Data Center Business in Japan: Key Research Findings 2014

Research Outline

- Research period: From August 2014 to January, 2015

- Research targets: Outsourcing companies, data center businesses, construction companies, design firms, and etc.

- Research methodologies: Face-to-face interviews by the expert researchers, survey via telephone/email, and literature research

What is a Data Center?

A data center in this research indicates a facility where IT businesses keep servers, computers, and other IT devices owned by their customers, or where IT businesses use their own in-house servers to provide internet connection, system maintenance supports, and other services to their customers. Note that overlapped floor areas to provide OEM business among multiple IT businesses and any server rooms at non-IT companies (user companies) are not included.

Summary of Research Findings

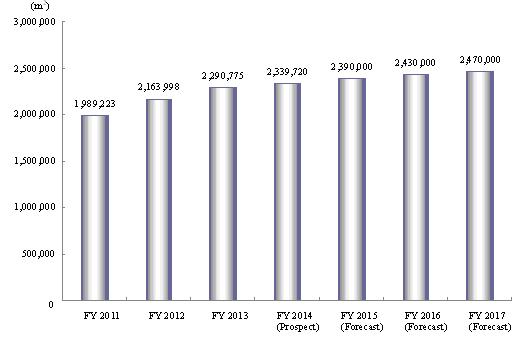

- Gross Floor Area of Domestic Data Centers Increases Steadily to Reach 2,470,000m2 by FY2017

CAGR (compound annual growth rate) of the gross floor area of domestic data centers from FY2011 to FY2017 is estimated as 3.7%, and the area is likely to reach 2,470,000 square meters by the end of FY2017. While the period between FY2012 and FY2013 saw many data centers to complete constructions, number of newly built data centers temporarily died down during FY2014. However, it is likely that IT businesses continue their investments to data centers during FY2015, expanding the gross floor area of domestic data centers.

- Steady Demands Expected for Data Centers Due to Business Continuity and Security Measures

There are following reasons why demands for data centers are increasing: More companies are in need of robust and highly-secured data centers to support business continuity and to take measures for regulations; more companies are shifting their servers to data centers as they need more server machines to handle increasing data volume while they simultaneously need to save energy; and more companies have begun outsourcing their standard, operational tasks due to lack of human resources for information systems.

- Investment to Data Centers in Tokyo Metropolitan Areas May Temporarily Slowdown Before Expansion Begins Again

Although CAGR (compound annual growth rate) of the gross floor area of domestic data centers in the Tokyo metropolitan area (including Tokyo, Kanagawa, Chiba, and Saitama Prefectures) is higher than other local areas, CAGR of that in the period between FY2014 and FY2017 is likely to slowdown temporarily because of difficulty in securing satisfactory square areas relevant for data centers, and of soaring construction expenses driven by the Tokyo Olympic Games to be held in 2020. However, robust demands from large companies within this area are likely to raise the growth rate, exceeding the same rate in other local areas in FY2018 and beyond.

Figure 1: Transition and Forecast of Gross Floor Area of Domestic Data Centers