InsurTech Market for Life Insurance in Japan: Key Research Findings 2017

Research Outline

- Research period: March to May, 2017

- Research target: Domestic Life Insurance Companies, Small Amount & Short Term Insurance companies, Siers, and InsurTech Ventures, and etc.

- Research methodologies: Face-to-face interviews by the expert researchers, surveys via telephone and email, and literature research

What are InsurTech and InsurTech Market?

InsurTech is a coined word made from insurance and technology. It means life insurance-related services using IT that allow developing new insurance products and services and/or streamlining and upgrading business processes which were unable to provide by the conventional life insurance companies.

InsurTech in this research can be categorized into the following 8 categories: “Development of health-promotion-type insurance products for each of individuals,” “Disease control programs,” “AI-used or Chat-bot-used consulting services regarding insurance and insurance reconsideration,” “Automation of underwriting using AI,” “Tracking services regarding a processes from recommendation of seeking a diagnosis to an actual diagnosis, or a process when informed of abnormality until an actual diagnosis,” “After sales services for contractors and their families by means of applications and other methods,” “Automation of assessment utilizing AI and/or BRMS,” and “Utilization of blockchain* as an infrastructure.” *A blockchain is a database of recording and authorizing the transactions of transfer of rights by utilizing computers on the P2P network that links the users.

The domestic InsurTech market size is calculated based on the sales of the market players who are the vendors and venture companies that develop new insurance products and services and support streamlining and upgrading of business processes that were unable to provide by the conventional life insurance companies.

Summary of Research Findings

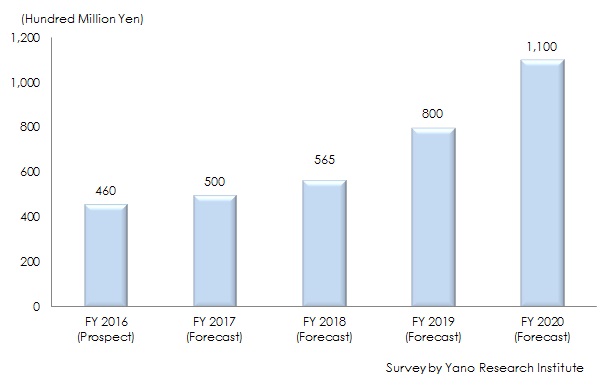

- FY2016 InsurTech Market Size Projected to Attain 46,000 Million Yen

The domestic InsurTech Market Size in FY2016 is likely to achieve 46,000 million yen, based on the sales of the market players of 8 categories of InsurTech. In addition to those solutions for streamlining and upgrading of business processes having driven the market, data collecting has been in progress in order to develop health-promotion type insurance and disease control programs that were unable to provide by the conventional life insurance companies. Thus, the market has been on the rise gradually.

- AI-Used Solutions of Streamlining and Upgrading of Business Processes Have Driven Market Growth

The market in FY2016 was led especially by those solutions of streamlining and upgrading of business processes that utilize AI and other methods. Currently, AI has been adopted in the limited solutions including judgement of accepting the insurance, and payment of insurance claims and incurred claims. Now that a number of successful cases created by combining attempts of innovative business processes, AI introduction in the streamlining and upgrading of business processes can continue being widened in 2017 and beyond.

- In Addition to Progress in Health Promotion Insurance and Disease Control Programs, Support to Ventures and API Disclosure Contribute to Market Expansion to 110,000 Million Yen by FY2020

With data possessed by the central ministries & agencies and local governments to be open, the development of health promotion insurance and disease control programs is expected to be in progress, which may lead to further discussion for disclosure of API in the field of insurance followed by increasingly invigorated that of banks. Furthermore, the environment to support and raise the venture companies is likely to be improved gradually. The market, therefore, is projected to attain 110,000 million yen by FY2020.

- Figure 1: Transition and Forecast of Domestic InsurTech Market Size