No.3165

Global Electric Commercial Vehicle Market: Key Research Findings 2022

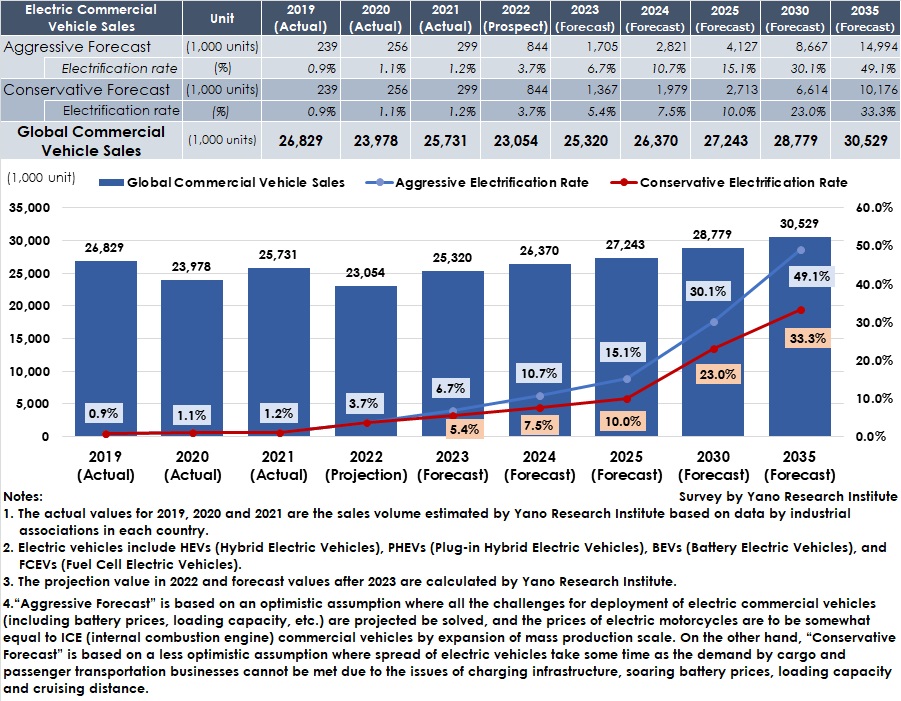

While Global Number of Commercial Vehicles Projected to be 30,530 Thousand Units by 2035, Rate of Electric Vehicles Expected to Grow to Maximum 50%

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of commercial vehicles, and found out the market status at major countries and the trend of major market players. This paper discloses the forecasts on the number of global sales and the rate of electric vehicles until 2035.

Market Overview

Global sales of commercial vehicles in 2021 were 25,731 thousand units, up by 7.3% year-on-year, with sales expected to decline in 2022 due to production constraints caused by the disruptions in supply chain affected by lockdown in COVID crisis and the Ukraine situation. From 2023 onwards, these constraints are expected to be eased and sales volumes to gradually recover, with emerging economies to drive the commercial vehicle market in the medium to long term view.

The sales of electric commercial vehicles in 2021 were 299 thousand units, 1.2% of the global commercial vehicle sales. Currently, the market is driven mainly by China and Europe where the sales have been spurred by subsidies and other stimulus measures at each of countries. In addition, the measures against commercial-vehicle-specific challenges such as loading capacity and cruising distance are in progress at each country. Europe has eased the loading capacity only for ZEVs (Zero Emission Vehicles, i.e. BEVs and FCEVs), with likewise trend observed in the US. As for the measures against cruising distance, many charging types are in consideration, including rapid charging, battery exchanging, conductive charging, etc., and infrastructure deployment is underway enabling freight and passenger transportation businesses to peacefully operate electric vehicles.

Thus, many efforts are underway to solve the issues on loading capacity rate and operation rate that are the criteria for freight and passenger transportation businesses to purchase vehicles. Such a trend is likely to accelerate at each country, in association with spread of electric vehicles.

Noteworthy Topics

Backdrop against Electrification of Commercial Vehicles

The total CO2 emissions in the transportation sector are mainly occupied by passenger cars and freight train cars, making it highly effective if decarbonization of passenger cars and freight train cars is implemented. Therefore, it is beneficial to spread electric vehicles that can drive only by motors that dispense with fossil fuels, E-fuel (synthetic fuels produced from hydrogen and carbon dioxide) and hydrogen engines, for reducing CO2. Also what is said to be effective is promotion of so-called modal shift that is to use marine vessels or railways as a means of cargo transportation, due to fewer emissions.

Companies are required to decarbonize their supply chain as a whole, needing to reduce CO2 emissions not only at the time of product manufacturing but also in distribution. In fact, some companies have set the goal to operate by using only BEVs for their product delivery. This may cause cargo owners to demand the use of BEVs to freight transporters. On the other hand, for cargo transporters, this can be an opportunity to generate new corporate value of contributing in cargo owners’ decarbonization strategy.

Thus, wide use of electric vehicles is expected hereafter, from the viewpoints of environmental issues and social responsibility in companies, which is likely to increase the global sales of electric commercial vehicles centered on BEVs.

Future Outlook

Hereafter, China and European countries are the main players to form the electric commercial vehicle market, while the spread of electric vehicles is also expected in India and emerging economies in the areas of atmospheric problems, last mile delivery logistics, and passenger transportation.

In China, due to various incentives, such as subsidies, for NEVs (New Energy Vehicles, i.e. PHEVs), BEVs and FCEVs, the sales of electric commercial vehicles are increasing. In particular, large-size buses occupy large percentage in new BEV sales, where Yutong Group is gaining power. China is playing a main role in the electric commercial vehicle market, as increase in bus exports and knockdown kit production.

In Europe, electrification mainly in small commercial vehicles has been in progress. As major commercial vehicle manufacturers have started extending the product profiles in 2022, the sales volume of EVs are expected to increase also in the areas of large-size trucks where electrification has been delayed.

Deployment of BEVs, that occupy large proportions in electric commercial vehicles, has been underway mainly in buses and small commercial vehicles, but it has the issues of cruising distance and lower loading capacity rate. Meanwhile, HEVs have the potential to aim at decarbonization by combining the use of alternative fuels and hydrogen engines. Rather than using only BEVs for commercial vehicles, use of HEVs, FCEVs, and alternative fuels can be applied for long-distance transportation, making it possible to apply right vehicle by powertrain.

Research Outline

2.Research Object: Commercial vehicle manufacturers, system suppliers, industry groups, etc.

3.Research Methogology: Face-to-face interviews (including online) by our expert researchers, survey via telephone, and literature research

About Electric Commercial Vehicle Market

A commercial vehicle in this research is defined as a vehicle that mainly aims to transport passengers or cargos. GVW (Gross Vehicle Weight) is used to classify the vehicles, i.e. small vehicles (GVW of 3.5 tons or less), small trucks (GVW of 3.5 to 8 tons), large trucks (GVW of 8 tons or more), small buses (GVW of 3.5 to 8 tons), large buses (GVW of 8 tons or more). The global vehicle sales have been calculated by using the above-mentioned classification.

There are two forecasts prepared for electrification rate of commercial vehicles. “Aggressive Forecast” is based on an optimistic assumption where all the challenges for deployment of electric commercial vehicles (including battery prices, loading capacity, etc.) are projected be solved, and the prices of electric motorcycles are to be somewhat equal to ICE (internal combustion engine) commercial vehicles by expansion of mass production scale. On the other hand, “Conservative Forecast” is based on a less optimistic assumption where spread of electric vehicles take some time as the demand by cargo and passenger transportation businesses cannot be met due to the issues of charging infrastructure, soaring battery prices, loading capacity and cruising distance.

<Products and Services in the Market>

ICE commercial vehicles, commercial vehicles that are HEV, PHEV, BEV, or FCEV

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.