

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.