No.2749

Last Mile Delivery Logistics Market in Japan: Key Research Findings 2021

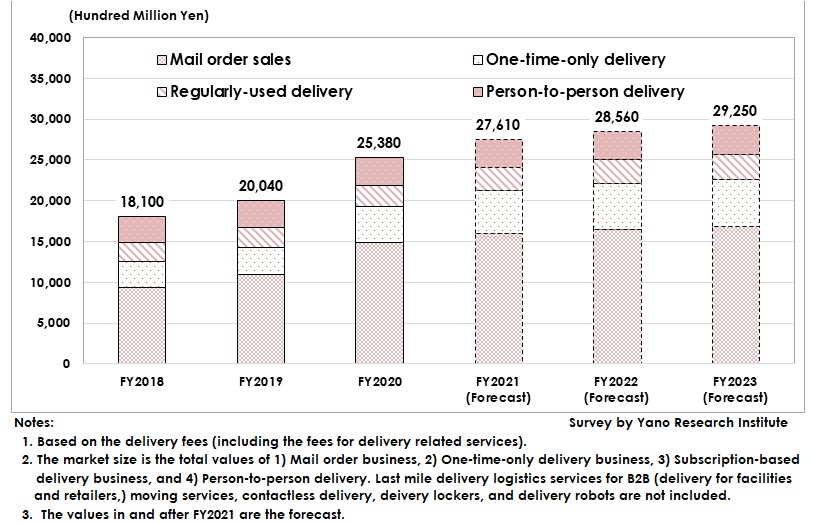

Last Mile Delivery Logistics Market Size for FY2020 Reached 2.5 Trillion yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic last mile delivery logistics market, and found out the trends by category, trends of market players, and future outlook.

Market Overview

The domestic last mile delivery logistics market size for FY2020 was estimated as 2,538,000 million yen, 127% of that of the previous fiscal year. Changes in people’s lifestyles caused by COVID-19 pandemic shifted to make things delivered rather than people go around and get them. Last mile delivery logistics has grown tremendously by being an infrastructure to support people’s lives, as stay-home demand increased. The factors of market growth are as follows: 1) Increase in the number of parcels to deliver, as mail order sales expanded, 2) growing use of food delivery couriers on behalf of those restaurants without any delivery functions, and 3) expansion of online supermarket users, including older persons.

The problem of redelivery has been on the decline especially in urban areas, as the rate of people staying home increased and as contactless delivery and delivery lockers spread to diversify the methods of receiving the delivered goods.

In this research, the last mile delivery logistics market is categorized into four categories: 1) Mail order business, 2) One-time-only delivery business (pizza or sushi delivery, food delivery services by existing fast-food and family restaurant chains, and food delivery couriers,) 3) Subscription-based delivery business (i.e., frequently-used services for regular customers to make the delivery at certain time ranges, such as meal delivery, co-op delivery, etc.) and 4) Person-to-person delivery.

Noteworthy Topics

Food Delivery Couriers

Food delivery couriers that deliver food on behalf of those restaurants without any delivery functions have been attracting attention. Food delivery couriers in this research refer to last mile delivery by the third parties and not by those companies of which the main business is freight transportation. For restaurants, food delivery couriers are useful in that they can instantly deliver food to consumers without any necessity of having in-house delivery functions. During the period from April to May 2020 when a state of emergency was declared, adoption of food delivery couriers at restaurants suddenly increased.

For users, food delivery couriers are useful in that food is selectable from whichever restaurants in the couriers’ websites and is delivered directly to a user’s home. The demand has been expanding. Hereafter, the market is likely to expand by delivering various other items not limited to food based on the service platform that has been developed over the past period.

Future Outlook

The domestic last mile delivery logistics market size is projected to attain 2,925,000 million yen by FY2023. As the delivery from mail order sales, occupying almost 60% of entire last mile delivery logistics, seems to keep on expanding, the last mile delivery logistics market is expected to continue the stable growth. On the other hand, there are some issues for the market: 1) The quantity of parcels from mail order sales may reach the peak someday; 2) consumers are decreasing, as the population is declining; and 3) no solution for the shortage of drivers that deliver the parcels. The future market may become more brisk by welcoming new market entries of those companies developed with new distribution scheme by having new approaches using delivery robots or drones that are currently in the demonstration phase.

Another significant issue in the market is too-often-used term “free shipping” which may have been causing erroneous recognition that the parcels are delivered to consumers free of charge. Such misunderstanding can lead to inadequate fare payment. In addition, drivers’ overtime will be regulated from April 2024, which potentially accelerates the shortage of drivers and subsequently stalls last mile delivery logistics that has already grown to a social infrastructure.

Now that last mile delivery logistics in COVID-19 calamity is more important than ever before, it can be a good opportunity to renew the recognition of “free shipping.” By building the awareness that delivery does cost, last mile delivery logistics can truly be established as one of social infrastructures supporting people’s lives.

Research Outline

2.Research Object: B2C logistics related businesses, government offices, etc.

3.Research Methogology: Face-to-face interviews by expert researchers, survey via telephone, and literature research

About the Last Mile Delivery Logistics Market

Last mile delivery logistics in this research is defined as the last journey of the whole delivery process to the final destinations, i.e., from the final logistics base to the final destination of a general consumer (B2C) or the delivery between general consumers (C2C). Last mile delivery logistics is classified into the following four categories: 1) Mail order business, 2) One-time-only delivery business (i.e. pizza/sushi and other food delivery business, food delivery services by existing fast-food and family restaurant chains, and food delivery couriers) 3) Subscription-based delivery business (i.e. frequently-used deliveries for regular customers to make the delivery at certain time ranges, such as meal delivery, co-op delivery, etc.) and 4) Person-to-person delivery. The market size is based on the delivery fees (including the fees for delivery related services). Note that last mile logistics services for B2B (delivery for facilities and retailers) and moving services are not included.

<Products and Services in the Market>

Mail order sales, one-time-only delivery business, home delivery service, Subscription-based delivery business food delivery couriers, regional support service, delivery robot, drone, contactless delivery, delivery locker

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.