No.3051

Consumer Survey on Living Assistance Services in Japan: Key Research Findings 2022

Usage Rate of Living Assistance Services in 2022 Remained Almost Unchanged from 2020

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a consumer survey in Japan regarding living assistance services. Target of the survey include both users and prospective users. The results are analyzed by comparing them to the results of the same survey carried out a couple of years earlier (2020). Here, some of the findings are announced.

Summary of Research Findings

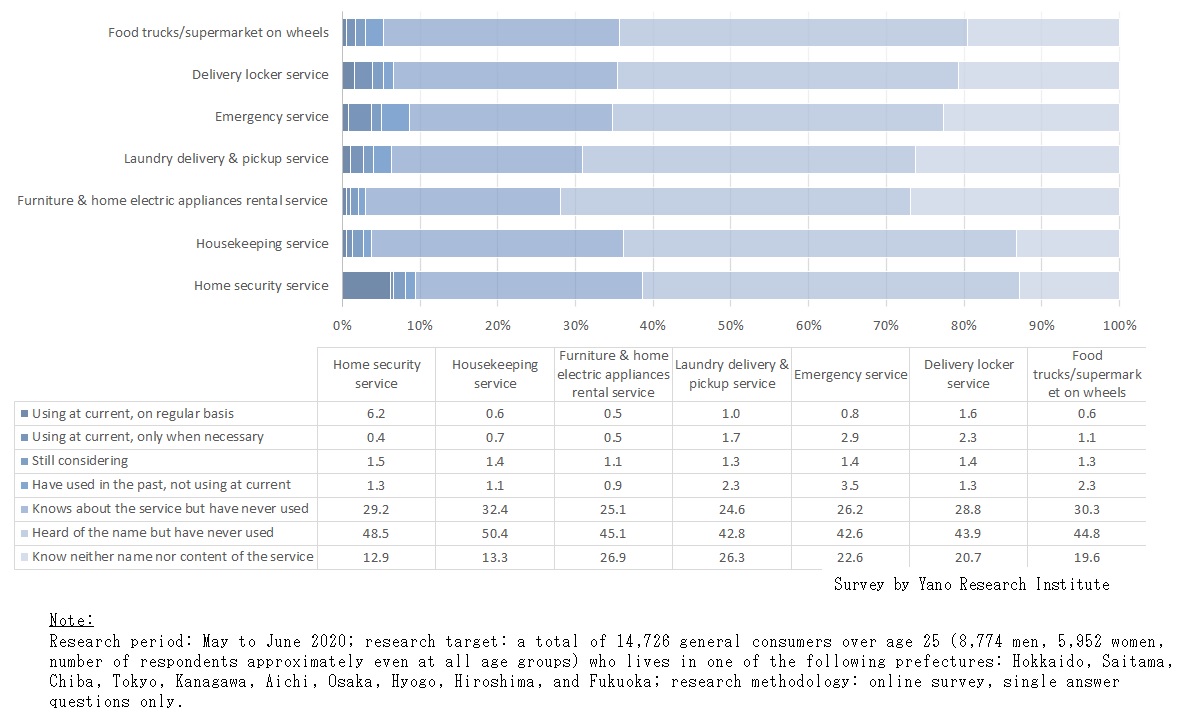

This research analyzes consumer trends in use of major living assistance services that may support them on day-to-day basis, based on the results from online survey. Such services include home security service, housekeeping service, furniture & home electric appliances rental service, laundry delivery & pickup service, emergency service, delivery locker service, and food trucks/supermarket on wheels. Here are some takeaways:

- Usage rate* of "home security service" remained almost unchanged at 6.6% (7.0% for 2020 survey). Since home security service is provided as a home security system, it tends to show higher usage rate than other living assistance services.

- Usage rate* of "housekeeping service" was 1.3% (1.5% for 2020 survey). While standard housekeeping services are provided within consumers’ homes, services involving tasks outside of their houses, such as personal shopper service, is also gathering attention. Still, the usage rate remained almost unchanged from the last survey.

- Usage rate* of "furniture & home electric appliances rental service" increased slightly to 1.0% (0.7% for 2020 survey). Main users of the service are single households and/or those living on rent, including students and new working adults.

- Usage rate* of "laundry delivery/pickup service" stayed at 2.8% (2.8% for 2018 survey). Increase of business operators providing laundry delivery and pickup services in the last few years has been stimulating the demand for (dry)cleaning and storing seasonal clothes.

- Usage rate* of "delivery lockers" reached 3.9% (3.5% for 2020 survey). As delivery without face-to-face interaction has become common not only for newly built apartments but also for detached houses, the usage rate is forecasted to grow further hereafter.

- Usage rate* of "emergency services" slightly declined to 3.7% (4.1% for 2020 survey). However, to estimate the actual number of users, it may be more realistic to include respondents that chose "have used (the service) before, but not using currently" (3.5%), because the use of such service occurs unexpectedly at the time of emergency, in other words, it is not a type of service used on a daily basis upon user’s will. From this standpoint, the estimated actual usage rate is 7.2% (8.3% for 2020 survey).

- Usage rate* of "food trucks/supermarket on wheels" was 1.7% (1.8% for 2020 survey). Nevertheless, considering that consumers are likely to buy at food trucks or supermarket only when necessary, actual users may have chosen “have used in the past, not using at current” (2.3%). For this reason, estimated actual usage rate is 4.0% (5.0% for 2020 survey).

Note: “Usage rate” above (with *) indicates a total of percentage points of "using at current, on regular basis" and "using at current, only when necessary".

Noteworthy Topics

Change in Working Environment Affects Use of Living Assistance Services

The coronavirus pandemic has prompted Japanese society to embrace diverse work styles, including work from home and telework. The shift in work environment has been affecting business climate of living assistance services considerably. While the survey results denote that domestic consumer generally lack experience of using living assistance services, business operators have been taking COVID-19 safety precautions and considerations on their workers and spaces properly, whether the service is provided in-person or not in-person. To expand the market further, it is necessary for business operators to make efforts in increasing repeat users, while acquiring large number of new users.

Research Outline

2.Research Object: General consumers at their age over 25, living in one of the following prefectures: Hokkaido, Saitama, Chiba, Tokyo, Kanagawa, Aichi, Osaka, Hyogo, Hiroshima, and Fukuoka

3.Research Methogology: Online survey

For this research, online survey was carried out to a total of 14,726 general consumers at their age over 25 (8,774 men and 5,952 women; number of respondents approximately even at all age groups), who lives in one of the following prefectures: Hokkaido, Saitama, Chiba, Tokyo, Kanagawa, Aichi, Osaka, Hyogo, Hiroshima, and Fukuoka. The survey was designed to analyze the trends regarding the use of living assistance services. This press release highlights the consumer usage trends on major living assistance services, i.e., home security service, housekeeping service, furniture & home electric appliances rental service, laundry delivery & pickup service, emergency service, delivery locker service, and food trucks/supermarket on wheels.

<Products and Services in the Market>

Housekeeping service, house cleaning service, home security service, remote monitoring service (for elderly/children), furniture & home electric appliances rental service, laundry home delivery & pick-up service, clothing storage service, emergency service, laundromat, delivery locker, food trucks and supermarket on wheels

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.