No.3058

Specialty Paper Market in Japan: Key Research Findings 2022

Specialty Paper Market Severely Impacted by Fluctuating Demand and Soaring Raw Materials & Fuel Prices

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the specialty paper market in Japan, and found out the trends by product type, the trends at market players, and future outlook. This press release focuses on the market of high-performance paper for industrial use.

Market Overview

By reason of its useful characteristics and properties, specialty paper has solid customer base and has been demanded stably. With a wide range of application, which extends from printing to various industrial use, the market had been somewhat unsusceptible to demand fluctuations.

Nonetheless, fundamental changes in demand structure declined the demand for general papers such as newsprint and printing paper, and specialty papers for printing was also affected in a similar manner. High-performance paper for industrial use is facing predicaments, due to hollowing out of manufacturing industry, significant fluctuation in demand, growing presence of price-competitive imports, and competition with local manufacturers at users’ overseas locations and product destinations.

Transition in demand structure and global competition has accelerated changes in client demand for specialty paper. Due to the situation, demand recovery is sluggish for some specialty papers, or not expected. Moreover, the influence of global spread of COVID-19 infections from 2020 has widened the gap in the level of demand recovery among product types.

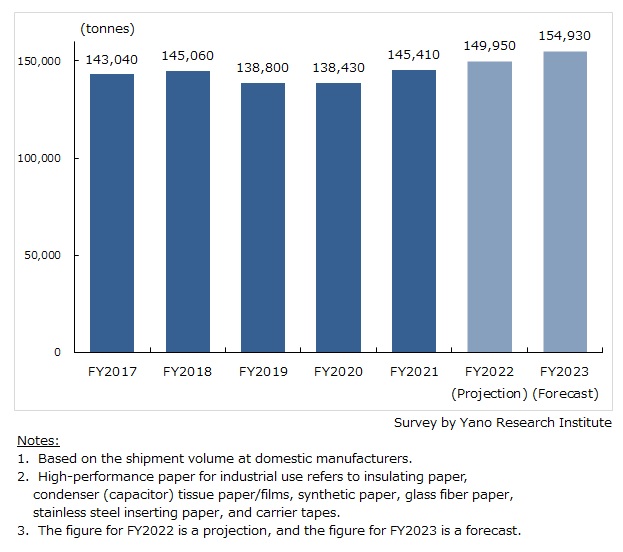

The market size of high-performance paper for industrial use is estimated at 145,410 tonnes for FY2021 (based on the shipment volume at domestic manufacturers). In detail, carrier tapes, which represents the highest composition ratio by shipment volume in FY2020-2021, has been showing strong sales against the background of rising demand for smartphones, tablet computers, and electronic parts for personal computers and vehicles. On the other hand, the shipment volume of synthetic paper, which has the second largest shipment volume, is on recovery trend in FY2021 despite the sharp drop in the previous fiscal year caused by COVID-19 crisis.

Noteworthy Topics

Coping with Customer Needs for Environmental Consideration

Against the backdrop of increasing societal focus on environmental issues in the last couple of years, environmental consideration has become imperative for user companies of specialty paper. To help them achieve their sustainable development goals, paper manufacturers are increasingly developing products that have little or no damaging effect on the environment.

The idea of replacing plastic with specialty paper like grease-proof paper has been driven by paper manufacturers to incorporate demand at customers for plastic-free (demand for alternatives to fossil-derived plastic). The promotion thrived chiefly in the area of product packages and adhesive labels used along with packaging. With changes in the market environment as tailwinds, paper manufacturers, leading manufacturers in particular, have been making progress in developing new materials that could be used as alternatives to plastic.

Future Outlook

In addition to diversification of customer needs, fundamental changes in demand structure and a gap in demand level between product types caused by COVID-19 crisis have made it rather difficult for the specialty paper industry to hope for overall growth.

As far as demand for specialty paper as electronic parts and vehicle parts is concerned, the demand remains at high level. Once a chip shortage is solved, demand for specialty paper for these applications is expected to turn for the better again.

Growing demand for 5G (fifth-generation mobile communication system), acceleration in digitization, and advancements in the development of automotive electronics have been expanding the overall demand for electronic parts. Moreover, demand in automotive industry is forecasted to increase further in line with the continual trend of car electronization, which will be leveraged further in a mid-to long-term by the full-fledged global penetration of BEV and FCEV (Fuel Cell Electric Vehicle) in addition to HEV and PHEV.

Under the circumstances, Yano Research Institute projects the specialty paper market to register positive growth through 2023, reaching 149,950 tonnes in 2022 (103.1% on a year-on-year basis) and 154,930 tonnes in 2023 (103.3%).

Research Outline

2.Research Object: Manufacturers of specialty paper, paper manufacturers, distributors, trading companies and other related companies.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone, surveys via questionnaire by mail, and literature research

What is the Specialty Paper? What is the High-Performance Paper for Industrial Use?

The term “specialty paper” does not have a concrete definition. However, it generally refers to the type of papers that are manufactured with characteristics and properties for specific end use, which puts them into a special grade in comparison to general papers. In this research, the specialty paper market includes about 30 types of papers: printer paper, sanitary paper, forge-proof paper for security printing, clean paper, grease-proof paper, medical grade paper for sterilization, colored high quality paper, decor paper, colored kraft paper (wrapping paper)/Kent paper, India paper, rice paper, synthetic paper, stainless steel inserting paper, insulating paper, condenser (capacitor) tissue paper/films, glass fiber paper, carrier tapes, filtering paper, adhesive labels, release liner paper, etc.

The market size of high-performance paper for industrial use is estimated by volume, based on the shipment volume at domestic manufacturers. The market includes specialty papers for industrial use, such as synthetic paper, stainless steel inserting paper, insulating paper (coil insulating paper, pressboard, vulcanized fiber), condenser (capacitor) tissue paper/films, glass fiber paper, and carrier tapes.

<Products and Services in the Market>

Printing paper, sanitary paper, forge-proof paper for security printing, clean paper, grease-proof paper, medical grade paper for sterilization, colored high-quality paper, decor paper, colored kraft paper (wrapping paper)/Kent paper, India paper, rice paper, synthetic paper, stainless steel inserting paper, insulating paper, condenser (capacitor) tissue paper/films, glass fiber paper, carrier tapes, filtering paper, adhesive labels, release liner paper, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.