Pharmaceutical Distribution (Wholesale) Business in Japan: Key Research Findings 2017

Research Outline

- Research period: October to December, 2017

- Research objects: Member companies of the Federation of Japan Pharmaceutical Wholesalers Association and companies in the business of pharmaceutical wholesaling

- Research methodologies: Questionnaire by the expert researchers, and literature research

What is Size of Pharmaceutical Distribution (Wholesale) Business?

The size of pharmaceutical wholesale business in this research indicates the total value of pharmaceutical products distributed through pharmaceutical wholesalers to medical facilities and pharmacies (i.e., total sales at companies of research subject). Those pharmaceutical products directly sold by manufacturers, sold through their distributors, or through food wholesalers are not included.

Note that the number of companies compiled differ by each business, i.e., pharmaceutical distribution (wholesale) business, ethical drug distribution (wholesale) business, and over-the-counter drug distribution (wholesale) business.

Summary of Research Findings

- Size of Pharmaceutical Distribution (Wholesale) Business in FY2016 Shrank by 3.3% on Y-o-Y Basis

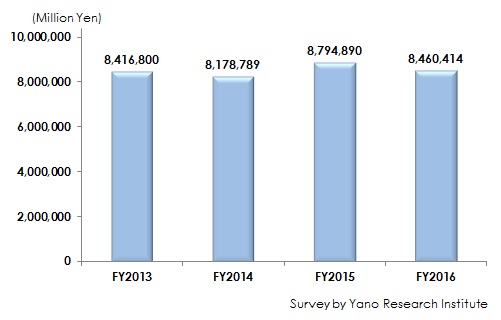

Size of FY2016 pharmaceutical distribution (wholesale) business, based on the sales of the leading 24 pharmaceutical distributors (wholesalers), fell below that of the previous fiscal year by 3.3% to result in 9,021.569 billion yen. The following factors are considered to have affected: FY2016 being applied to the year of NHI price revision, infiltration of generic drugs, the newly established system of recalculation of specific drugs (the range of annual sales being between more than 100 billion yen to 150 billion yen or less,) and other reasons. After repetitive restructuring since 1990s, the industry of pharmaceutical distribution (wholesale) business has concentrated into 5 leading groups, meaning that it is the oligopolistic market with the top-five enterprises dominating a little over 80%.

- Generic Drugs Grew to 10.0% in Sales Component Ratio of Ethical Drugs at Top 5 Distributors (Wholesalers) in FY2016

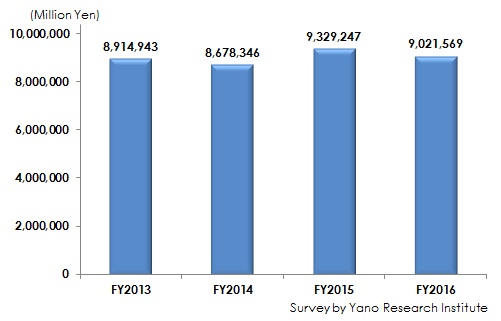

Size of the ethical drugs distribution (wholesale) business in FY2016 decreased by 3.8% from the previous fiscal year to end up with 8,460.414 billion yen, based on the sales of the leading 19 ethical drugs distributors (wholesalers). When looking at the sales composition ratio of the top 5 enterprises in FY2016 by category, the items subject for newly revised pricing (aiming to drive efficient new drug development) has occupied the largest share of 35.8%, followed by patented articles and other products occupying 30.8%, the next came long-term listed items accounting for 23.5%, and generic drugs accounting for 10.0%. There is a tendency for the past few years that the ratio of long-listed items decreasing whereas those of newly revised pricing items and generic drugs increasing.

- Figure 1: Transition of Size of Pharmaceutical Distribution (Wholesale) Business

- Figure 2: Transition of Ethical Drugs Distribution (Wholesale) Business Size