No.3237

CNF (Cellulose Nanofiber) Market in Japan: Key Research Findings 2023

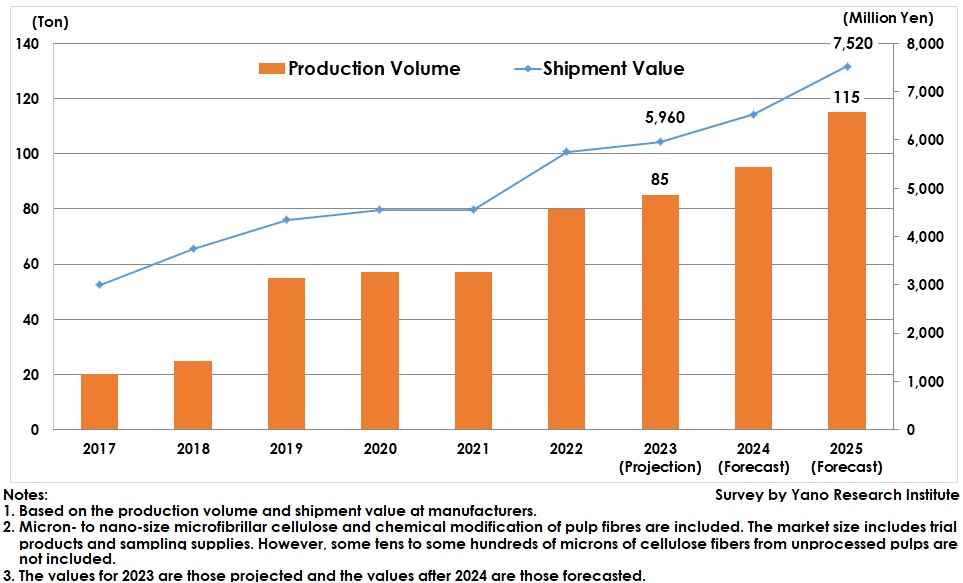

Global CNF Production Volume in 2023 to be 85 Tons, with Shipment Value 5,960 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global CNF (cellulose nanofiber) market for 2023, and found out the market trends, trends of market players, and future outlook.

Market Overview

The global production volume of CNFs (cellulose nanofibers) in 2023 including trial products and sampling supplies is estimated to grow to 85 tons, 106.3% on a YoY basis, while the shipment value to 5,960 million yen, 103.7% on a YoY basis. Currently, the total production capacity of CNF production facilities at domestic CNF manufacturers is 1,070 tons per year, with the utilization rate of CNF production facilities (on an output basis) being approximately 8% of the global production volume (projection), failing to reach 10% of the total facility capacity. }

When CNFs were first developed, they were regarded as an epoch-making bio-derived material with its physical property of the strength 5 times larger than iron and the weight one fifth of iron. They were expected to replace metals, glass fiber, carbon fiber, aramid fiber, etc. for the use in a variety of areas including automobiles and other “mobilities”, household appliances, construction materials, etc. In fact, however, the adoption of CNFs is observed as functional additives geared for cosmetics, food, ink, coating materials, etc., or in sports shoes and daily necessities, and no cases observed in mobilities, household appliances or construction materials that were supposed to be the sure areas. The next few years after 2023 are the crucial moment whether or not CNFs can be in demand.

Noteworthy Topics

Improvement in Shock Resistance Required in Deployment in Automotive Interior, Another Approach May be to First Appeal from Engine-Room Unit Parts

The composite materials that consist of CNFs and resins are expected to expand the demand as plant-derived reinforcement resins with extensive applications such as to automobiles, household appliances, construction materials, etc., but the shock resistance of general CNF composite resins remains to be approximately 2 to 4 kJ/m2 in Charpy impact strength.

Because automotive interior parts, the largest potential market segment for CNF composite resins, require some 10 to 12kJ/m2 of shock resistance, the development of CNF composite resins is underway at manufacturers with their top priority to improve the shock resistance. Generally speaking, however, the implementation of a new material for an automobile takes about four to five years before it is decided. Therefore, unless being able to achieve 10kj/m2 or so of shock resistance by 2025 at the latest, the development at manufacturers is highly likely not to be in time for the adoption in the 2030 automobile releases.

If such a situation continues, utilization of CNF composite resins can recede from a “Goal-focused development theme” to a “mid- to long-term development theme” for OEM (automakers) and Tier1 companies.

Still, there are many auto parts that do not directly receive any shocks even when a collision occurs such as engine room units or those with small risks of causing passenger injuries because they do not scatter even when broken at the time of a collision. CNF composite resins can be used for such auto parts even with their current physical properties.

Also, both drones without any passengers and next-generation mobilities with slow speed do not need to be much shock-resistant as automobiles, rather, they are highly demanded to be light, instead. It may be a good scenario to first approach from being adopted in these components, the experience of which can be the breakthrough for implementation in engine room units, and then to the final goal of being deployed as automotive interior and exterior parts.

Future Outlook

When propelling the development of CNF composite resins, there is a way to aim the deployment in a wide variety of areas by making up the missing properties. On the other hand, there is another option of creating new markets through proposals that exceed expectations of user companies by pursuing the remarkable CNF-distinctive performance and by appealing to customers for the cutting-edge performance and added values that cannot be found in other existing materials.

There also are needs for other unique performances that can only be obtained after cellulose being defiberized into nano scale, such as high bending elasticity, dispersion stability, emulsion stability, thixotropy, etc. By finding out the most appropriate elements from various forms and sizes of fibers from a micrometer to a nanometer through organization of knowhow and technologies accumulated in the past CNF development, thereby to surpass the user expectations, which may be able to generate and expand the demand for CNFs for 2030.

Research Outline

2.Research Object: Cellulose nanofiber manufacturers (paper manufacturers, chemical manufacturers, etc., users, and R&D institutions)

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and literature research

About CNF or cellulose nanofiber

Cellulose nanofibers (hereinafter CNFs) are cellulose fibers included in plants, and are defiberized into nanoscales. There are mainly three methods to extract CNFs from cellulose fibers: Chemical disintegration method where hydrogen bond of molecular chains are loosen via catalyst or acid before putting them into a grinder; and Mechanical disintegration methods which can be categorized into the method using high-pressure homogenizers for delaminating cell walls of the fibers and liberate the nanoscale fibrils; and water collision method where nanofibers are obtained through cellulose-dispersed liquid collided with kinetic energy of water at high speed.

<Products and Services in the Market>

Cellulose nanofiber (CNF), products that used CNFs as an additive agent or as reinforcement

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.