No.3086

Global Electric Power Steering Market: Key Research Findings 2022

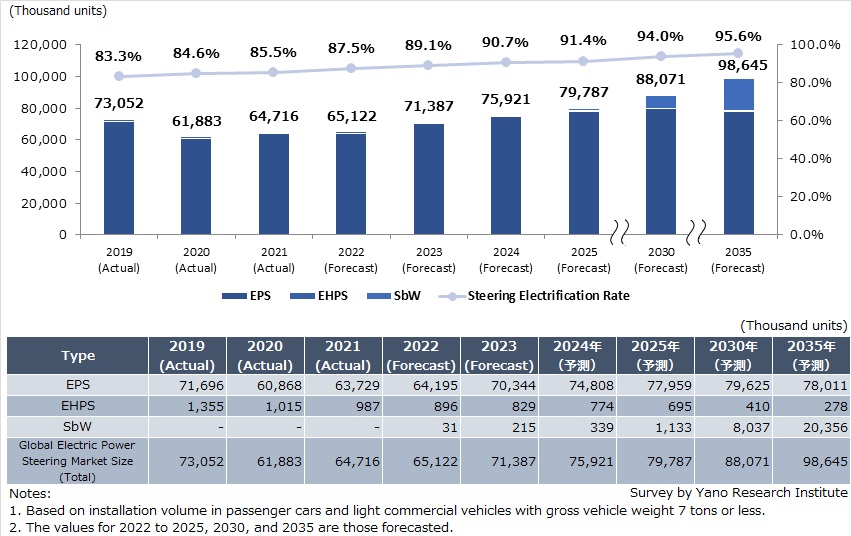

Global Electric Power Steering Market Size for 2035 Projected to be 98,645 Thousand Units by Installed Volume

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global electric power steering market, and found out the market overview and trend of major market players.

Market Overview

The estimated global EPS (electric power steering) system market size in 2021 was 64,716 thousand units based on installation volume in vehicle production volume, and is likely to expand to 98,645 thousand units by 2035. Of such systems, the installation of SbW (steer-by-wire) systems has increased for safety improvement and can expand to 20,356 thousand units by 2035.}

Because of stricter fuel restrictions and spread of automobiles equipped with ADAS (Advanced Driving Assistant System), adoption of EPS systems is increasing globally, especially rapid in North America and China throughout 2021 where the installation has been delayed, which has led the worldwide electrification of steering to rise to 85.5%.

As the replacement to EPS systems from existing HPS (Hydraulic Power Steering), the system of many cases adopted in small commercial vehicles and in emerging countries including India and ASEAN countries, is expected to increase hereafter, the market is projected to grow furthermore. In markets such as Japan, Europe, North America, and China, installation of SbW systems is projected to expand from 2025 when autonomous driving level advances to 3 or higher, aiming to improve safety through coordinated control with braking and suspension.

Noteworthy Topics

Key for SbW (Steer by Wire) Systems to Widespread is Coordinated Control

In the development of EPS systems, fail-safe designs have been standardized to conform to ASIL (Automotive Safety Integrity Level) D in ISO 26262 functional safety standards in the automotive industry, thereby to enable a vehicle to continue driving even when a component becomes out of order.

SbW systems, that are expected to widespread from 2025, require dual power supply systems to secure redundancy for fail-safe performance, and also require reduction of system cost. Manufacturers cope with dual power supply systems by adding capacitors and with cost reduction by using existing components and adding low-cost versions for compact cars into their product portfolios.

At European suppliers, development of vehicle coordinated control modules is underway, likewise in Japanese suppliers. Coordinated controls in brakes and suspensions bring about the merits of steering operation improvement and shortened braking distance. To attain new requirements that are imposed by NCAP (New Car Assessment Program*) at each country year by year, coordinated controls that contribute in safety improvement is likely to be the biggest factor for SbW systems to widespread.

* NCAP (New Car Assessment Program) is the assessment criteria established to test the safety of new cars, aiming to reduce injuries and fatalities in traffic accidents.

Future Outlook

The electrification rate for steering reached 85.5% in 2021. As a result of increased installation of EPS in large vehicles including pick-up trucks that are popular in North America and in Chinese local automakers, the electrification rate has been steadily on the rise. Up until 2035, the market is likely to be driven by electrification of steering in India, ASEAN and African countries where conventional HPS systems are still adopted in many cases.

While column-assist EPS systems are the most installed among all EPS systems as of 2021, they are expected to continue being adopted in emerging countries due to low cost. However, as AD (Autonomous Driving) & ADAS (Advanced Driving Assistant System) functions better work with rack or pinion-assist EPS, adoption of column-assist EPS systems is expected to gradually decline through 2035.

SbW systems that are likely to fully widespread from 2025 are projected to be installed more, in order to support autonomous driving level 3 or higher, and for improving safety through coordinated control of the chassis area such as brakes and suspension. SbW systems therefore are expected to occupy approximately 20% of the entire global electric power steering system market by 2035.

Research Outline

2.Research Object: Manufacturers of EPS (electric power steering) systems and EPS components, and commercial vehicle manufacturers

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone/email, and literature research

About Electric Power Steering (EPS) Market

An EPS (Electric Power Steering) is a technology to assist an automotive steering system by using an electric motor. An ECU (Electronic Control Unit) receives signals from a torque sensor to judge the driver’s steering efforts and control the motors for right assistance accordingly. There are four types of EPS according to where it assists the drivers from (or according to where the motor is attached): Column-Assist EPS, Single-Pinion Assist EPS, Dual-Pinion Assist EPS, and Rack-Assist EPS. They have rapidly widespread due to improved fuel efficiency and control functions compared to conventional hydraulic power steering systems.

The electric power steering market in this research targets the following: EHPS (Electronic Hydraulic Power Steering) system that assists steering by generating hydraulic pressure using electric motors, SBW (Steer by Wire) that has no mechanical connections between steering column and steering rack, and steering actuators that are added to the column part or the steering gear part of a hydraulic power steering system for middle-to-large-size vehicles. The global market size is calculated on the basis of installation volume in passenger cars and light commercial vehicles with gross vehicle weight 7 tons or less.

<Products and Services in the Market>

Electric power steering system (Column-Assist EPS, Single-Pinion Assist EPS, Dual-Pinion Assist EPS, and Rack-Assist EPS), electric hydraulic power steering system, steer-by-wire system, steering actuator, motor, ECU, torque sensor, motor position sensor, steering angle sensor, combination switch

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.