Insurance Shops Market in Japan: Key Research Findings 2017

Research Outline

- Research period: From January to February 2017

- Research targets: Joint agencies operating insurance shops, life insurance companies, etc.

- Research methodologies: Face-to-face interviews by the expert researchers, surveys via telephone/email

What are Insurance Shops?

The insurance shops in this research shall be the joint agencies selling insurance products from multiple insurance companies. The market size is calculated based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses.

Summary of Research Findings

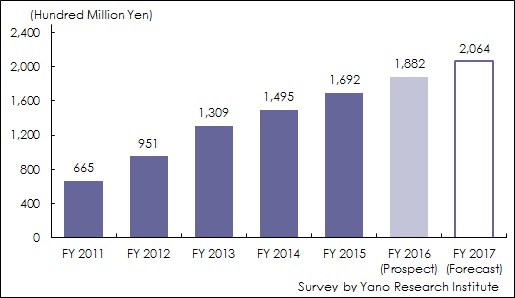

- FY2016 Insurance Shops Market Size Based on Newly Contracted Annualized Premium of Insurance Products Projected to Rise by 11.2% on Y-o-Y Basis to Attain 188.2 Billion Yen

The insurance shops market in FY2015 attained 169.2 billion yen, based on the premium of insurance products that have been converted into the new fiscal-year contract of each of the businesses. The market is likely to increase by 11.2% on year-over-year basis to attain 188.2 billion yen in FY2016, and is expected to exceed 200 billion yen to achieve 206.4 billion yen by FY2017. While laws and regulations having been relevantly enforced and revised, the market conditions have come to be severe because negative interest rates have worsened the operations of life insurance at the insurance companies, which discontinued some of insurance products and hiked up insurance premiums. Still, increasing number of insurance shops have opened, and growing number of consumers have not only reviewed their current insurance premium but also have newly or additionally bought insurance products.

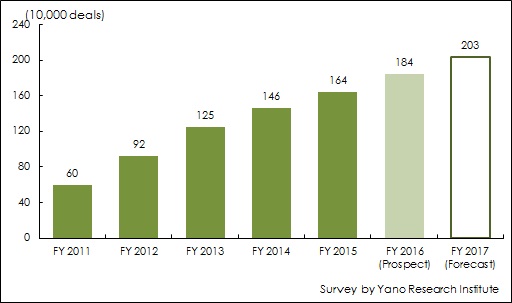

- Number of New Contract Deals at Insurance Shops in FY2016 Projected to Attain 1,840 Thousand Cases, Increase by 12.2% on Y-o-Y Basis

Number of new contract deals concluded at insurance shops in FY2015 was 1,640 thousand, whereas in FY2016 such number of deals is estimated to be 1,840 thousand, a rise by 12.2% from the previous fiscal year, and is likely to grow further to 2,030 thousand by FY2017, reaching 2 million deals. The obligation to grasp the intentions of consumers has enable the shops to understand the consumer needs which increased the number of additionally contracted insurance per household, and revealed new insurance contractors belonging to young, elderly, and rich populations.

- With More Attention Paid to Market by Diverse Financial Institutions, Insurance Shops Have Not Only Been Started Being Bought by Insurance Companies But Also by Local Banks and Securities Companies

After laws and regulations being enforced and revised, the insurance shops market has become healthier to attract local banks and quasi-leading securities company groups, subsequently to insurance companies, for subsidiary acquisition of such shops to make the business one stop. In addition, some subsidiaries of non-life insurance companies have started opening insurance shops.

The insurance shops market that has been paid attention to by financial organizations is currently still small in size, but it is highly promising to grow further.

- Figure 1:Transition of Newly Contracted Annualized Premium of Insurance Products (Market Size) at Insurance Shops

- Figure 2:Transition of Number of New Contract Deals Concluded at Insurance Shops