Global Markets of Quantum Dot Displays/Components: Key Research Findings 2018

Research Outline

- Research period: From December 2017 to March 2018

- Research targets: Manufacturers of quantum dot (QD) display components, QD displays, and of assembled products for end-users, and etc.

- Research methodologies: Face-to-face interviews by the expert researchers, surveys via telephone/email, and literature research

What are Quantum Dot Display Components?

Quantum dot (hereafter QD) display components in this research indicate the following materials that are used for displays utilizing QD: QD materials (a solution containing QD particles and binding resins), QD sheets or films, barrier films for QD sheets/films or for QDEF (Quantum Dot Enhancement Films), QD color filters (color-conversion pixels which include QDs are used as color filters to replace the conventional color filters for LCDs), QLED (i.e., those that using QD as electroluminescence), and etc.

Among the mentioned above, the global market size of quantum dot display components in this research indicates the global shipment volume of QD particles used for displays at manufacturers (in tons).

Summary of Research Findings

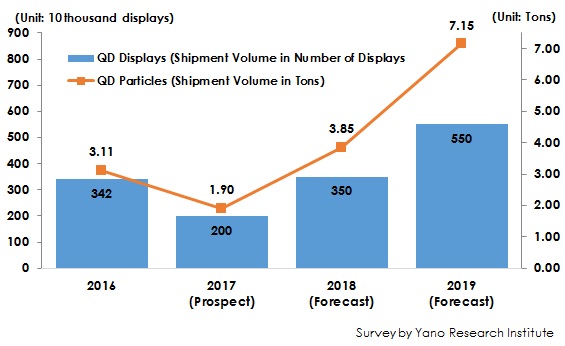

- 2017 Global QD Display Market Likely to Decline to 58.5% on Y-o-Y Basis to 2 Million Displays

Quantum dot (hereinafter referred to as “QD”) displays were developed by multiple manufacturers of assembled products and displays. However, among such manufacturers, those that actually decided to mass produce TVs using QD displays were only major Korean and some Chinese assemble-product makers. Because introduction of QD displays was only limited to high-end TVs, and the sales of QD-display-equipped TVs have fallen in the market, the global QD display market in 2017, based on the shipment volume at manufacturers, is likely to largely scale down to 58.5% of the size of the previous year to attain 2 million displays.

- 2017 Global Shipment Volume of QD Particles for Displays Projected to End Up With 1.9t, 61.1% on Y-o-Y Basis

QD displays are mainly those that contain an LCD backlight unit comprising QD sheet/film i.e., a sheet-type binding resin with quantum dot particles scattered on. By adding QD sheets/films, LCDs have increased brightness and reproducibility of colors in spite of smaller energy consumption. However, price hike of materials on top of sluggish sales of QD display-equipped TVs has led the global shipment volume of QD particles for displays at manufacturers in 2017 to decline to 1.9 tons, 61.1% of that of the previous year.

- 2018 Global Shipment Volume of QD Particles for Displays Expected to Make Remarkable Strides to 3.85t, 202.6% on Y-o-Y Basis

Because multiple assembled-products makers and display makers are planning to launch mass production of TVs and monitors using QD displays, other than those large Korean as well as some Chinese assembled-products makers already mentioned, and more QD particles are likely to be used in association with larger screens required for TVs, the global QD particle market, based on the shipment volume at manufacturers, is projected to expand dramatically to 3.85 tons, or 202.6% of that of the previous year.

- Figure 1: Transition and Forecast of Global Market Size of Quantum Dot (QD) Displays and QD Particles