No.2860

Logistics Tech (Trucking Technology) Market in Japan: Key Research Findings 2021

Logistics Tech Market Growth Driven by Trucking Technologies and Services

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic logistics tech (trucking technology) market and found out the market trends by category, the trends of market players, and future perspectives.

Summary of Research Findings

Driving the economy by managing the flow of things, it is no exaggeration to say that logistics today is a social infrastructure. However, because the industry is highly labor intensive, it is in fact one of the industries that face serious manpower shortage. The worksites of outdoor logistics (delivery) are facing chronic truck driver shortage, while fleet management up to individuals (without standardized process) and non-digital management methods both remain an issue. To address these challenges, implementation of logistics technologies is accelerated, stimulated by the trends of digital transformation, Business Continuity Planning (BCP), SDGs, and ‘2024 issues’.

Meanwhile, it should be noted that the system should be flexible enough to adapt to day-to-day changes at delivery worksites and has a great user interface design that is easy to use for non-tech savvy person.

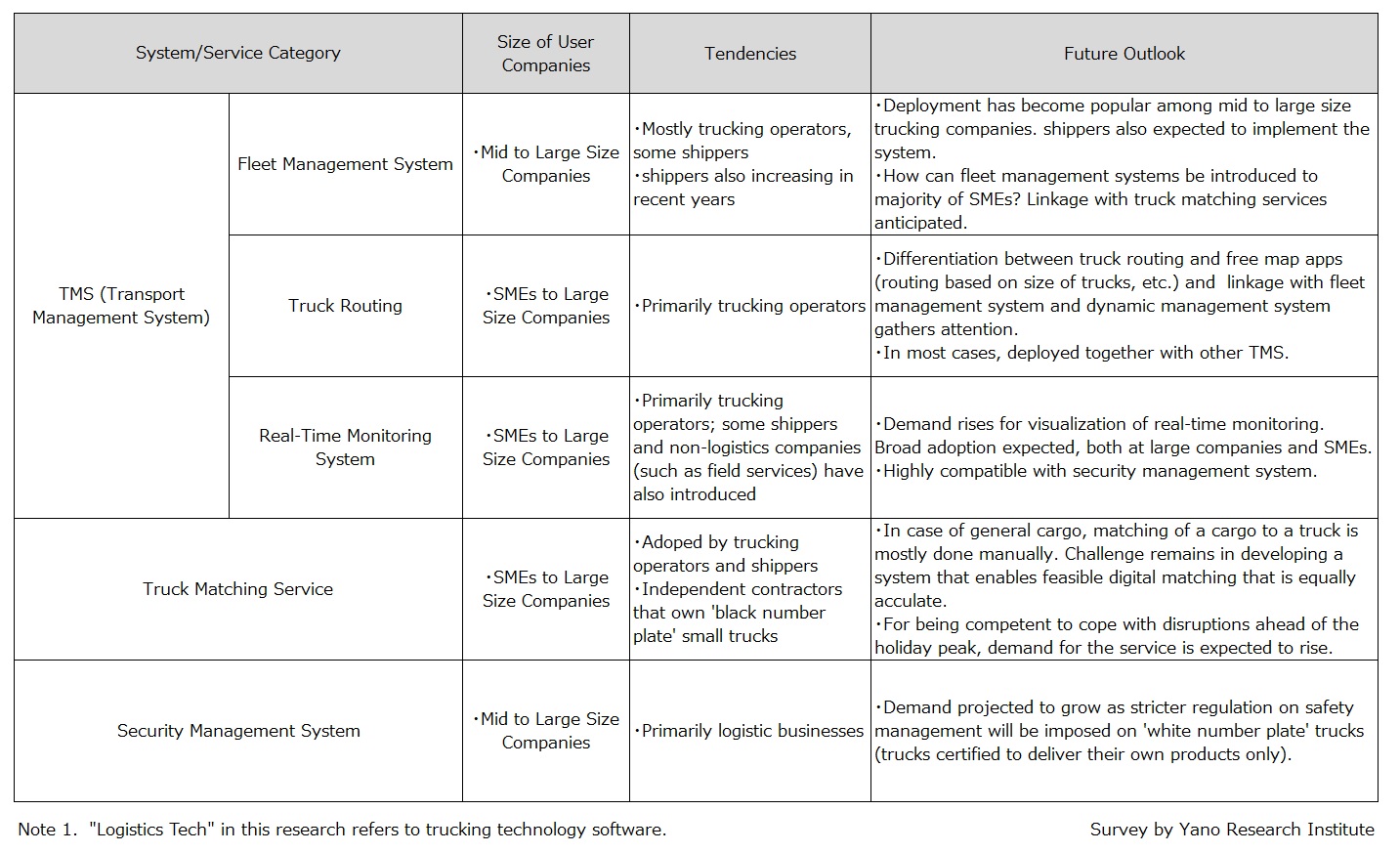

In the research, the findings from the survey on users of the logistics tech (trucking technologies), including their business size, trends, and perspectives regarding the introduction of the logistics technologies hereafter, are summarized. While the level of deployment was subject to business conditions of their customers’ industry, all in all, the number of deployments in FY2020 stayed at almost the same level as in the previous fiscal year. Since increasing number of logistics companies as well as shippers are considering the introduction of technologies as a proactive measure against the ‘2024 issues’, the market is forecasted to expand toward 2024.

Given the current deployment status of logistics technology services and attempts of digital transformation, the industry is still at “digitalization” phase. To foster the logistics DX, cross-industry system that harness data for end-to-end visibility is necessary. Whoever that leads the development of such systems will be a key player of the promotion of logistics DX.

Noteworthy Topics

‘2024 Issues’ and Development of Sustainable Logistics

In accordance with the Workstyle Reform Act that came into force in April 2019, restrictions on overtime workhours are imposed. Even though trucking operators were given five years as a grace period to apply upper limits of overtime hours for their drivers, the new regulation that caps overtime at 960 hours a year will be effective from April 2024. This situation is called ‘2024 issues’ in the logistics industry. In anticipation of the ‘2024 issues’, real-time monitoring system that visualizes operations and enable real-time location tracking, fleet management system that improves efficiency and occupancy rate, and truck matching services, are garnering attention.

The real-time monitoring system enables instantaneous visualization of operation, such as “where is the driver now, and what is he/she doing”; employers may find out which destination takes long time to unload (time spent waiting), which driving route at what time of day takes longer time to deliver, etc. By visualizing, user companies can develop improvement plans based on accumulated data.

As a next step to follow the visualization and status improvement, wider adoption of fleet management systems for reducing empty trucks and efficient routing, as well as truck matching services for improving truck occupancy rate and truck load efficiency, are expected. In addition to the benefit of reducing drivers’ workhours, streamlining the trucking operation by logistics tech service spotlights the viewpoint of carbon neutrality.

Another matter of concern regarding ‘2024 issues’ is the drivers’ paycheck. Because the regulation caps overtime work hours while obligating employers to pay an extra wage for overtime work exceeding 60 hours per month, trucking operators are likely to reduce overtime work of drivers to 60 hours per month at maximum. Since drivers of some small and medium sized operators today work overtime over 120 hours per months, when the law come into force, the monthly pay of each driver may shrink by approximately 50 to 100 thousand yen, according to the market source. Even if the employers wish to secure finances to pay drivers fully, 50 to 100 thousand yen per driver is not a feasible amount of money they can obtain with self-help efforts only. For these reasons, it is inevitable that the labor cost of drivers will skyrocket, and the cost of logistics will increase by 2024.

Considering the serious shortage of drivers and long work hours, it is difficult for the trucking operators to comply with the overtime work limit AND keep goods moving as freely as pre-enforcement time. Since the logistics industry is in the pyramid structure with multiple subcontractors, SMEs that actually deliver items cannot solve the ‘2024 issues’ on their own. Attempts involving shippers and prime contractors are indispensable. Creating reasonable and comfortable work environment that guarantees justifiable wages will lead to the implementation of sustainable logistics.

Research Outline

2.Research Object: Service providers and user companies of logistics systems and services that relates to delivery services

3.Research Methogology: Face-to-face interviews by the expert researchers (including online interviews) and literature research

What is the Logistics Tech (Trucking Technology) Market?

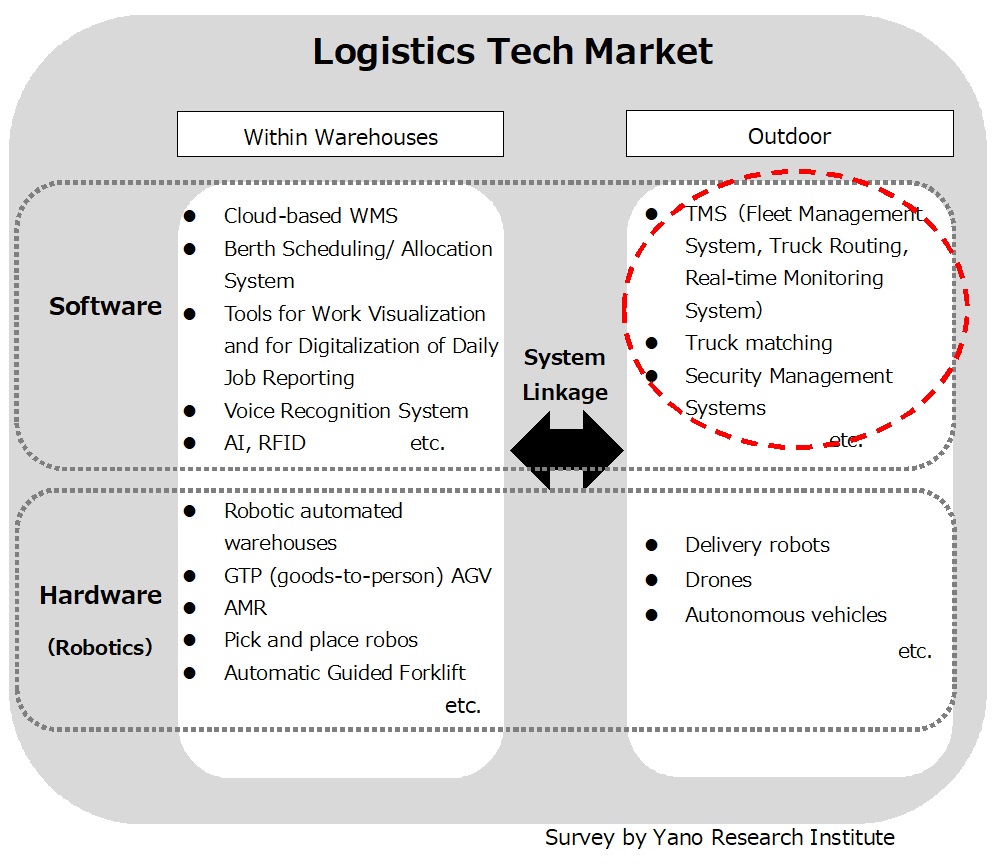

Logistics tech refers to logistics systems and services using the latest technologies such as cloud and AI.

The logistics tech (trucking technology) market in this research indicates the software market regarding delivery, including TMS (Transportation Management System) such as fleet management system, truck routing system, and real-time monitoring system, as well as truck matching service and security management system.

*Reference:

“Logistics Tech (Warehouse Logistics Technology) Market in Japan: Key Research Findings 2020” issued on Jan 25, 2021

https://www.yanoresearch.com/en/press-release/show/press_id/2640

<Products and Services in the Market>

TMS (fleet management system, truck routing system, real-time monitoring system), truck matching service, security management system

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.