No.3247

Cloud Service Market (IaaS/PaaS) in Japan: Key Research Findings 2023

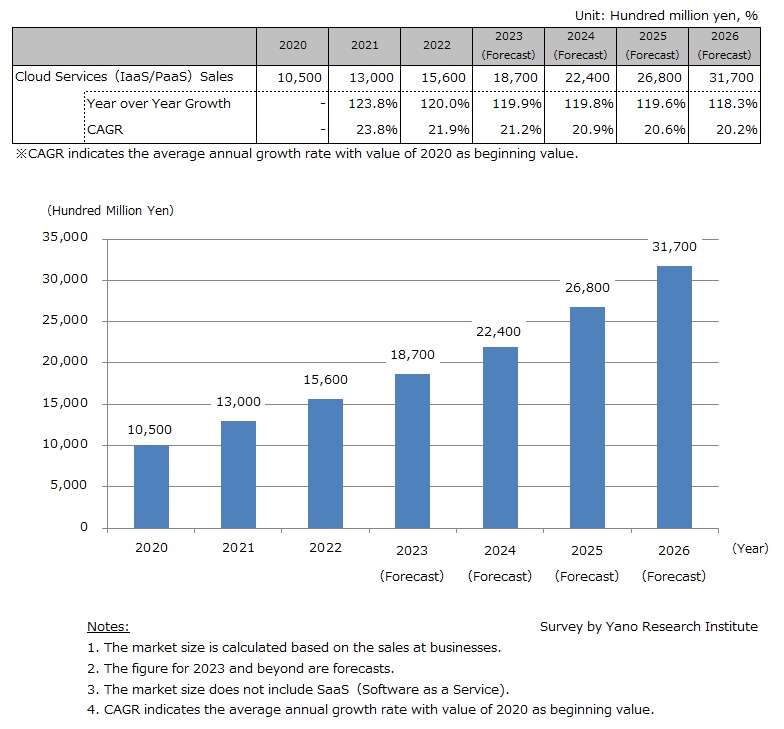

Cloud Service Market for 2022 Valued at 1,560,000 Million Yen, 120.0% of the Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the cloud service market (IaaS/PaaS) in Japan, and found out the market size (transition and forecast), the trends at cloud vendors, and the penetration status of new services.

Market Overview

The market size of cloud services (IaaS/PaaS) is estimated at 1,560,000 million yen in 2022, up 20% from the preceding year (based on the sales at businesses). Although the majority of the customer businesses are still simple system migration, where existing business process is transferred as it is to a newer hardware infrastructure or a different software platform, expansion of a range of target operations and the surge of public cloud adoption have maintained stable market growth. It is assumed that the growth also owes to the vendors that became accustomed to system migration with shorter period of time. In addition, the trend of companies, especially among enterprises with large-scale IT department, to build system/application in-house is also contributing to the market expansion. Growing popularity of hybrid cloud/multi-cloud, which increased the recognition and the use of cloud managed services, have been affecting the market growth positively.

Noteworthy Topics

Full-scale Penetration of Sovereign Cloud to Start from 2023

Sovereign clouds indicate the type of clouds with computing architecture that provides security and data access adhering to local laws and regulations.

Although one of the advantages of cloud is data being accessible from anywhere, cloud users must think thoroughly where to store their data. For example, the GDPR (General Data Protection Regulation) is a regulation that requires businesses to protect the personal data and privacy of EU citizens, restricting processing of such data outside of EU member states. Implementation of GDPR has increased the need for deeper consideration on data handling within EU member states.

While cloud migration has been accelerated in the last few years, risks like GDPR have necessitated private companies and public authorities to contemplate carefully on the storage of critical data on foreign-capital clouds (there are many countries and regions that have some type of legislation regulating data). The situation has given a rise to sovereign clouds, the services that guarantee compliance with local data privacy and security laws and regulations.

A sovereign cloud secures all data on hosting country and forbids foreign access. It guarantees data processing and storing bound to one jurisdiction. Unauthorized access to critical data is avoidable by the use of sovereign cloud. With hundreds of organizations and enterprises that are in need to handle highly confidential data, sovereign cloud is expected to become a major option when selecting a cloud platform. As IT vendors are making attempts to penetrate and earn high recognition of sovereign clouds, the domestic demand for sovereign cloud is forecasted to rise from 2023 onwards.

Future Outlook

Digital transformation (DX) is a major growth driver of the cloud market, but it does not proceed at once. Users do not necessarily have to take cloud native approach, i.e., they do not need to build and manage applications in cloud computing environment entirely from the start. They can accelerate DX by upgrading to/scaling to cloud native apps after they migrate existing systems to cloud. Cloud migration is projected to increase further, and therefore the cloud service market is poised to grow increasingly.

While digital transformation has been steadily utilized in the process of streamlining and improving productivity, there is room for further development regarding use of digital technology to increase competitiveness, such as through utilization of data collected onsite. Despite some progress in data accumulation, visualization, and cloud migration at factories, stores, and hospitals, they still lack use of analytics to derive business data insights. In order to promote DX in this area, agile mindset is necessary - you need to allow iterative trial-and-error in a short timeframe. With flexibility and usefulness in various situations, cloud services will becoming increasingly indispensable for companies and other users.

Research Outline

2.Research Object: Domestic vendors related to cloud services (providers of public cloud and its peripheral services), domestic private companies, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone and email, mailed and online corporate questionnaire

What is the Cloud Service (IaaS/PaaS)?

IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) in this research refers to the cloud computing environment managed on public cloud (by cloud providers) that offer virtualization, automation, and other technologies via internet.

Size of the cloud service market is calculated based on the sales at cloud providers. However, SaaS (Software as a Service) is not included in the market size.

<Products and Services in the Market>

IaaS, PaaS

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.