No.3375

Female Care & FemTech (Consumer Goods & Services) Market in Japan: Key Research Findings 2023

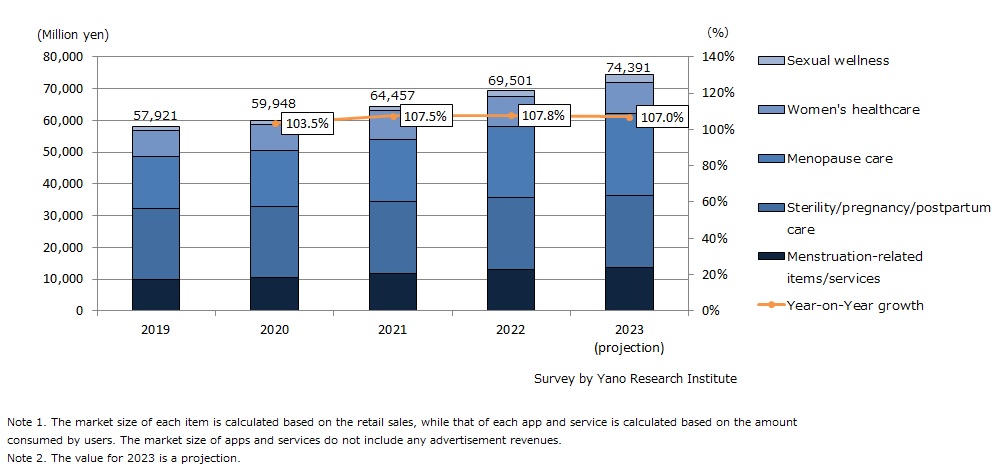

Female Care and FemTech Market Size (Consumer Goods & Services) in 2022 Attained 69,501 Million Yen, 107.8% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic female care and FemTech market (consumer goods and services), and found out the current status and trends of domestic market players, and challenges and perspectives of the market.

Market Overview

The female care (femcare) and FemTech market (consumer goods and services) in 2022 was estimated to have risen to 69,501 million yen, 107.8% of the size of the previous year. Considering that the annual market growth in 2020 was 103.5%, the market is gaining momentum from 2021.

A rise of societal interest to address various issues in women's life stages was observed in 2022, as seen in the full execution of the Act on Promotion of Women's Participation and Advancement in the Workplace, the start of national health insurance coverage of infertility treatment, and the “promoting utilization of FemTech” listed in “The Basic Policy on Gender Equality and Empowerment of Women 2022” by Gender Equality Bureau Cabinet Office. It was also a year of a series of FemTech-related exhibitions.

In view of the market growth in the last few years, in 2019 and 2020, the dawning phase of the market, period products showed remarkable growth partly due to the media's attention to absorbent panties and menstrual cups. The following 2021 and 2022 saw major businesses entering the market one after another with absorbent panties, which led to a higher growth rate in the field of menstrual hygiene products. However, there are signs of a lull in the market in 2023, as some companies have suspended their operations. Meanwhile, although the use of period apps is spreading widely and are highly recognized, size of the app market is small because most of them are available for free.

On the other hand, the market related to menopause is garnering more attention since around 2021. There had been a tendency among women to hesitate on discussing menopause in public, even more than about their periods. Besides, symptoms caused by menopause may not be easily distinguishable from symptoms caused by other health conditions including menstruation, many women did not recognize them as menopause problems. However, now that health issues regarding menopause is widely recognized, the market is growing. Increase of media coverage in recent years have increased public recognition of health issues related to menopause, and the governmental moves to acknowledge menopause problems as common societal issue is increasing. The use of supplements, Chinese herbal medicine, and information services are expanding.

Noteworthy Topics

Female Care (Femcare) Product Sale Channel Expanded to Nationwide Chain Stores

The sales channel of femcare items, which used to be limited to online or only at some physical stores, are expanding to variety stores (household goods retailers, etc.) and drugstores operated nationwide. Many of the femcare items are compatible with in-person sales at physical stores because these products, such as absorbent panties and menstrual cups, are completely new products developed based on innovative concepts. Consumers have substantial demands for fully understanding what the products are and how to use them before making purchase. On the flipside, it meant that selling these products at physical stores require staffs with full understanding of products to respond to customer inquiries. This was a challenge at retailers, especially drugstores, for it was difficult to provide thorough training on all of their staffs. In addition, in many cases store owners had reservations in selling femcare products because they are relatively high-priced than the rest of the products sold at their stores.

However, thanks to the increased coverage of FemTech and femcare in women's magazines, television, and other media, and to public relation activities by market entrants, FemTech and femcare products start to win shelves at nationwide drugstores from the latter half of 2022. Related items are now featured and sold in one section. The retailers are seemingly overcoming the conventional sales barriers by educating staff and strengthening promotions through POP advertising and other marketing materials. Retailing at physical stores is presenting opportunities for women who are prospective customers (interested in the products but have not purchased) to pick up the product and see for themselves, while those potential customers (those who had never heard of the products or had no interest in them) to ponder on their health conditions or on health issues unique to women.

Future Outlook

In 2023, the female care (femcare) and FemTech market (consumer goods and services) in 2023 is expected to grow to 107.0% of the prior year to 74,391 million yen. The market is expected to expand at the same rate as in 2021 and 2022.

The opening of a national center specializing in women's health will be a tailwind for further development of the femcare & FemTech market (consumer goods and services). In August 2023, the government decided to open a national center for advanced medical research specializing in women's health in FY2024. The center is expected not only to advance development by sharing domestic research data and results, but also to provide appropriate information for individual woman.

Research Outline

2.Research Object: Domestic female care (“femcare”) item manufacturers and distributors, FemTech providers, distributors of FemTech products, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone and email, questionnaire survey, and literature research

What are the Consumer Goods & Services of the Female Care (“Femcare”) and FemTech Market?

The female care and FemTech market (consumer goods and services) in this research targets the items and services related to the following five fields: 1) Menstruation related items/services, 2) Sterility, pregnancy & postpartum care, 3) Menopause care, 4) Women's healthcare, and 5) Sexual wellness.

The market size of each item is calculated based on the retail sales, while that of each app and service is calculated based on the amount consumed by users. The market size of apps and services do not include advertisement revenues.

<Products and Services in the Market>

[Menstruation-related items/services] Period (absorbent) panty, menstrual cup, menstrual disc, non-polymer (cotton) sanitary napkin, cloth menstrual pad, detergent for menstrual bleed, period tracking app, etc. [Sterility/pregnancy/postpartum care items/services] Supplement (folic acid, mineral, vitamin), pregnancy test kit/ ovulation test kit, basal thermometer, self-syringe kit, pelvic support belt, postpartum shapewear girdle, postpartum shapewear, maternity clothing and dresses, maternity underwear, pregnancy-safe skincare items, apps/social media for fertility care and prenatal care (ovulation management, in vitro fertilization support, etc.), search engines for fertility treatment information and clinics, fertility consultation services, endometrial flora check kit, ovarian reserve testing kit, apps for pregnant and parturient women (nutritional management, health management, record keeping), online consultation services for pregnant and parturient women and those who try to be pregnant, etc. [Menopause items/services] Supplement (soybean isoflavone, equol, black cohosh, vitamins, etc.,) Chinese medicines (dong quai, Poria cocos, Camellia japonica 'Kamiminoso’ [cultivar of common camellia], Shokukusho Tang, etc.), incontinence care items, skincare for menopause generations, vaginal healthcare, menopause-care app, online consultation services for women in the age range of menopause, mailed equol test kit, etc. [Women's healthcare-related items/services] Supplements & Chinese medicines (PMS supplements, hormone-related supplements), intimate care items, perioperative care items (compression socks & stockings, post-surgery bras and underwear) after surgeries for gynecologic cancers (breast cancer, cervical cancer), underwear for women (sleep bra, thermal underwear), mailed test kit on gynecological cancers, hormone test kit, etc. [Sexual wellness-related items/services] Self-pleasure items, items for pelvic floor muscle exercises, mailed test kit on venereal diseases, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.