No.3008

Video Content Business in Japan: Key Research Findings 2022

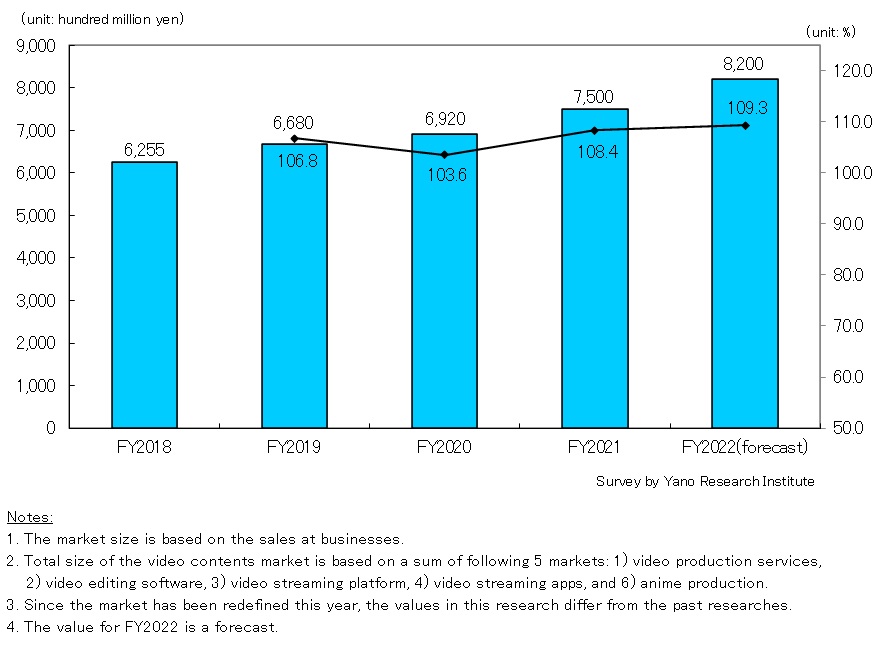

Video Content Business (Total of 5 Major Markets) for FY2022 Forecasted to Grow to 109.3% YoY to 820,000 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic market of video content business, and found out the current situation, the market trends by major segment, and future perspectives.

Market Overview

Size of the video content business market (as a total of 5 major markets) for FY2021 was valued at 750,000 million yen, 108.4% of the previous fiscal year. Stable growth in recent years attributed to the penetration of smartphones and tablet computers that enabled users watch videos anywhere; the devices improved convenience of users drastically.

The most significant market driver in FY2021 was the recovery of video production services and anime production agencies, which resumed normal operation through telework. Projects deferred during the covid crisis were resumed.

Moreover, the market of video editing software has been growing steadily in the last couple of years. Entry-level video editing software became popular among youth, ranging from elementary school kids to university students. Demand for editing software grew among young people that wish to become a creator, as well as for businesses editing educational videos.

Noteworthy Topics

Growing Demand for Video Streaming Platform in Education Industry

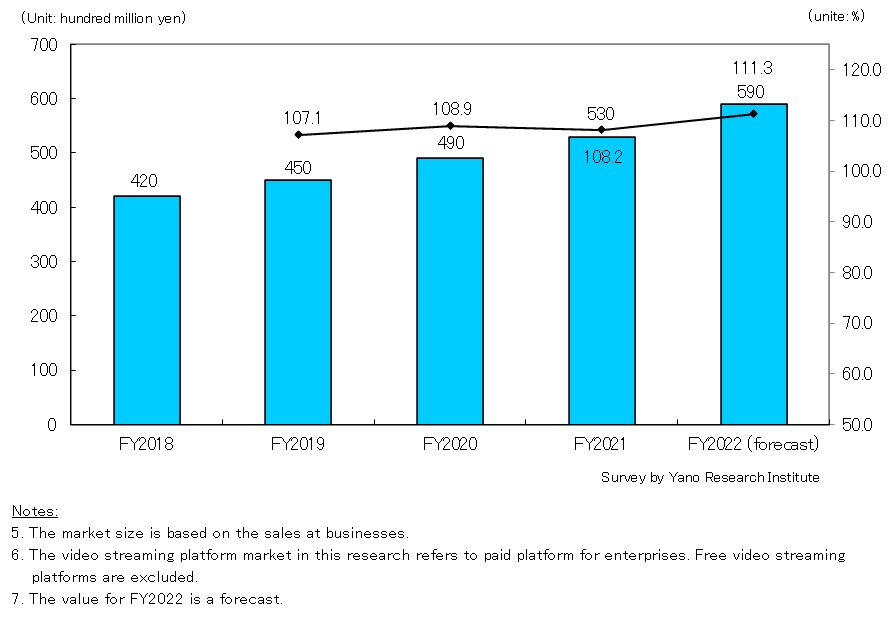

Video streaming platform in this research indicates pay-per-view video streaming platform for enterprises, which enables a large number of users to view their videos. Businesses mostly used the platforms for sharing contents, including marketing videos and training videos, as well as for developing website for selling videos. By using platforms, not only can they embed videos on a designated website, but also control viewer access.

The market size of video streaming platform for FY2021 was valued at 53,000 million yen, 108.2% of the preceding fiscal year. Underpinned by a trend of companies providing exclusive streaming (open only to registered members and employees), the demand for pay-per-view video streaming service is expanding year by year. While the demand for video streaming increased in various industries, a sector that made inquiries the most in FY2021 was education industry. Demand for creating videos for e-learning websites and providing internal employee training are on the rise.

Future Outlook

Video content business in Japan (as a total of 5 major markets) for FY2022 is forecasted to grow to 109.3% of the previous fiscal year to 820,000 million yen, based on the sales at businesses.

Recent rise of social media has accelerated the replacement of still images with videos in timelines and advertisements. Meanwhile, as face-to-face activities become difficult due to the spread of coronavirus, companies actively invested in communications using video content for corporate advertising, sales promotion, investor relations, and shareholders' meetings. Wider use of video content by enterprises have intensified the competition among video content production vendors. Under the circumstances, video production service providers are required to offer high-quality services at reasonable price.

Research Outline

2.Research Object: Video content businesses (service providers, vendors, manufacturers), related businesses, related associations, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey by telephone/email, and literature research

What is the Video Content Business Market?

In this research, the video content business market refer to five markets: 1) video production services, 2) video editing software, 3) video streaming platforms, 4) livestreaming apps, and 5) anime production. Size of the total market is a total of these five markets. Here are the definitions of each market:

1. Video production services indicate B2B video production services, which create videos such as product presentation videos and seminar videos to be used by enterprises internally and externally. B2C video ads are not included.

2. Video editing software refers to computer applications used for creating/editing digital videos.

3. Video streaming platforms indicate pay-per-view platforms for enterprises, which enable a number of users to view videos concurrently. Note that free video streaming platforms are excluded.

4. Livestreaming apps refer to paid subscription services that allow users to view videos through real-time streaming.

5. Anime production refers to creation of anime. In addition to image creation, licensing fees of proprietary anime content are also included.

<Products and Services in the Market>

Video Production Service, Video Editing Software, Video Streaming Platform, Livestreaming Apps, Anime Production

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.