No.3248

Human Resources/General Affairs Outsourcing Market in Japan: Key Research Findings 2023

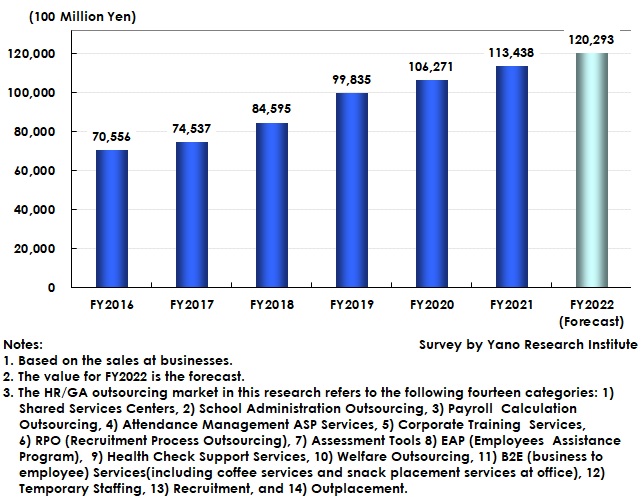

HR/GA Outsourcing Market Size for FY2021 Rose by 6.7% on YoY, Projected to Rise by 6.0% on YoY for FY2022

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic outsourcing market for human resources/general affairs and found out the trends of total major 14 service categories, trends of market players, and future perspectives.

Market Overview

The human resources (HR)/general affairs (GA) outsourcing market size (total major 14 categories) in FY2021 increased by 6.7% on a year-on-year basis to 11,343,800 million yen. The breakdown by category was as follows: the shared service category (comprised of shared services centers and school administration outsourcing) rose by 4.0% on a YoY basis to 557,800 million yen, outsourcing of HR operations (comprised of payroll calculation outsourcing, attendance management ASP services, corporate training services, RPO, and assessment tools) expanded by 7.0% on a YoY to 977,600 million yen, outsourcing of general affairs (comprised of EAP, health check support services, welfare outsourcing, and B2E services) increased by 5.4% on a YoY to 280,300 million yen, and recruiting work outsourcing (comprised of temporary staffing, recruitment, and outplacement) rose by 6.9% on a YoY to 9,528,100 million yen, indicating that the category of recruiting work outsourcing occupies about 80% of the whole market.

Noteworthy Topics

One-Stop Operation Accelerated through High Value-Added Services Instead of Mere Work Outsourcing

As a recent topic of the market, rapidly advanced technologies have contributed considerably in expanding the ranges of services provided without human interventions through systemized business operations. Year by year, the necessity for the service users is increasing to review their existing work processes and operation structures as soon as possible, including drawing of a line between business processes to be outsourced with human interventions and those without. Such a trend has led some service vendors to cutting off and systematize routine operations thereby to improve task efficiency. In line with this, almost all the categories in the market see expansion in service ranges across tasks and to make alliance with companies in different industries, encouraging the service provisions and HR data operations to be done one stop.

Aiming to improve the unit price of received orders per company, service vendors have kept on accelerating the enhancement of their services to provide from not only simple tasks but also to high value-added services. Growing numbers of outsourcing businesses have started providing consultation services and solutions, after proposing the services that meet corporate needs, to achieve total business support through reforming of work processes as well as organizations. Especially, consulting for the work processes related to ever-needed workstyle reform, digital transformation, and SDGs target achievements are increasing in the wake of technological advancements and corona crisis. Through considerations on what user requires from outsourcing, the services provided have become one stop and built on platforms.

Future Outlook

What is most influential to HR/GA outsourcing industry is the economic trends that affect performances at user companies. On the other hand, increasing numbers of companies propel workstyle reforms, digital transformation, and human capital management aiming to strengthen corporate management and talent attraction, which is expanding the service demand to the level overwhelming the influence of declining economy that can be the considerable negative factor for the market. Even in the corona crisis, the situations have raised the demand for outsourcing services rather than reduced.

Decrease in working population has also affected substantially. In addition to rising momentum for major Japanese companies to start outsourcing HR and GA tasks, taking advantage of the opportunity of compulsory retirement of those employees who had engaged in that tasks reaching the retirement ages, the factors, such as more repeat user companies, more profound service offering by outsourcing service vendors, and spreading demand even to non-user SMEs, show how promising the market is. In particular, the demand at SMEs, that have become rapidly apparent with the advent of cloud services available at affordable prices, stimulates the brisk market. This tendency is noteworthy, as it is likely to contribute to further market expansion.

Note that manpower shortages stemming from decreasing working population apply also to the service vendors, making them suffer from chronic challenges of securing necessary human resources and training them. In addition, deployment of HRTech (Human Resources Technology) continues to be a significant issue. Reviewing of the services to offer from labor intensive to knowledge intensive and fundamental revision of in-house business processes are required to be accelerated furthermore.

Research Outline

2.Research Object: Major businesses providing outsourcing services for HR (human resources and GA (general affairs)

3.Research Methogology: Face-to-face interviews by expert researchers (including online), surveys via telephone & email, and literature research

The Human Resources/General Affairs Outsourcing Market

The HR/GA outsourcing market in this research refers to the following fourteen categories: 1) Shared Services Centers, 2) School Administration Outsourcing, 3) Payroll Calculation Outsourcing, 4) Attendance Management ASP Services, 5) Corporate Training Services, 6) RPO (Recruitment Process Outsourcing), 7) Assessment Tools 8) EAP (Employees Assistance Program), 9) Health Check Support Services, 10) Welfare Outsourcing, 11) B2E (business to employee) Services(including coffee services and snack placement services at office), 12) Temporary Staffing, 13) Recruitment, and 14) Outplacement.

The data for temporary staffing business until FY2020 are quoted from “the worker dispatch business report (the sales at general worker dispatch businesses)” by MHLW.

<Products and Services in the Market>

Shared Services Centers, School Administration Outsourcing, Payroll Calculation Outsourcing, Attendance Management ASP Services, Corporate Training Services, RPO (Recruitment Process Outsourcing), Assessment Tools EAP (Employees Assistance Program), Health Check Support Services, Welfare Outsourcing, B2E (business to employee) Services (including coffee services and snack placement services at office), Temporary Staffing, Recruitment, and Outplacement.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.