Retail FX (Foreign Exchange) Trading Market in Japan: Key Research Findings 2015

Research Outline

- Research period: From July to September, 2015

- Research target: Commodity futures dealers, dedicated retail FX trading companies, securities companies, Internet banking corporations, etc.

- Research methodologies: Face-to-face interviews by the expert researchers, supplemented by interviews via telephone and e-mail

< What is Retail FX (Foreign Exchange) Trading? >

Retail FX (Foreign Exchange) trading in this research indicates the first financial product in Japan to handle foreign exchange transactions for private investors. It emerged after the revision to the Foreign Exchange Control Law in April 1998. The trading is executed based on notional principal, the leveraged margin deposit that works as collateral, and settle the account for only the difference caused between the period of position opening and closing. This report deals with OTC FX transactions market.

Summary of Research Findings

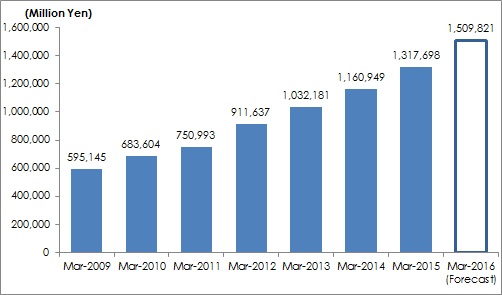

- Market Size (Balance of Margin Deposits) for Fiscal Year Ending in March 2015 Attained \1,317.6 Billion, Up by 13.5 % on Y-o-Y Basis

The market size of retail FX (Foreign Exchange) trading (the balance of margin deposits) for the year ending in March 2015 achieved 1,317.6 billion yen, an increase by 13.5 percent from the previous fiscal year. The market size continues rising, even after it exceeded 1 trillion yen in the fiscal year ending in March 2013.

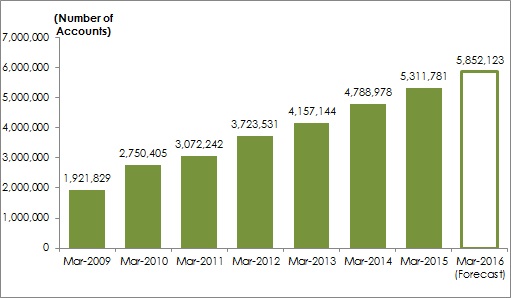

- Number of Accounts for Fiscal Year Ending in March 2015 Marked \5.31 Million, Increase by 10.9 % on Year-Over-Year Basis

In addition to improved customer convenience, the efforts to focus on transaction transparency, improvement in integrity and trust by the market players have led to continuous increase of new accounts opened by individual investors. Consequently, the number of accounts for the year ending in March 2015 attained 5.31 million, a rise by 10.9% from the previous fiscal year of the same period.

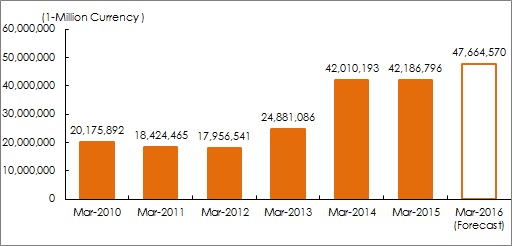

- Annual Turnover of Fiscal Year Ending in March 2015 Achieved \4,218 Trillion

(1 Million Currency Units Converted to \100 Million), Rise by 0.4 % on Y-o-Y Basis

The fiscal year ending in March 2015 updated the highest annual turnover in the history of the FX market, although the rise from the previous year was slightly by 0.4%. The weakened yen started since the latter half of FY2014 has rapidly raised the turnover to be as high as that in the previous year.

- Market Size for Year Ending in March 2016 Projected to Attain \1,509.8 Billion, with Number of Accounts 5.85 Million, and Annual Turnover \4,766 Trillion

The continuous efforts to further improve the investment environment by the market players aiming to increase the number of inexperienced new investors entering the market, expand new customers in the local cities, to raise transparency in transactions, and to improve integrity and trust are projected to boost the market size to attain 1,509.8 billion yen, and the number of accounts to 5.85 million for the fiscal year ending in March 2016. Also, considering the cumulative turnover at leading companies from April to June 2015 likely to be on the rise, the annual turnover for the fiscal year ending in March 2016 is expected to achieve 4,766 trillion yen (1 million currency units converted to \100 million), a rise by 13.0% the previous fiscal year of the same period.

- Figure 1:Transition of Estimated Market Size of Balance of Deposited Margin

- Figure 2: Transition of Number of Accounts

- Figure 3: Transition of Annual Turnover