Language Business Market in Japan: Key Research Findings 2015

Research Outline

- Research period: April to July, 2014

- Research target: Foreign language schools, publishers of language education materials, manufacturers of electronic dictionaries, suppliers of hardware and software for language learning, companies and organizations in e-learning business and correspondence education, companies and organizations selling language study materials, organizing/operating qualification exams, arranging overseas education, and in interpreting and translating business, and etc.

- Research methodologies: Face-to-face interviews by the specialized researchers, surveys via telephone/FAX, and literature research

<What is language business market?>

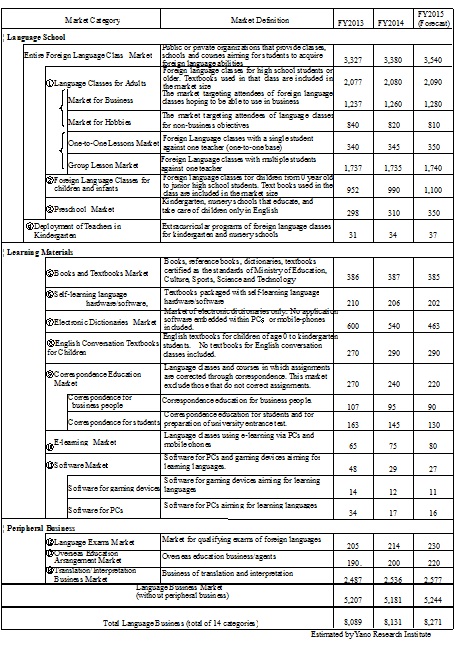

Language business market in this research indicates the following 14 categories of foreign language class markets: 1) Foreign language classes for adults, 2) Foreign language classes for children/infants, 3) Pre-schools, 4) Deployment of teachers to kindergarten/day-care centers for children, 5) Textbooks, 6) Self-learning language hardware/software, 7) Electronic dictionaries, 8)Textbooks of English conversation classes for children/infants, 9) Correspondence education, 10) E-learning, 11) Software, 12) Language exams, 13) Overseas-education arrangement, 14) Interpretation/translation business. Note that markets of language exams, overseas-education arrangement, and interpretation/translation business are defined here as language “peripheral business.”

Summary of Research Findings

- Language Business Market in FY2014 Projected to Achieve 813.1 Billion Yen, 100.5% from Preceding Year

Size of language business market (total of 14 categories) in FY2014 rose to 813.1 billion yen, 100.5% of the size in the preceding fiscal year, based on the sales of the businesses. Among the 14 categories, e-learning and English conversation textbooks for children have grown favorably to boost the entire language business market. However, the categories of software, correspondence education, and electronic dictionaries have deeply declined, which counterbalanced the entire market to stay the same level as the previous fiscal year.

- E-Learning Expanded Dramatically

E-learning market size based on the sales of the businesses attained 7.5 billion yen, 115.4% of the size in the preceding fiscal year. Especially, those service providers offering English conversation services using Skype and other tools increased the sales. This stems from rising social awareness of the services through stock listing, advertisements on TVCM, and etc.

- Language Business Market in FY2015 Projected to Achieve 827.1 Billion Yen, 101.7% on Y-o-Y Basis

The entire language business market (total of 14 categories) in FY2015 is projected to achieve 827.1 billion yen, 101.7% of the size in the preceding year. The market is likely to remain stable for the time being, because of the continuous favorable sales expected by the categories of foreign language classes for children/infants, pre-schools, deployment of teachers to kindergarten/day-care centers for children, and textbooks of English conversation classes for children/infants.

- Transition of Size of Language Business Market by Category