No.3259

Photovoltaic Power Generation Market in Japan: Key Research Findings 2023

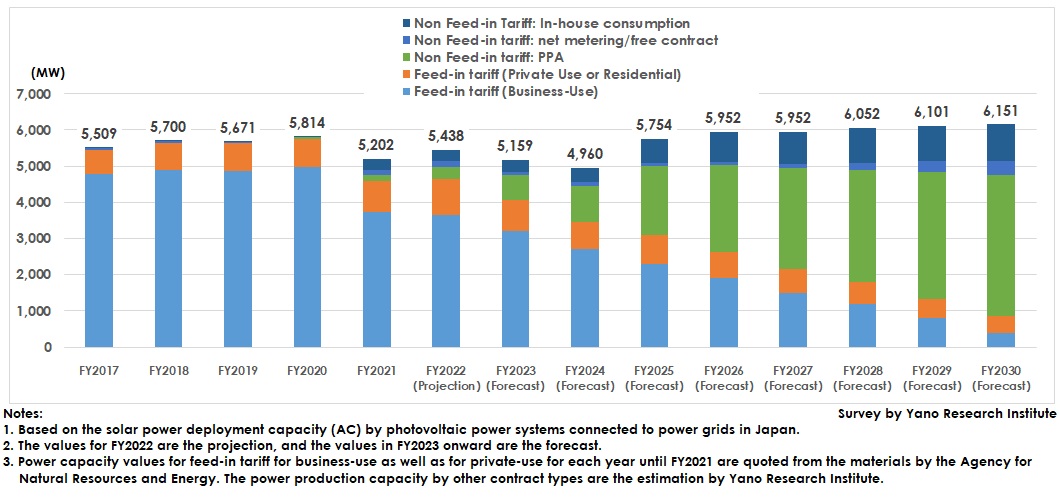

Domestic Photovoltaic Deployment Projected to Achieve 6,151MW by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has carried out the research on domestic photovoltaic introduction and has found out the challenges in expanding the deployment and the current statuses of peripheral markets (O&M (operation & maintenance) services, inspection/diagnostic services, etc.). This paper discloses the forecast on Photovoltaic deployment by FY2030.

Market Overview

The domestic photovoltaic deployment capacity in single year of FY2022 is estimated as 5,438MW. By contract type (business form), feed-in tariff scheme geared to businesses occupies the largest amount at 3,650MW (market share 67.1%), followed by feed-in tariff (residential) at 981MW (market share 18.0%), indicating that deployment under feed in tariff scheme has dominated 85.1% of the entire deployment. PPA (Solar Power Purchase Agreement) * is estimated to follow them at 347MW (market share 6.4%), in-house consumption at 307MW (market share 5.6%), and net metering/free contract 153MW (market share 2.8%).

Japan has developed photovoltaic power sources mainly through feed-in tariff scheme. To integrate the renewable energy including photovoltaic power into the electricity market, feed-in premium scheme that connects with the electricity market has been introduced since FY2022, in addition to the existing feed-in tariff scheme. This has led new photovoltaic power plants with 1,000kW or more of the capacity geared for businesses not to be able to bid in feed-in tariff but to be eligible in feed-in premium, starting from FY2022. Furthermore, those photovoltaic power plants with the capacity of 500kW or more become eligible for feed-in premium in FY2023 and onward, and those plants with the capacity of 250kW or more from FY2024.

Note that those power plants geared to businesses with the capacity between 10kW and less than 250kW that are not eligible for the bidding at feed-in tariff or feed-in premium as of FY2022 face low electricity procurement price, as follows: 11 yen per 1kW for the plants with the capacity between 10kW to less than 50kW, 10 yen per 1kW for the plants with the capacity between 50kW and less than 250 kW. This indicates that photovoltaic development assuming purchasing through feed-in tariff scheme is at the crossroads.

*1) PPA (Power Purchase Agreement) refers to an agreement where a PPA developer arranges for the design, permitting, financing and installation of a solar energy system on a customer’s property and operates and maintains the system. The customer receives the electricity generated by the solar energy system at a long-term fixed price. As the solar power system is owned not by the electricity demander but the third party, it is called a third-party ownership model.

Noteworthy Topics

Challenges toward Expanding Photovoltaic Power Generation Deployment

As photovoltaics can generate power with sunshine and emits no CO2 in the process of power generation, it is regarded as the easiest renewable energy to operate among other various renewable energy sources, which has led the deployment nationwide. The Sixth Strategic Energy Plan has been determined to show Japan’s direction on energy. Aiming to further expand the deployment of photovoltaics for FY2030, there are mainly two challenges needed to be solved.

The first challenge is to solve the power grid congestion. Due to the power grid constraints, the expense for construction works at photovoltaic power companies for grid connections is huge with longer period needed for connecting power grids, making it an obstacle for new photovoltaic deployments geared to businesses.

The second is promoting the installations at appropriate locations. In the situation where appropriate lands for installing new open-air solar power generation facilities is decreasing, installations on rooves as well as at abandoned farm fields are expected. However, installations on rooves especially of existing houses and SME facilities tend to have a problem of load withstanding. As for photovoltaics deployment at abandoned farmlands, there is a difficulty of farmland conversion.

Future Outlook

Supposing that the challenges of enormous expenses for grid connectivity construction works, longer period for power grid connections, and appropriate land shortages are to be solved by around FY2025, the domestic photovoltaic deployment capacity by single year of FY2030 is projected to be 6,151MW. By contract type (business form), PPA occupies the largest amount, followed by in-house consumption. While new applications for feed-in tariff decreases, PPA is likely to increase new deployment, because it requires no initial cost, obtains “additionality” that is placed importance in the RE100 (Renewable Energy 100) initiative, and can earn incentives.

*2) RE100 is the global corporate renewable energy initiative bringing together hundreds of large and ambitious businesses committed to 100% renewable electricity.

Research Outline

2.Research Object: Photovoltaic power companies, electricity retailers, PPA (Power Purchase Agreement) businesses, Photovoltaic power O&M (Operation &Maintenance) service providers and traders, companies having the services and technologies related to reusing and recycling of used solar panels, companies with advanced use cases of photovoltaic power facilities, public institutions, etc.

3.Research Methogology: Face-to-face interviews (including online) by specialized researchers, and survey via telephone

About Photovoltaic Deployment Capacity

Photovoltaic deployment capacities that applied to feed-in tariff scheme geared to businesses and to residences until FY2021 have been quoted from the materials by Agency of Natural Resources and Energy, deployment capacities at other contract types have been estimated by Yano Research Institute.

<Products and Services in the Market>

Photovoltaic power generation, PPA (power purchase agreement), O&M services, Photovoltaic power plant secondary market, used solar panel reuse/recycling, inspections, and diagnosis.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.