Credit Card Shopping Market in Japan: Key Research Findings 2015

Research Outline

- Research period: From May to September, 2015

- Research target: Domestic leading credit card issuers, smart-device payment solution providers, etc.

- Research methodologies: Face-to-face interviews by the expert researchers, surveys via telephone/email

What is the credit card shopping market?

The credit card shopping market is calculated based on shopping billings of credit card members who have used credit cards for shopping in and outside the country.

Summary of Research Findings

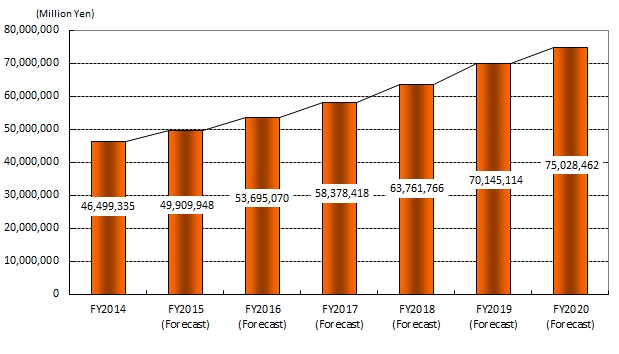

- Credit Card Shopping Market in FY2014 Attained \46 Trillion, 109.6% on Y-o-Y Basis

Size of the credit card shopping market in FY2014 (based on credit card shopping billings) attained 46 trillion yen, 109.6% of that in the previous fiscal year. The market growth was due to the efforts by the card issuers to raise credit card availability, wider accessibility of credit cards within the EC market, and increased opportunities to use credit cards at expanded categories of lifestyle habits including payment of public utilities, school fees, house rents, and ceremonial occasions.

- Smart-Device Payment Solution Business In Progress

The smart-device payment solutions have widely been accepted since 2013. The adoption of such solutions includes the small or mid-size companies which were unable to introduce the conventional credit-card payment services, and also sole proprietors and even individual people. This enabled payment at the table of one of those small restaurants and restaurant chains. Since 2014, the payment solution service providers, one after another, have started providing terminals or devices that can be used for integrated-IC-installed credit cards, making the IC-installed credit cards to be acceptable at growing number of member stores, which may eventually lead to increase the availability of IC.

- Cashless Trends and Launch of FinTech Likely to Raise Credit Card Shopping Market to Attain \75 Trillion by FY2020

Rising cashless trends and new payment solutions to be provided by the launching members of FinTech, which aims to improve convenience for foreign tourists in Japan towards the Olympic Games to be held in 2020, credit card shopping billings are likely to remain being on the rise. In addition, with increased availability of credit-card payment in the area of lifestyle habits, the credit card shopping market is expected to attain 75 trillion yen based on credit card shopping billings by FY2020.

- Figure 1: Transition and Forecast of Credit Card Shopping Market Size