IT Subsidiary Market in Japan: Key Research Findings 2015

Research Outline

- Research period: November 2014 to February 2015

- Research target: Subsidiary engaged in information technology services for large companies

- Research methodologies: Face-to-face interviews by the specialized researchers, telephone/FAX surveys, and literature research

<What is an IT Subsidiary?>

An IT subsidiary in this research indicates a company separated from an information technology department of a large company to provide IT services to parent and other companies within and outside the group. The IT services that those subsidiaries engage in include development, operation and maintenance of computer systems and software updates.

Size of the IT subsidiary market is calculated based not only on internal sales derived from parent and group companies but also on external sales stemmed from companies outside the group.

Summary of Research Findings

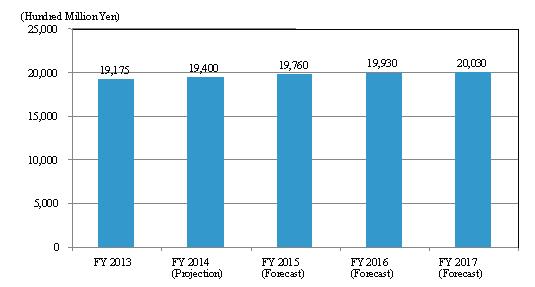

- IT Subsidiary Market Size in FY2014 Expected to Attain 1,940 Billion Yen, Up by 1.2% on Y-o-Y Basis Due to Increase of IT Investment and to Repair Demands of Company Systems to Cope with “My Number” System

IT investment that has been suppressed at private businesses expanded during the period between FY2013 and FY2014 for the first time in a while, owing to Abenomics effects. As for the external sales, there are rising demands for local governments to repair their systems for dealing with “My Number System,” a national identification number system, to be newly introduced. These factors are likely to raise the IT subsidiary market in FY2014 by 1.2% from the preceding fiscal year to achieve 1,940 billion yen, based on the sales of the businesses.

- IT Subsidiary Market Size for FY2017 Projected to Achieve 2,300 Billion Yen, Driven by Growing Demands to Prepare for Tokyo Olympic Games and by Alignment of Private and Public Sectors for “My Number” System

The IT subsidiary market for FY2015 is projected to rise by 1.9% from the previous fiscal year, because of expanding external sales stemmed from “My Number” system and of rising internal sales derived from system integration and development at parent and group companies aiming for business development overseas. However, such globalization demands from parent and group companies are likely to subside, on top of IT cost reduction due to more companies start using cloud computing and establish offshore offices. These factors offset the favorable external sales caused by system integration orders by the non-group companies aiming for global business development, flattening the total market size during the period between FY2016 and FY2017 to end up with the similar level as the preceding fiscal year.

Figure 1: Transition of Size of IT Subsidiary Market